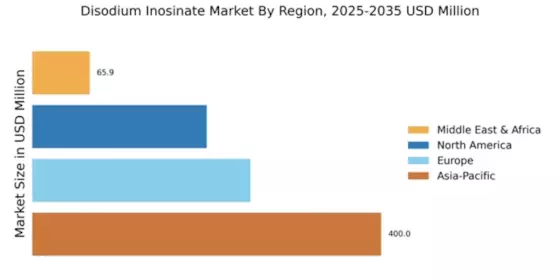

Market Growth Projections

The Global Disodium Inosinate Market Industry is poised for substantial growth, with projections indicating a market size of 0.92 USD Billion in 2024 and an anticipated increase to 1.83 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.46% from 2025 to 2035, highlighting the increasing adoption of disodium inosinate across various food applications. The market dynamics are influenced by factors such as rising consumer demand for flavor enhancers, the expansion of the processed food sector, and the growing awareness of umami flavors. These elements collectively contribute to a favorable outlook for the disodium inosinate market.

Rising Demand for Flavor Enhancers

The Global Disodium Inosinate Market Industry is experiencing a surge in demand for flavor enhancers, particularly in the food and beverage sector. As consumers increasingly seek products with enhanced taste profiles, disodium inosinate serves as a potent flavor enhancer, often used in conjunction with monosodium glutamate. This trend is reflected in the projected market growth, with the industry expected to reach 0.92 USD Billion in 2024 and potentially 1.83 USD Billion by 2035. The compound's ability to amplify umami flavors makes it particularly appealing in processed foods, snacks, and seasonings, thereby driving its adoption across various culinary applications.

Growth in Processed Food Consumption

The Global Disodium Inosinate Market Industry is significantly influenced by the rising consumption of processed foods. As urbanization and busy lifestyles lead consumers to opt for convenient meal solutions, the demand for flavor enhancers like disodium inosinate has escalated. This ingredient is commonly found in ready-to-eat meals, sauces, and snacks, where it enhances flavor without the need for excessive salt. The market is projected to grow at a CAGR of 6.46% from 2025 to 2035, indicating a robust future for disodium inosinate as a key component in the processed food sector.

Increasing Awareness of Umami Flavor

The Global Disodium Inosinate Market Industry benefits from the growing awareness and appreciation of umami flavor among consumers. This savory taste, recognized as the fifth taste, is increasingly sought after in culinary experiences. Disodium inosinate, often used in combination with other flavor enhancers, plays a crucial role in delivering this flavor profile. As chefs and food manufacturers experiment with umami-rich ingredients, the demand for disodium inosinate is likely to rise. This trend aligns with the overall market growth, as the industry is expected to reach 1.83 USD Billion by 2035, driven by consumer preferences for richer taste experiences.

Regulatory Support for Food Additives

The Global Disodium Inosinate Market Industry is positively impacted by regulatory support for food additives. Governments and food safety authorities often recognize the safety and efficacy of disodium inosinate, facilitating its use in various food applications. This regulatory backing not only encourages manufacturers to incorporate disodium inosinate into their products but also reassures consumers about its safety. As the market evolves, this support is likely to contribute to the anticipated growth, with projections indicating a market size of 1.83 USD Billion by 2035, reflecting the increasing acceptance of food additives in the industry.

Expansion of the Food and Beverage Industry

The Global Disodium Inosinate Market Industry is closely tied to the expansion of the food and beverage sector. As new food products are developed and existing ones are reformulated to meet consumer preferences, the need for effective flavor enhancers becomes paramount. Disodium inosinate is increasingly utilized in various applications, from snacks to sauces, to improve taste and consumer satisfaction. The continuous innovation within the food industry, coupled with the projected market growth to 0.92 USD Billion in 2024, suggests a promising future for disodium inosinate as a staple ingredient in food formulation.