Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure is a vital driver for the Ablation Devices Market. As healthcare systems evolve and improve, access to advanced medical technologies, including ablation devices, is becoming more widespread. Investments in healthcare facilities, particularly in emerging markets, are facilitating the adoption of innovative treatment options. This expansion is expected to lead to an increase in the number of procedures performed, as more patients gain access to effective therapies. Additionally, the establishment of specialized centers for ablation procedures is likely to enhance the quality of care and patient outcomes. Consequently, the ablation devices market is poised for growth as healthcare infrastructure continues to develop and adapt to the needs of diverse populations.

Rising Incidence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases is a critical factor propelling the Ablation Devices Market. As populations age and lifestyle-related health issues become more prevalent, the demand for effective treatment options for conditions such as atrial fibrillation is increasing. According to recent estimates, cardiovascular diseases account for a substantial percentage of global mortality, necessitating innovative treatment solutions. Ablation procedures have emerged as a viable option for managing these conditions, leading to a projected increase in the use of ablation devices. The market is expected to grow as healthcare providers seek to implement more effective interventions to address the growing burden of cardiovascular diseases, thereby enhancing patient outcomes and quality of life.

Technological Innovations in Ablation Devices

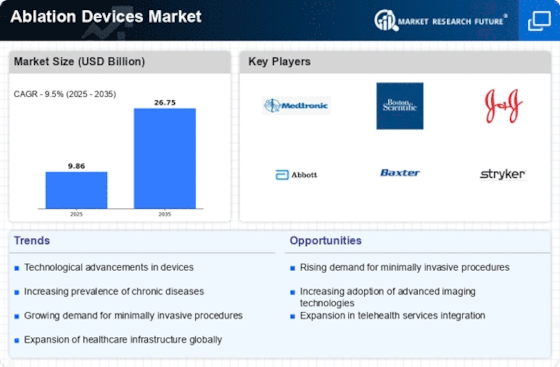

The Ablation Devices Market is witnessing a surge in technological innovations that enhance the efficacy and safety of procedures. Advancements such as radiofrequency ablation, cryoablation, and laser ablation are becoming increasingly prevalent. These technologies allow for more precise targeting of tissues, reducing damage to surrounding areas. For instance, the introduction of advanced imaging techniques, such as MRI and CT-guided ablation, has improved the accuracy of these procedures. The market for ablation devices is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This growth is driven by the increasing demand for effective treatment options for various conditions, including cancer and cardiac arrhythmias.

Increasing Demand for Minimally Invasive Procedures

The trend towards minimally invasive procedures is a key driver in the Ablation Devices Market. Patients and healthcare providers are increasingly favoring techniques that reduce recovery time and minimize surgical risks. Ablation procedures, which often require only small incisions or no incisions at all, align well with this demand. The market is expected to expand as more healthcare facilities adopt these techniques, leading to a projected increase in the number of ablation procedures performed annually. This shift is particularly evident in the treatment of chronic conditions, where traditional surgical methods are being replaced by less invasive alternatives. As a result, the ablation devices market is likely to see a significant uptick in usage, reflecting changing patient preferences and advancements in medical technology.

Growing Awareness and Acceptance of Ablation Therapies

Growing awareness and acceptance of ablation therapies among both healthcare professionals and patients is significantly influencing the Ablation Devices Market. Educational initiatives and successful case studies are contributing to a better understanding of the benefits and effectiveness of ablation procedures. As patients become more informed about their treatment options, there is a noticeable shift towards choosing ablation therapies over traditional surgical methods. This trend is likely to drive market growth, as increased acceptance leads to higher demand for ablation devices. Furthermore, healthcare providers are increasingly recognizing the advantages of these therapies, which may result in more frequent recommendations for ablation procedures, further bolstering the market.

Leave a Comment