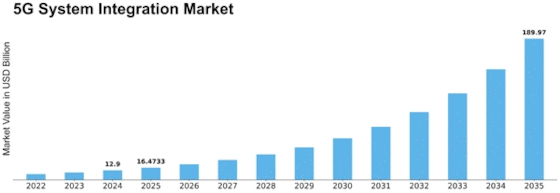

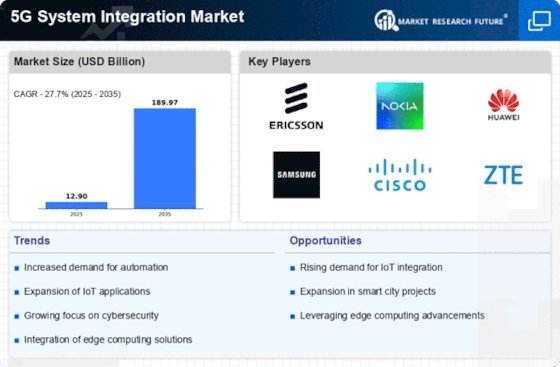

5g System Integration Size

5G System Integration Market Growth Projections and Opportunities

Safety and security systems, interconnected with remote monitoring capabilities, are steadily augmenting their presence within the global smart home and office landscape. These interconnected devices empower consumers to remotely supervise and manage home appliances and office equipment through their smartphones or tablets. Within these intelligent environments, a gamut of products and services, including IP security cameras and intelligent locks, are equipped to automatically transmit notifications directly to users' mobile devices.

Smart home and office devices play a pivotal role in proactively alerting consumers before potential disasters unfold. They serve as vigilant assistants, offering regular alerts to parents on their smartphones, ensuring the safety of their homes. For instance, sophisticated sensors deployed in smart homes can promptly detect issues, promptly notifying users if the TV remains on or if a security door is left ajar.

The evolving demographic landscape, characterized by an increasing aging population, necessitates advanced bio-monitoring systems and remote monitoring technologies. These innovations are aimed at empowering elderly individuals to maintain their independence while ensuring their safety and well-being.

Moreover, intensified competition between established electronics giants and burgeoning startups has contributed to the affordability of a wide array of products. These offerings span from smoke alarms and carbon monoxide detectors to electronic locks and motion sensors, making them more accessible to a broader consumer base.

The convergence of safety and security devices with remote monitoring capabilities has significantly elevated the safety quotient within smart home and office domains. By empowering users with real-time notifications and preemptive alerts, these interconnected systems revolutionize how individuals interact with their living and working spaces. The convenience and peace of mind afforded by these innovations not only cater to contemporary needs but also anticipate the evolving requirements of an aging demographic, fostering a more secure and independent lifestyle.

Leave a Comment