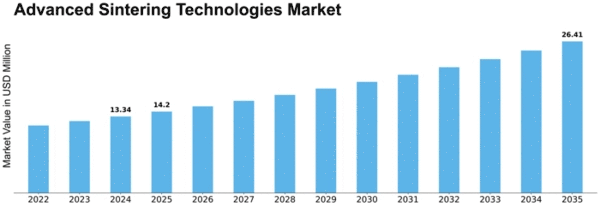

Advanced Sintering Technologies Size

Advanced Sintering Technologies Market Growth Projections and Opportunities

Mechanical advancements affect the market. Advanced sintering technologies advance as materials science and design improves. These advancements increase sintering efficiency and accuracy and expand enterprise applications.

The advanced sintering technologies market was worth USD 964.14 million in 2020 and is expected to reach USD 1,657.50 million by 2028, growing 7.49%.

Advanced sintering technologies are shaped by market need. This market grows due to demand for innovative materials with improved mechanical characteristics and execution. This interest is driven by car, aircraft, medical, and hardware companies seeking sintering technologies that meet strict requirements and deliver high-quality results.

Advanced Sintering Technologies is also affected by global economic conditions and trends. Financial growth, modernization, and assembling area strength directly affect advanced sintering technology adoption. As companies aim to enhance their production cycles and stay serious, imaginative sintering arrangements gain popularity, driving market growth.

Advanced sintering technology markets are shaped by material costs and accessibility. The cost and availability of natural materials, especially sophisticated sintering powders, directly affect production costs. Material cost changes might affect corporate revenues and venture decisions. Thus, market players closely monitor and adapt to material market developments to ensure acceptable and financially sound jobs.

Administrative and environmental concerns also shape the Advanced Sintering Technologies market. Government agencies emphasize sustainable and eco-friendly manufacturing methods, thus companies must use sintering technologies that minimize environmental impact. Compliance with administrative principles drives advanced sintering process development, promoting greener and more reasonable arrangements.

Consolidations, acquisitions, organizations, and coordinated efforts affect market competition. Important relationships between organizations and research foundations help advance sintering technology by exchanging information and assets. Market players demand creative and market-reaching companies to strengthen their competitive positions.

International variables shape the Advanced Sintering Technologies market. Exchange rates, geopolitical tensions, and global financial vulnerabilities might affect the manufacturing network and market. These international factors should be explored by companies in this industry to ensure ongoing access to key assets and markets.

Shopping habits of end-use companies help create better sintering technology. To meet consumer demands for performance, durability, and customization, companies use sophisticated sintering processes. Sintering technology' ability to create complicated and reworked parts matches purchasers' changing tastes.

Leave a Comment