- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

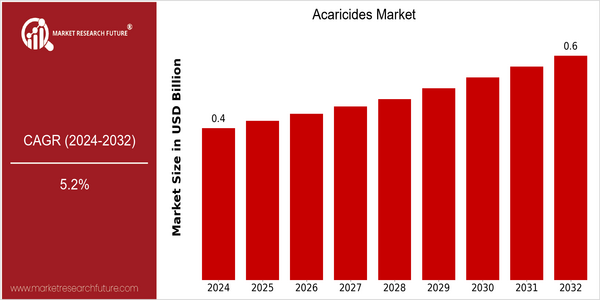

| Year | Value |

|---|---|

| 2024 | USD 0.42 Billion |

| 2032 | USD 0.63 Billion |

| CAGR (2024-2032) | 5.2 % |

Note – Market size depicts the revenue generated over the financial year

The global acaricides market is poised for steady growth, with a current market size of USD 0.42 billion in 2024, projected to reach USD 0.63 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.2% over the forecast period. This growth trajectory indicates a robust demand for effective pest control solutions, driven by increasing agricultural productivity needs and the rising prevalence of pest-related challenges in crop management. As farmers and agricultural stakeholders seek to enhance yield and protect crops from damaging pests, the acaricides market is expected to expand significantly. Several factors are contributing to this upward trend, including advancements in formulation technologies that enhance the efficacy and safety of acaricides. Innovations such as biopesticides and integrated pest management strategies are gaining traction, aligning with the global shift towards sustainable agriculture. Key players in the market, such as BASF SE, Syngenta AG, and FMC Corporation, are actively investing in research and development to introduce novel products and formulations. Strategic initiatives, including partnerships and collaborations aimed at expanding product portfolios and market reach, further underscore the dynamic nature of the acaricides market, positioning it for continued growth in the coming years.

Regional Market Size

Regional Deep Dive

The Acaricides Market is experiencing significant dynamics across various regions, driven by agricultural advancements, pest resistance issues, and regulatory frameworks. In North America, the market is characterized by a strong emphasis on integrated pest management (IPM) practices, while Europe is witnessing stringent regulations aimed at reducing chemical usage. The Asia-Pacific region is rapidly expanding due to increasing agricultural activities and the need for effective pest control solutions. Meanwhile, the Middle East and Africa are seeing growth fueled by rising agricultural investments, and Latin America is capitalizing on its diverse agricultural landscape to enhance acaricide usage. Each region presents unique growth potential shaped by local agricultural practices, regulatory environments, and economic conditions.

Europe

- The European Union's Farm to Fork Strategy aims to reduce pesticide use by 50% by 2030, prompting manufacturers to develop biopesticides and alternative acaricides that comply with these regulations.

- Companies such as BASF and Corteva Agriscience are actively involved in developing eco-friendly acaricides, responding to consumer demand for sustainable agricultural practices.

Asia Pacific

- The rapid adoption of modern agricultural techniques in countries like India and China is driving the demand for effective acaricides, with local companies like UPL Limited leading the charge in product innovation.

- Government initiatives in countries such as Australia are promoting the use of integrated pest management, which includes the strategic application of acaricides to enhance crop yields.

Latin America

- Brazil's agricultural sector is booming, with the government supporting the use of acaricides to combat pests that threaten key crops like soybeans and coffee, leading to increased market activity.

- Local companies are focusing on developing acaricides that are effective against the unique pest challenges faced in tropical climates, enhancing their competitive edge in the market.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new guidelines for the registration of acaricides, emphasizing the need for reduced environmental impact, which is pushing companies to innovate with more sustainable products.

- Key players like Bayer and Syngenta are investing in research and development to create advanced acaricides that target specific pests while minimizing harm to beneficial insects, reflecting a trend towards precision agriculture.

Middle East And Africa

- In Africa, the African Development Bank is funding projects aimed at improving agricultural productivity, which includes the promotion of effective pest control measures like acaricides.

- The Middle East is witnessing an increase in greenhouse farming, which is creating a niche market for specialized acaricides that cater to controlled environments.

Did You Know?

“Acaricides are not only used in agriculture but also play a crucial role in controlling pests in public health, particularly in managing tick populations that can transmit diseases.” — World Health Organization (WHO)

Segmental Market Size

The Acaricides Market is currently experiencing stable growth, driven by increasing agricultural demands and the need for effective pest management solutions. Key factors propelling this segment include the rising prevalence of acarid pests that threaten crop yields and the implementation of stringent regulatory policies aimed at ensuring food safety. Additionally, advancements in formulation technologies are enhancing the efficacy and safety profiles of acaricides, further boosting demand. Currently, the adoption stage of acaricides is characterized by mature deployment, particularly in regions like North America and Europe, where companies such as BASF and Syngenta lead in innovative product offerings. Primary applications include agricultural crops, horticulture, and public health, with specific use cases seen in the treatment of mites in cotton and fruit crops. Macro trends such as sustainability initiatives and the push for integrated pest management are catalyzing growth, as stakeholders seek environmentally friendly solutions. Technologies like precision agriculture and biopesticides are shaping the segment's evolution, offering new methodologies for effective pest control.

Future Outlook

The Acaricides Market is poised for significant growth from 2024 to 2032, with a projected market value increase from $0.42 billion to $0.63 billion, reflecting a compound annual growth rate (CAGR) of 5.2%. This growth trajectory is driven by the rising demand for effective pest control solutions in agriculture, particularly in the face of increasing pest resistance to conventional pesticides. As farmers seek to protect their crops and ensure food security, the adoption of acaricides is expected to rise, with penetration rates potentially reaching 30% in key agricultural regions by 2032. Technological advancements in formulation and application methods are anticipated to further enhance market dynamics. Innovations such as targeted delivery systems and biopesticides are gaining traction, offering environmentally friendly alternatives that align with global sustainability goals. Additionally, supportive regulatory frameworks aimed at reducing chemical residues in food products are likely to encourage the development and use of safer acaricides. As these trends unfold, the market will not only expand in value but also evolve in its approach to pest management, positioning acaricides as a critical component of integrated pest management strategies.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 5.20% (2023-2032) |

Acaricides Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.