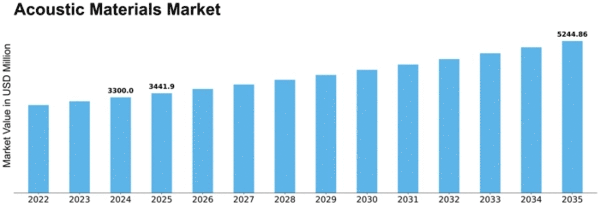

Acoustic Materials Size

Acoustic Materials Market Growth Projections and Opportunities

Acoustic Materials Market Size was valued at USD 3 Billion in 2022 and is projected to grow from USD 5 Billion in 2023 to USD 10 Billion by 2030, exhibiting a compound annual growth rate (CAGR) of 4.00%

Construction Industry Demand: The construction industry is a major driver of demand for acoustic materials, utilizing them in buildings, offices, residential spaces, and infrastructure projects to mitigate noise pollution and enhance acoustical comfort. As urbanization and infrastructure development continue to expand globally, the demand for acoustic materials for sound insulation and absorption rises accordingly.

Automotive Sector Requirements: In the automotive sector, acoustic materials are used to reduce noise and vibration within vehicles, improving passenger comfort and overall driving experience. As consumers prioritize quieter and more comfortable vehicles, automakers increasingly invest in acoustic materials for noise control, influencing market dynamics.

Manufacturing and Industrial Applications: Acoustic materials find extensive use in manufacturing and industrial settings to dampen noise generated by machinery and equipment. Industries such as aerospace, machinery manufacturing, and industrial manufacturing rely on acoustic materials to comply with occupational health and safety regulations and improve workplace conditions.

Regulatory Compliance and Standards: Adherence to regulatory requirements and industry standards is crucial for manufacturers of acoustic materials to ensure product safety and performance. Compliance with noise regulations, building codes, and environmental standards influences market competitiveness and customer trust.

Technological Advancements: Continuous advancements in material science, manufacturing processes, and acoustic engineering drive innovation in the acoustic materials market. Adoption of advanced technologies, such as nanotechnology, composite materials, and digital simulation tools, enhances the performance, durability, and versatility of acoustic materials, shaping market trends.

Consumer Preferences and Lifestyle Trends: Changing consumer preferences and lifestyle trends, such as the demand for open-plan office spaces, smart homes, and electric vehicles, influence the requirements for acoustic materials. Consumers seek environments that offer noise reduction, privacy, and comfort, driving market demand for innovative acoustic solutions.

Environmental Sustainability: Growing concerns about environmental sustainability drive the demand for eco-friendly and sustainable acoustic materials. Manufacturers increasingly focus on developing recyclable, biodegradable, and low-VOC (volatile organic compound) materials to meet green building standards and environmental regulations, influencing market dynamics.

Urbanization and Infrastructure Development: Rapid urbanization and infrastructure development in emerging economies fuel the demand for acoustic materials for use in residential, commercial, and public infrastructure projects. As cities expand and populations grow, the need for noise control solutions becomes increasingly important, driving market growth.

Market Competition and Pricing: The competitive landscape within the acoustic materials market, characterized by the presence of key players, market share distribution, and pricing strategies, influences market dynamics. Manufacturers need to innovate, differentiate their offerings, and optimize pricing strategies to maintain competitiveness and market share.

Technological Integration and Product Innovation: Integration of acoustic materials with advanced technologies, such as IoT (Internet of Things), smart sensors, and digital control systems, drives product innovation in the acoustic materials market. Smart acoustic materials that offer real-time monitoring, adaptive noise control, and customizable acoustic environments cater to evolving customer needs and market trends.

Leave a Comment