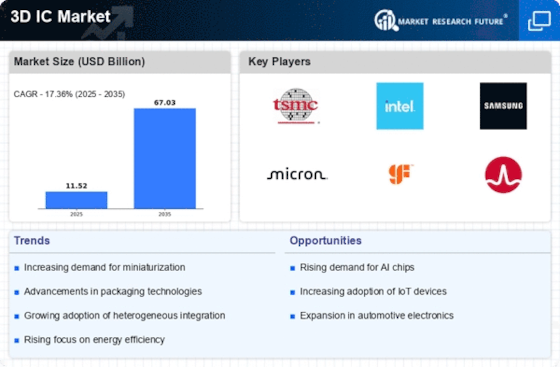

Top Industry Leaders in the 3D IC Market

*Disclaimer: List of key companies in no particular order

The Competitive Landscape of the 3D IC Market

The 3D IC market, a futuristic fusion of silicon layers. This intricate tapestry of opportunity demands a clear understanding of the players, strategies, and factors shaping the competitive landscape. Navigating this intricate landscape requires a clear understanding of the strategies, factors, and players shaping this competitive terrain. Understanding the competitive landscape is crucial for navigating this intricate ecosystem.

Some of the 3D IC companies listed below:

- United Microelectronics Corporation

- Tezzaron Semiconductor Conductor Corporation

- 3M Company Besang Inc.

- IBM Corporation

- Xilinx Inc.

- Monolithic 3D Inc.

- Intel Corporation

- Toshiba Corp. Amkor Technology

- Samsung Electronics Co. Ltd.

Strategies Adopted by Leaders

- Technological Prowess: Industry leaders like Samsung, Intel, and TSMC invest heavily in R&D, pushing the boundaries of 3D stacking technologies like TSV (Through-Silicon Via) and heterogeneous integration. Smaller players innovate with niche techniques like 3D NAND and chip-on-chip stacking, carving out their own space.

- Vertical Integration: Some players, like Samsung and Micron, vertically integrate wafer fabrication, chip design, and packaging, offering tight control over quality and cost. Others rely on foundries like TSMC for manufacturing, focusing on design and IP licensing.

- Application Focus: Market leaders cater to specific industry segments. Samsung excels in mobile and memory applications, while Intel targets high-performance computing and AI. This specialization allows for tailored solutions and deeper market penetration.

- Ecosystem Collaboration: Open-source standards and strong partnerships with software developers and equipment manufacturers are crucial for wider adoption and accelerated innovation in the 3D IC ecosystem.

Factors for Market Share Analysis:

-

3D Integration Technology: Analyzing market share by technology type (TSV, 3D NAND, chip-on-chip) reveals dominant players in each segment and future growth potential. For instance, Samsung leads in 3D NAND, while Intel dominates in logic stacking.

-

Application Segment: Understanding the needs of different end-user segments (mobile, consumer electronics, automotive, etc.) is key. Mobile devices prioritize miniaturization and power efficiency, while high-performance computing demands high-density stacking and bandwidth.

-

Geographical Variations: North America and Asia Pacific remain the largest markets, with China driving rapid growth. Understanding regional manufacturing capabilities, government policies, and technology adoption rates is crucial for targeted expansion.

-

Foundry Landscape: The dominance of foundries like TSMC and Samsung significantly impacts market dynamics. Analyzing their technology roadmaps, client partnerships, and pricing strategies helps players navigate the supply chain landscape.

New and Emerging Companies:

- SK Hynix: This Korean memory giant is rapidly entering the 3D logic IC market, leveraging its expertise in 3D NAND and challenging established players like Samsung and Intel.

- Cerebras: This American startup specializes in wafer-scale 3D ICs for AI applications, offering unparalleled computing power and targeting the high-performance computing segment.

- Yole Developement: This French market research firm provides valuable insights and forecasts for the 3D IC market, helping players identify opportunities and make informed strategic decisions.

Industry Developments:

On Sep. 25, 2023- TSMC announced a breakthrough set (3Dblox 2.0 and 3DFabric Alliance) to redefine the future of 3D IC. The 3Dblox 2.0 features a 3D IC design capability that significantly boosts design efficiency. The 3DFabric Alliance continues to drive memory, substrate, testing, manufacturing, and packaging integration.

TSMC detailed the new 3Dblox 2.0 and 3DFabric Alliance achievements at the 2023 OIP Ecosystem Forum. The company also mentioned that it will continue to push the envelope of 3D IC innovation, making its 3D silicon stacking and advanced packaging technologies accessible to its customers.

On Sep. 25, 2023- ProteanTecs, a leading global provider of deep data analytics for advanced electronics, announced that it has joined the TSMC Open Innovation Platform (OIP) 3D Fabric Alliance. The 3D Fabric Alliance was formed to encourage 3D IC innovation, readiness, and customer adoption.

On Sept. 27, 2023- Synopsys, Inc. (SNPS) announced extending its collaboration with TSMC to streamline multi-die system complexity with the unified exploration-to-signoff platform and proven UCIe IP on the TSMC N3E process. The comprehensive multi-die system design solution supports 3dblox 2.0 standard and TSMC 3dfabric technologies to boost productivity for fast heterogeneous integration.

On Oct. 02, 2023- Cadence Design Systems (CDNS) announced the availability of enhanced system prototyping methods based on its Integrity 3D-IC Platform, aligned with the 3Dblox 2.0 standards. The platform has been tailored to suit TSMC's latest 3DFabric technologies, such as chip-on-wafer-on-substrate, integrated fan-out, and system-on-integrated chips. This collaboration will allow customers to model system prototypes, expediting the design process for AI, mobile, 5G, hyper scale computing, and IoT 3D-IC designs.