Acute Agitation Aggression Treatment Size

Acute Agitation Aggression Treatment Market Growth Projections and Opportunities

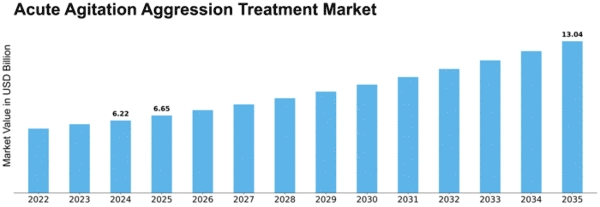

Acute agitation aggression treatment Market size is estimated to reach USD 9.4 billion by 2032 at 6.95% CAGR during the forecast period. The Acute Agitation Aggression Treatment Market operates within a dynamic framework influenced by various factors that collectively shape its growth and development. Instantaneous agitation and violence are among the majority of symptoms of some mental illness. For that purpose, health personnel have to hurry up as well as to choose the well-functioning method of intervention. Overall, the goal is to ensure not only safety of the patients with psychosis but also health care providers and the surroundings. The market dimension is profoundly influenced by aspects like the ecrinence of mental health conditions, the progress of treatments techniques, the interplay of regulations, the changing psychiate care design, and the increasing need for safer and more patient-friendly approaches.

Advanced field in psychiatric care management brings the natural change to the industry of agitation and aggression medicines commercialization. Today, the patients are progressively finding the individuality and the psychocentric treatment in psychiatry. The range of agitation and aggression treatments integration that is now available makes comprehensive models that involve multidisciplinary teams work better together and also use holistic strategies. An interaction between psychiatrists, other health workers, and patients determines the dynamics of the market, which points out that exact treatment of emergencies calls for a more sophisticated approach to mental health.

The tendency towards favoring more secure and more patients' oriented procedures is a force that generally acts upon the market mechanism of acute agitation and aggression treatment market. The number of harmful symptoms which accompany the use of traditional anesthetics, like excessive sedation and respiratory depression, discovered the need of producing safer and well-tolerated alternatives. Healthcare providers and patients alike seek interventions that not only effectively manage acute agitation and aggression but also minimize the risks and discomfort associated with treatment. The emphasis on patient-centric care contributes to the evolving market dynamics.

Leave a Comment