Top Industry Leaders in the Acrylates Copolymer Market

Acrylates copolymers, the versatile building blocks of diverse applications, find their way into paints, coatings, adhesives, and construction materials. This robust market, projected to reach a staggering arena where manufacturers vie for a share of the polymer pie. Let's explore the strategies, factors, and developments shaping this dynamic realm.

Strategies Shaping the Copolymer Landscape:

-

Product Diversification: Leading players like Arkema and Evonik are expanding their portfolios, developing specialized acrylates copolymers for specific needs. This includes UV-curable resins for coatings, high-performance binders for adhesives, and low-VOC options for paints, catering to niche markets and evolving regulations. -

Sustainability Spotlight: Green awareness is influencing choices. Companies like DSM are investing in bio-based acrylates copolymers derived from renewable resources, minimizing reliance on fossil fuels and aligning with eco-conscious customers. -

Technological Innovation: R&D pushes boundaries. Companies like Dow Chemical are pioneering novel copolymerization techniques to create acrylates with enhanced functionalities, like improved film hardness, weather resistance, and adhesion properties. -

Regional Expansion: Asia-Pacific, with its booming construction and consumer goods sectors, holds immense potential. Companies like Wacker Chemie are setting up production facilities in this region to capitalize on the local demand. -

Strategic Partnerships: Collaboration fuels growth. For instance, BASF partnered with a leading coatings manufacturer to develop customized acrylates copolymer solutions for specific end-use applications.

Factors Dictating Market Share:

-

Performance Prowess: Superior film formation, adhesion properties, resilience to weathering, and chemical resistance are crucial selling points. Established brands like Rohm have built reputations for consistent performance, attracting loyal customers. -

Cost-Effectiveness: Price remains a crucial factor, particularly in mature markets. Chinese manufacturers often offer lower prices, challenging established players to optimize production and pricing strategies while maintaining quality. -

Regulatory Landscape: Stringent regulations on VOC emissions and hazardous materials dictate market trends. Players who comply with these regulations, like Ashland Inc. with its low-VOC acrylates copolymers, gain a competitive edge. -

Application Diversity: Catering to diverse industries offers resilience. Companies with broad product portfolios like Kuraray Chemical benefit from diversification, mitigating risks in saturated segments.

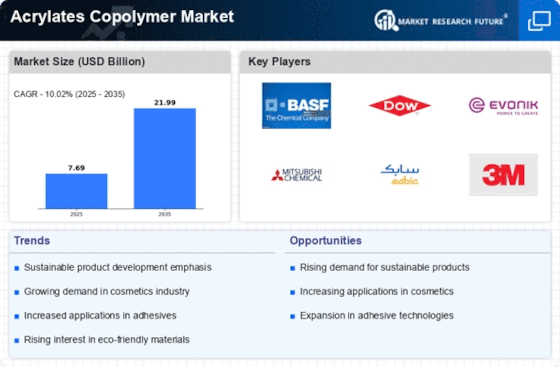

Key Players:

- Arkema (France)

- Celanese Corporation (the U.S)

- ACURO ORGANICS LIMITED( India)

- OMNOVA Solutions Inc (the U.S)

- The Dow Chemical Company( the U.S.)

- The Lubrizol Corporation (the U.S.)

- Georgia-Pacific Chemicals LLC(the U.S.)

- Exxon Mobil Corporation( the U.S.)

- B. Fuller Company

- INEOS( the U.K.)

Recent Developments:

-

August 2023: BASF SE introduced a new line of bio-based acrylates copolymers for waterborne adhesives, further promoting sustainability efforts. -

October 2023: Dow Chemical Company launched a new copolymer specifically designed for high-performance UV curable coatings, offering faster curing times and improved scratch resistance. -

November 2023: Arkema S.A. received regulatory approval for a novel acrylates copolymer for food packaging applications, minimizing potential migration of chemicals into food products. -

December 2023: The US Environmental Protection Agency proposed new regulations on certain monomers used in acrylates copolymers, potentially impacting future product formulations.