Market Share

5G Fixed Wireless Access Market Share Analysis

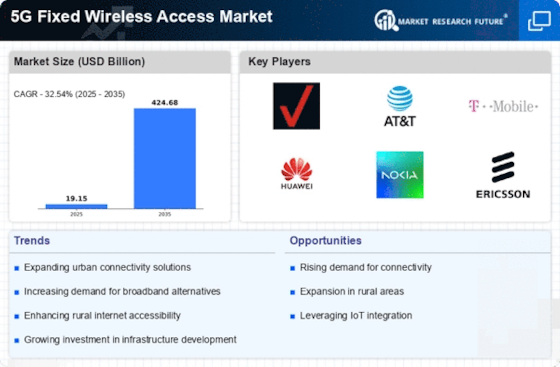

The techniques employed by industry competitors to determine their market share positioning are crucial in the ever-changing 5G Fixed Wireless Access (FWA) market. Companies are using a variety of strategic tactics to carve out their place in this rapidly expanding market as the competition to establish supremacy heats up. Early acceptance and quick implementation of 5G FWA infrastructure is a crucial tactic. Businesses who take the lead and make large investments in developing strong 5G networks establish themselves as industry leaders, earning a competitive advantage and snatching up a sizeable portion of the market. In the context of 5G FWA, differentiation is yet another essential component of market positioning. Businesses aim to set themselves apart from the competition by creating distinctive value propositions, which may be achieved through greater network performance, creative service packages, or exclusive alliances. This strengthens a company's market presence in addition to aiding in client acquisition and retention. Especially in a market where customers are becoming more picky about the features and quality of their connection services, effective differentiation may be a game-changer. In the 5G FWA area, cooperation and strategic partnerships are essential to one's market share position. Businesses frequently join forces with other members of the telecommunications ecosystem, such as content providers, equipment producers, and infrastructure suppliers. These kinds of alliances enable the development of comprehensive solutions, the extension of the service offering, and the enhancement of the overall value proposition for customers. Companies may take advantage of synergies to improve their market position and increase their share of the 5G FWA market by proactively interacting with key stakeholders. Furthermore, in the 5G FWA industry, pricing methods are a significant factor in deciding market share. Businesses have to walk a tightrope between providing low pricing to draw in a large consumer base and guarantee long-term profitability. While some may concentrate on providing high-quality services at a premium price to rapidly increase their market share, others may use aggressive pricing to cater particular audience. Choosing the appropriate price plan is essential for long-term success in a market where customers demand value and affordability. In the 5G FWA market, innovations are the cornerstone of market share positioning tactics. Businesses that put money into R&D to deploy innovative services and technologies stay on the cutting edge of innovation. Whether it's integrating cutting-edge network functionalities, enhancing user experiences with intelligent applications, or investigating novel applications for 5G, innovation serves to both draw in new clients and keep hold of current ones. Companies can stay competitive in the quickly changing 5G FWA landscape by being on the cutting edge of technology advancements. Furthermore, businesses are employing global expansion as a calculated strategic move to grow their market share in the 5G FWA. Businesses can obtain a footing in regions with less competition and win over new clientele by extending their reach into neglected or unexplored markets. Companies that expand geographically can also benefit from the varying connection requirements of various areas, which helps them stand out in the marketplace.

Leave a Comment