Growing Aging Population

The MEA Medical Devices Market is experiencing a notable increase in demand due to the growing aging population across the region. As life expectancy rises, the prevalence of chronic diseases such as diabetes and cardiovascular conditions is also increasing. This demographic shift necessitates advanced medical devices for effective management and treatment. For instance, the World Health Organization indicates that by 2030, the number of individuals aged 60 years and older in the MEA region is expected to double. Consequently, healthcare providers are investing in innovative medical technologies to cater to this demographic, thereby driving growth in the MEA Medical Devices Market.

Rising Healthcare Expenditure

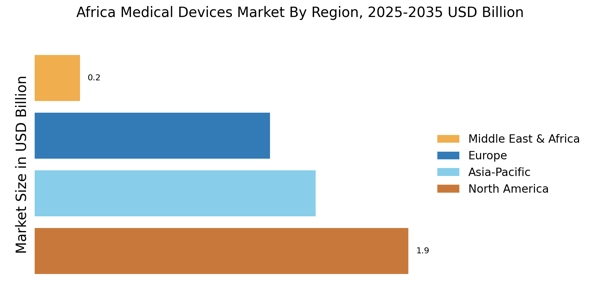

In recent years, there has been a marked increase in healthcare expenditure across the MEA region, which is significantly influencing the MEA Medical Devices Market. Governments and private sectors are allocating more resources to enhance healthcare infrastructure and access to advanced medical technologies. According to the World Bank, healthcare spending in the Middle East and North Africa is projected to reach approximately USD 200 billion by 2025. This surge in investment is likely to facilitate the adoption of cutting-edge medical devices, thereby propelling the growth of the MEA Medical Devices Market.

Government Initiatives and Policies

Government initiatives and policies aimed at improving healthcare access and quality are significantly influencing the MEA Medical Devices Market. Various countries in the region are implementing reforms to enhance healthcare systems, which includes the promotion of local manufacturing of medical devices. For instance, the UAE has launched initiatives to support the development of a robust medical device manufacturing sector. These policies are expected to reduce dependency on imports and stimulate local innovation, thereby fostering growth in the MEA Medical Devices Market.

Increasing Prevalence of Chronic Diseases

The MEA Medical Devices Market is being propelled by the rising prevalence of chronic diseases, which is becoming a critical public health concern. Conditions such as obesity, diabetes, and hypertension are on the rise, leading to a greater demand for medical devices that aid in monitoring and treatment. The International Diabetes Federation reports that the number of adults with diabetes in the MEA region is expected to reach 55 million by 2045. This alarming trend is prompting healthcare systems to invest in innovative medical devices, thus driving the expansion of the MEA Medical Devices Market.

Technological Innovations in Medical Devices

Technological innovations are playing a pivotal role in shaping the MEA Medical Devices Market. The integration of artificial intelligence, telemedicine, and wearable devices is transforming patient care and enhancing the efficiency of medical procedures. For example, the adoption of telehealth solutions has surged, allowing healthcare providers to reach patients in remote areas. This trend is expected to continue, with the market for telemedicine in the MEA region projected to grow significantly in the coming years. Such advancements are likely to create new opportunities and drive growth within the MEA Medical Devices Market.