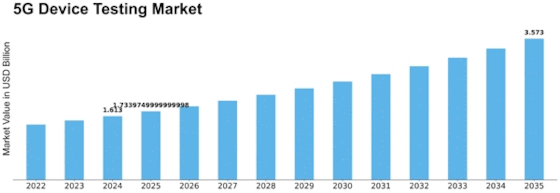

5g Device Testing Size

5G Device Testing Market Growth Projections and Opportunities

The 5G device testing market is undergoing significant transformations due to various market factors that influence its dynamics. One crucial factor is the rapid proliferation of 5G technology worldwide. As the fifth generation of wireless technology becomes more prevalent, the demand for 5G devices, such as smartphones, IoT devices, and other connected gadgets, is on the rise. This surge in demand necessitates rigorous testing to ensure the reliability, performance, and compatibility of these devices with 5G networks.

Moreover, the competitive landscape plays a pivotal role in shaping the 5G device testing market. With numerous players entering the 5G ecosystem, including device manufacturers, network operators, and testing solution providers, the market experiences heightened competition. This competition fosters innovation and pushes testing technologies to evolve, thereby enhancing the overall quality of 5G devices.

Standardization and regulatory compliance are other critical market factors influencing the 5G device testing landscape. Standardization bodies and regulatory authorities play a vital role in establishing guidelines and requirements for 5G devices. Adherence to these standards ensures interoperability and seamless connectivity across diverse networks and devices. Consequently, testing solutions must keep pace with evolving standards, making it essential for market players to invest in research and development to meet these compliance needs.

Furthermore, the complexity of 5G technology itself contributes to the growth of the device testing market. The intricate nature of 5G networks, with features like massive MIMO, beamforming, and advanced modulation schemes, poses unique challenges in testing. To address these challenges, sophisticated testing solutions are required to assess the performance, security, and functionality of 5G devices comprehensively. As the technology continues to advance, the demand for cutting-edge testing solutions escalates, driving growth in the market.

The global nature of the 5G rollout is another key factor shaping the device testing market. Different regions may have distinct frequency bands, spectrum allocations, and network architectures for 5G. Testing solutions need to adapt to these regional variations, ensuring that 5G devices can seamlessly operate across diverse geographical landscapes. This geographic diversity introduces complexity to the testing process, necessitating versatile and adaptable testing solutions.

In addition to these factors, the increasing importance of quality of service (QoS) and quality of experience (QoE) in the 5G era propels the demand for robust testing solutions. Users expect high-performance, low-latency connectivity from their 5G devices, and testing becomes instrumental in delivering on these expectations. Consequently, device testing encompasses not only technical parameters but also user-centric aspects, ensuring a holistic evaluation of 5G devices.

Leave a Comment