Research Methodology on the 3D Cell Culture Market

Introduction

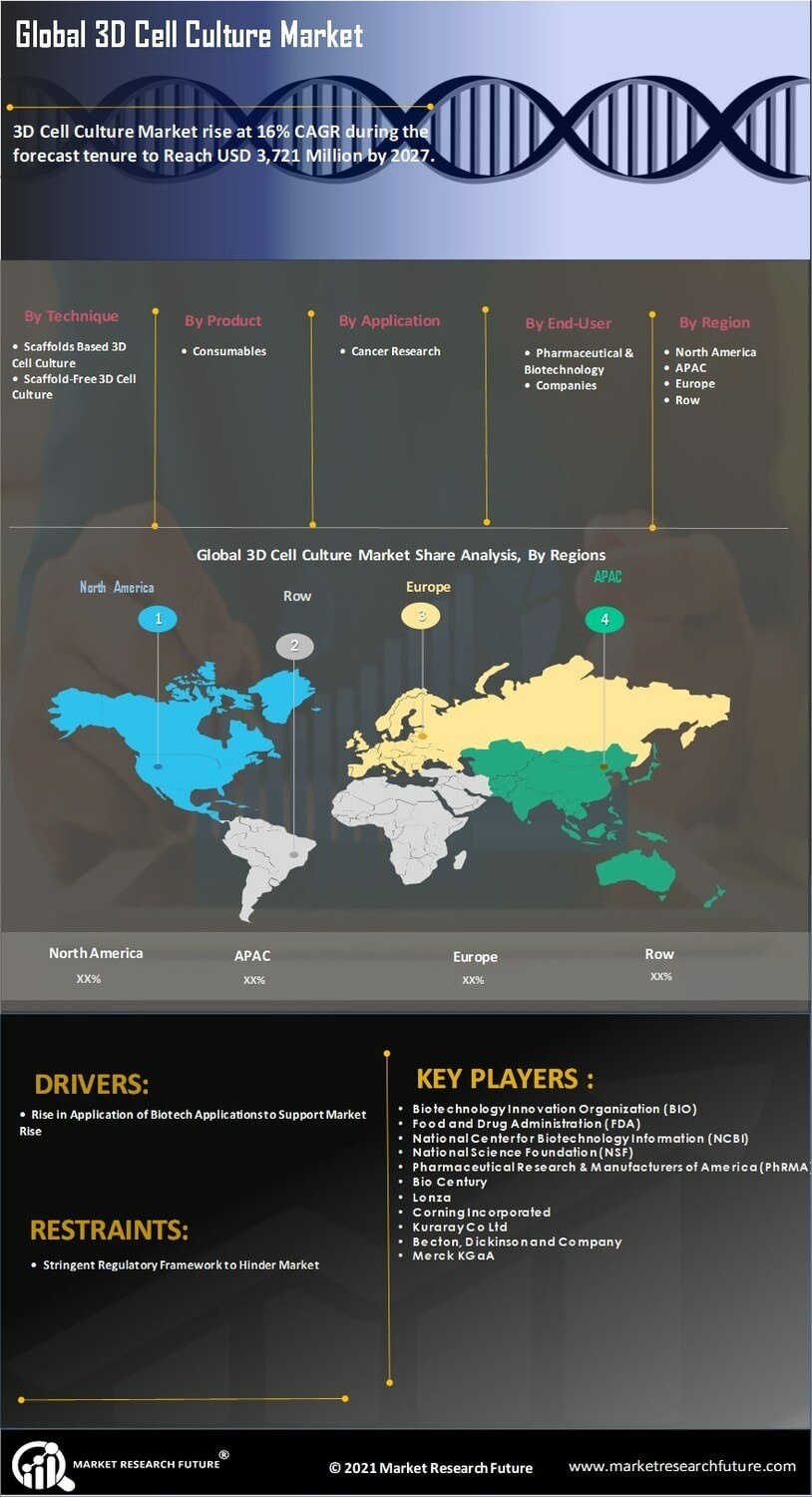

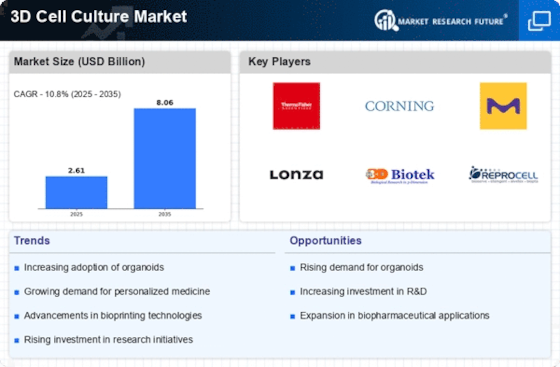

The 3D cell culture is a powerful tool for advancing our understanding of biological phenomena in vivo. The technique involves culturing three-dimensional cellular structures which improve the cellular model for various mechanisms used in various research areas. The creation of cell arrangements in a 3D environment is becoming more relevant to drug discovery, bioprocessing and tissue engineering applications. This research provides a comprehensive analysis of the 3D cell culture market and examines market opportunities, competitive landscape and industry dynamics.

Research Methodology

Research Design

This study is an extensive research report, that applies quantitative and qualitative research methodologies to assess the 3D cell culture market. An extensive survey of the 3D cell culture market is done with respect to the current market structure and future market scenarios. The data is collected through secondary research and primary interviews, with expert opinions and market trends.

Data Collection

The data is collected through a combination of primary and secondary research. Primary research includes interviews with key 3D cell culture companies and their executives, to get maximum and updated information on the 3D cell culture market arcading all the aspects of the market. Secondary research, on the other hand, covers recent developments and projects related to the 3D cell culture market, along with information from industry associations, databases, trade journals, and directories.

Data Analysis

The data is analyzed utilizing an array of statistical methods and graphical charts. The method of analysis used in the study consists of descriptive statistics, trend analysis and market size estimation. The data collected is further analyzed by various statistical methods such as Porter’s Five Forces Model and SWOT analysis, for further validation of the market trends/analysis. The analysis of the collected data also helps in forming market projections and trends.

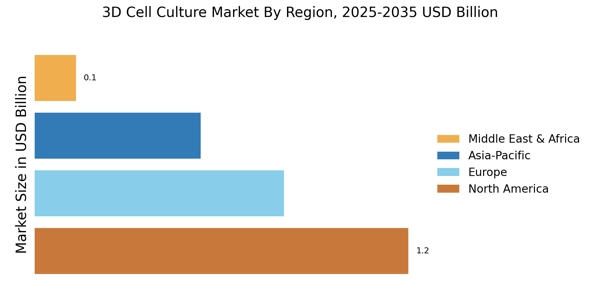

Research Scope

The research on the 3D cell culture market is focused primarily on the current market dynamics, size and trends of the market segments and prospective analysis. The research report also provides information on the competitive landscape and competitive companies along with their products, their approaches and their SWOT analysis. The research also covers a review of the geographical markets in the 3D cell culture space.

Conclusion

This study provides a comprehensive analysis of the 3D cell culture market covering market dynamics and providing market strategies. The study reveals that the 3D cell culture market is expected to grow at a significant rate during the forecast period of 2023-2030.