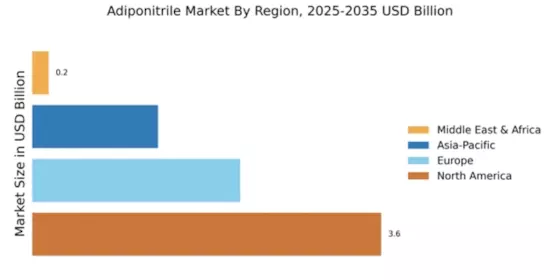

North America : Market Leader in Adiponitrile

North America is poised to maintain its leadership in the Adiponitrile market, holding a significant share of 3.61 in 2025. The region's growth is driven by robust demand from the automotive and textile industries, alongside increasing investments in sustainable production methods. Regulatory support for eco-friendly practices further enhances market potential, making it a key player in the global landscape. The United States stands out as the leading country, with major companies like Ascend Performance Materials and Invista driving innovation and production. The competitive landscape is characterized by a mix of established players and emerging firms, all vying for market share. The presence of advanced manufacturing facilities and a skilled workforce positions North America as a hub for Adiponitrile production, ensuring continued growth and investment.

Europe : Emerging Market with Growth Potential

Europe's Adiponitrile market is on a growth trajectory, with a market size of 2.15 in 2025. The region benefits from increasing demand in the automotive and electronics sectors, alongside stringent regulations promoting sustainable practices. The European Union's commitment to reducing carbon emissions is a significant driver, encouraging investments in greener production technologies and enhancing market dynamics. Germany and France are leading countries in this market, with key players like BASF SE and Domo Chemicals contributing to innovation and production capacity. The competitive landscape is evolving, with a focus on sustainability and efficiency. As companies adapt to regulatory changes, Europe is set to become a vital player in The Adiponitrile, fostering collaboration and technological advancements.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing rapid growth in the Adiponitrile market, with a projected size of 1.3 in 2025. This growth is fueled by increasing industrialization and rising demand from the automotive and textile sectors. Countries in this region are focusing on enhancing production capabilities and adopting advanced technologies, which are crucial for meeting the growing market needs and regulatory standards. China and Japan are the leading countries in this market, with major companies like Mitsubishi Chemical Corporation and Nippon Shokubai Co., Ltd. playing pivotal roles. The competitive landscape is marked by a mix of local and international players, all striving to capture market share. As the region continues to develop, the presence of key players and their commitment to innovation will drive the Adiponitrile market forward.

Middle East and Africa : Emerging Opportunities in Adiponitrile

The Middle East and Africa region is at the nascent stage of developing its Adiponitrile market, with a size of 0.17 in 2025. The growth is primarily driven by increasing industrial activities and a focus on diversifying economies. Governments are implementing policies to attract foreign investments, which is expected to enhance production capabilities and market dynamics in the coming years. Countries like South Africa and the UAE are emerging as potential markets, with local companies beginning to explore opportunities in the chemical sector. The competitive landscape is still developing, but the presence of international players could catalyze growth. As the region invests in infrastructure and technology, the Adiponitrile market is likely to see significant advancements and opportunities.