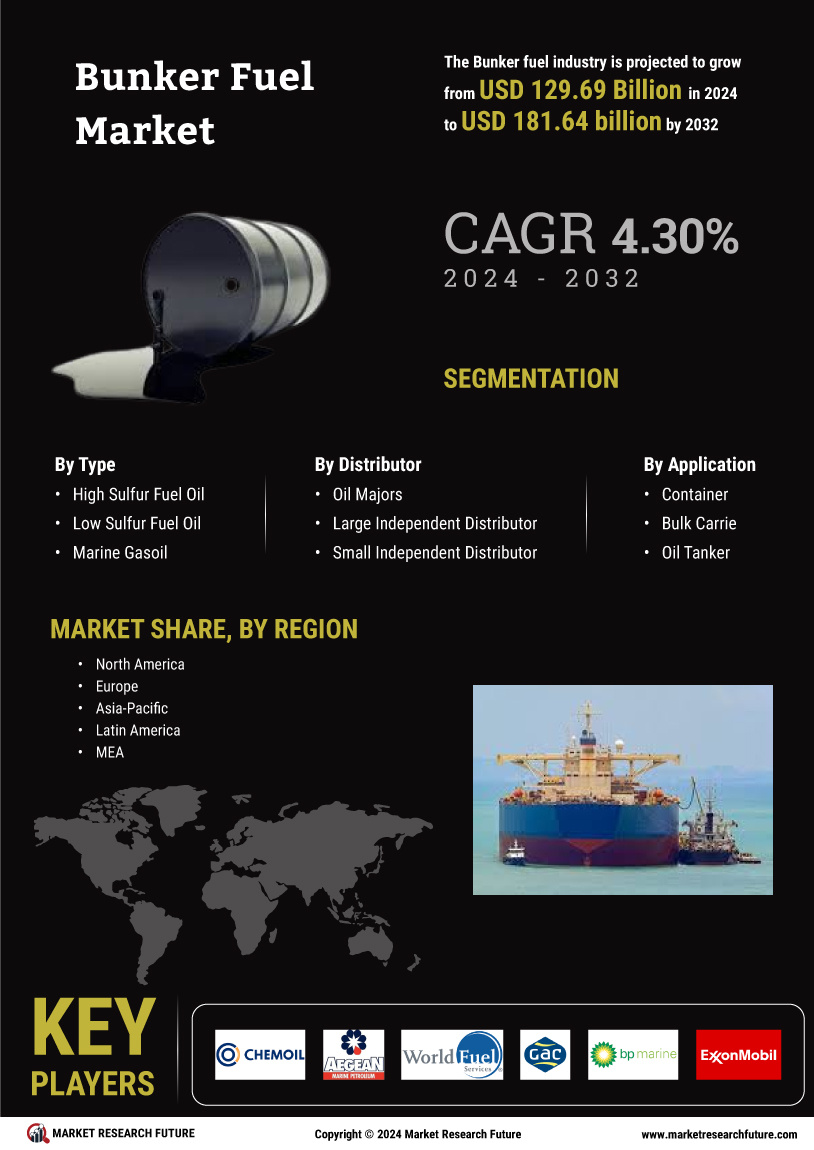

Rising Global Trade and Shipping Activities

The resurgence of The Global Bunker Fuel industry. As economies recover and expand, the demand for shipping services has surged, leading to increased fuel consumption. According to recent data, the global shipping industry is expected to grow by 4% annually, which directly correlates with the rising need for bunker fuel. This growth is further fueled by the expansion of e-commerce and international supply chains, necessitating efficient and reliable shipping solutions. Consequently, the bunker fuel market is poised to benefit from this upward trend, as shipping companies seek to optimize their fuel usage to meet growing demands.

Technological Innovations in Fuel Management

Technological advancements in fuel management systems are transforming the bunker fuel market. Innovations such as real-time monitoring and predictive analytics enable shipping companies to optimize fuel consumption and reduce operational costs. These technologies facilitate better decision-making regarding fuel procurement and usage, which is crucial in a market characterized by fluctuating prices. The integration of digital solutions is expected to enhance efficiency, potentially leading to a reduction in fuel consumption by up to 10%. As companies increasingly adopt these technologies, the bunker fuel market is likely to experience a shift towards more sustainable practices, aligning with broader environmental goals.

Geopolitical Factors and Supply Chain Dynamics

Geopolitical tensions and their impact on supply chains are critical drivers in the bunker fuel market. Events such as trade disputes, sanctions, and regional conflicts can disrupt fuel supply routes, leading to volatility in fuel prices. For instance, tensions in oil-producing regions can result in supply shortages, prompting shipping companies to seek alternative sources or adjust their fuel strategies. This unpredictability necessitates a flexible approach to fuel procurement, influencing market dynamics significantly. As a result, the bunker fuel market is likely to see fluctuations in demand and pricing, driven by the ever-changing geopolitical landscape.

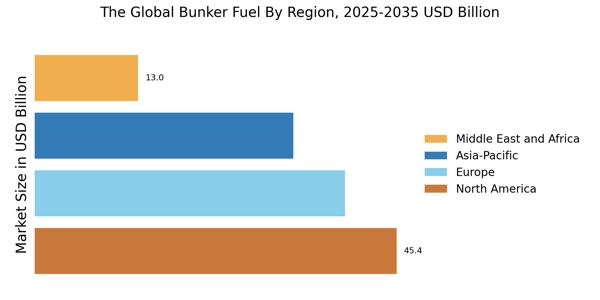

Investment in Infrastructure and Port Facilities

Investment in port infrastructure and facilities is a vital driver for the bunker fuel market. As shipping volumes increase, ports are expanding their capabilities to accommodate larger vessels and enhance fuel supply operations. This trend is evident in various regions, where governments and private entities are investing in modernizing port facilities to improve efficiency and reduce turnaround times. Enhanced infrastructure not only facilitates smoother fuel supply chains but also attracts more shipping companies, thereby increasing demand for bunker fuel. The ongoing investments in port development are expected to bolster the bunker fuel market, supporting its growth trajectory in the coming years.

Regulatory Compliance and Environmental Standards

The increasing stringency of environmental regulations is a pivotal driver for the bunker fuel market. Regulatory bodies are imposing stricter limits on sulfur emissions, compelling shipping companies to transition to low-sulfur fuels. This shift is evident in the International Maritime Organization's regulations, which have led to a notable increase in the demand for compliant fuels. The bunker fuel market is adapting to these changes, with a projected growth rate of approximately 3.5% annually as companies invest in cleaner technologies. Compliance not only mitigates environmental impact but also enhances the reputation of shipping firms, making adherence to regulations a critical factor in market dynamics.