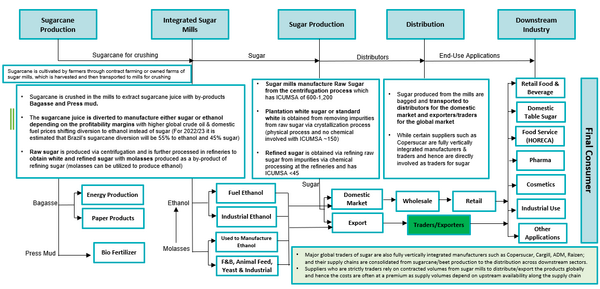

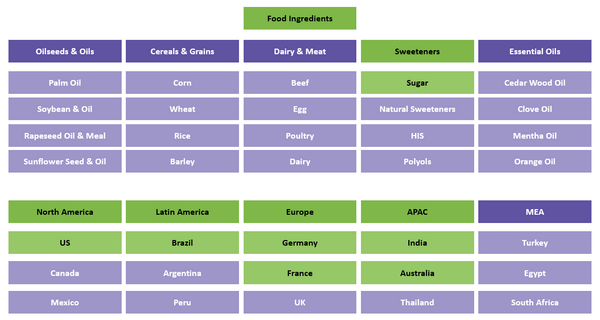

The Global Sugar market size is estimated at $97.54 billion in 2022 and is projected to grow at a CAGR of 1.5 percent from 2022 to 2026 supported by a recovery in consumption levels from the downstream retail and foodservice sector with sugar being an important source of calorific content in diets across geographies, along with growing demand for sugar use in other downstream applications such as pharma and industrial usage. While the demand for sustainably sourcing sugar is seen to gain traction among key end-use industry buyers. Sugar Market Outlook The current global sugar market is witnessing a period of seasonally high supply, amid the harvest season in key producing regions. While initial estimates for 2022/23 denote a surplus of 5.57 MMT, driven by an expected recovery in Brazilian output, coupled with higher volumes from Asia. While regional tightness is anticipated in the US and Europe, on the account of adverse weather, high energy costs and shifting acreage to grains & oilseeds tightening supply. The International Sugar Organization (ISO) in its latest quarterly bulletin projecting a global surplus of 5.6 MMT in 2022/23, compared with a deficit of 1.3 MMT the previous season. While sugar output in Brazil’s Centre-South (CS) region is likely to increase this season as against earlier expectations due to more favourable weather conditions and domestic fuel tax policies which is seen favouring higher sugarcane diversion to sugar instead of ethanol. Global sugar demand is projected to recover 1.9 percent in 2022/23, driven by a revival in consumption from the downstream industries is likely to recover, mainly from the foodservice sector, with lockdown restrictions being removed across major consuming regions. However, recent global concerns of high inflation and macroeconomic downturn is seen to restrict demand recovery from the major downstream end-use sectors. Higher agricultural input costs, especially in Europe amid the ongoing energy crisis exacerbated by the Russia-Ukraine war, along with higher costs of production expected in Brazil and India, driven by increasing fertilizer and energy costs is likely to exert upward pressure on prices.. Sugar Pricing Insights Global sugar prices are projected to trade volatile with recent favorable weather in Brazil seen raising supply estimates and strong harvest volumes seen from Asia. Favorable weather conditions expected in Centre-South Brazil allowing for more cane to be crushed than expected before the rainy season sets in properly is seen to raise sugar output. Along with the decision taken by Brazil’s new President Lula da Silva to continue with the exemption of fuel from the federal tax which is seen to lower the diversion of cane to ethanol thus raising sugar supply and negatively impacting prices Further, the good progress of sugarcane harvest in India and Thailand is seen to raise global sugar availability with the industry group Czarnikow upward revising estimates of global sugar production for 2022/23 by 0.8 MMT to 179.2 MMT. Sugar Supply Outlook Initial expectations indicate higher sugar output in Brazil where mills are likely to allocate record quantity of sugarcane for sugar production, as sugar is likely to give better financial returns than ethanol. According to the latest report of consultancy Safras & Mercado - the total sugarcane crushing in the center-south of Brazil in the season 2023-24 (April-March) is likely to be 565 MMT as compared to the estimated 545 MMT for the current crop yielding sugar production of 39.04 MMT denoting an increase by 8.3% next season. While Brazilian agency Conab recently hiked its Brazil 2022/23 sugar production estimate to 36.4 MMT from the prior estimate of 33.9 MMT The current Thai sugar cane crush has recently begun, with mills in the North and Northeast able to take advantage of the dry fields estimated to yield sugar output of 10.6 MMT (0.5 MMT higher than the previous season). While, according to the Indian Sugar Mills Association (ISMA), initial estimates project lower Indian sugar output for 2022/23 by 1.4% to 35.5 MMT due to 4.5-5 MMT diversion of sugarcane to ethanol production as compared with 3.4 MMT of the current season. While India is seen likely to approve sugar exports in two tranches for the 2022/23 season as it assesses its sugar supply situation with a total of 7-8 MMT of exports expected (down from 11.2 MMT of the previous season) which is seen to tighten global availability Sugar Value Chain Regional Market Insights Brazilian sugar export volumes are seen to recover for 2022/23 in line with an expected recovery in domestic output levels. With mills projected to exports 26.62 Thousand MT of sugar for the season, which is 3.8 percent higher than the previous season Initial estimates of ISMA projecting lower Indian sugar output for 2022/23 by 1.4 percent to 35.5 MMT, due to 4.5 MMT diversion to ethanol production as compared with 3.4 MMT of the current season. While India is seen likely to approve sugar exports in two tranches for the 2022/23 season as it assesses its sugar supply situation with a total of 7-8 MMT of exports expected (down from 11.2 MMT of the previous season) Total sugar supply in Europe is projected to contract 1.7 percent Y-o-Y to 19.78 MMT, driven by rising concerns of tighter domestic output, due to extreme heatwaves across key producing regions and surging input costs seen to restrict output. While the intensifying energy crisis in the continent is likely to result in energy rationing and a subsequent reduction in operating rates by sugar refineries and also, lead to early harvesting of beet, which is seen to result in lower sucrose recovery rates. Supplier Intelligence The category intelligence covers some of the key global and regional players such as Cosan Raizen, EID Parry, Sao Martinho, among others. In Brazil, Raízen and ASR Group announced a partnership in August 2022 that is likely to set the standard for sustainable raw cane sugar supply chains globally. The unprecedented multi-year agreement between the partners creates the world’s first fully physically traceable and 100 percent non-genetically modified (non-GM) certified supply chain MSM Malaysia Holdings Bhd (MSM Malaysia) and Wilmar Sugar Pvt Ltd (Wilmar Sugar) have signed an collaboration agreement in early 2022. Both companies will jointly focus on the sourcing and supplying of the raw sugar and monitor sustainability performance based on the NDPE (No Deforestation, No People Exploitation) Sugar Policy. Segmentation Overview:

1. Executive Summary

1.1. Global Market Outlook

1.2. Supply Market Outlook

1.3. Demand Market Outlook

1.4. Recommendations – Category Strategy Framework

1.5. Category Opportunities & Risk

1.6. Negotiation Levers

1.7. Talking Points: Sugar

1.8. Impact of COVID-19 – Sugar

2. Global Market Analysis

2.1. Global Sugar Demand and Supply Analysis

2.1.1. Sugar Consumption by Country, 2022, Percentage

2.1.2. Sugar Production by Country, 2022, Percentage

2.1.3. Sugar Supply-Demand Estimates, 2017-2022, MMT

2.1.4. Global Sugarcane and Sugar Beet Production by Country, 2022, MMT

2.2. Global Sugar Trade Dynamics

2.2.1. Global Sugar Export Volumes, 2017-2022E, MMT

2.2.2. Sugar Exports by Country, 2021 Actuals, Percentage

2.2.3. Sugar Imports by Country, 2021 Actuals, Percentage

3. RegionaL Market Analysis

3.1. Brazil Regional Market Snapshot

3.1.1. Supply and Demand Estimates, 2017-2022, MMT

3.1.2. Brazil Export Share by Country, 2021 Actuals, Percentage

3.1.3. Brazil Import Share by Country, 2021 Actuals, Percentage

3.2. India Regional Market Snapshot

3.2.1. Supply and Demand Estimates, 2017-2022, MMT

3.2.2. India Export Share by Country, 2021 Actuals, Percentage

3.2.3. India Import Share by Country, 2021 Actuals, Percentage

3.3. USA Regional Market Snapshot

3.3.1. Supply and Demand Estimates, 2017-2022, MMT

3.3.2. USA Export Share by Country, 2021 Actuals, Percentage

3.3.3. USA Import Share by Country, 2021 Actuals, Percentage

3.4. Australia Regional Market Snapshot

3.4.1. Supply and Demand Estimates, 2017-2022, MMT

3.4.2. Australia Export Share by Country, 2021 Actuals, Percentage

3.4.3. Australia Import Share by Country, 2021 Actuals, Percentage

3.5. Europe Regional Market Snapshot

3.5.1. Supply and Demand Estimates, 2017-2022, MMT

3.5.2. Europe Sugar Production Overview, 2017-2022, MMT

4. Market Monitoring Insights

4.1. Cost Structure Analysis, 2022

4.1.1. Brazil

4.1.2. USA

4.1.3. EU

4.2. Price Drivers and Analysis, Nov 2022 – Oct 2023

4.2.1. Brazil Sugar Price Forecast, Nov 2022 – Oct 2023, USD/MT

4.2.2. India Sugar Price Forecast, Nov 2022 – Oct 2023, USD/MT

4.2.3. USA Sugar Price Forecast, Nov 2022 – Oct 2023, USD/MT

4.2.4. EU Sugar Price Forecast, Nov 2022 – Oct 2023, USD/MT

5. Industry Analysis

5.1. Porter Five Forces Analysis

5.2. Market Trends and Innovations

6. Supplier base Analysis

6.1. Global Supplier List and SWOT Analysis

6.2. Key Global Supplier Profile

6.2.1. Cosan S.A. – Raizen

6.2.2. Sao Martinho S.A.

6.2.3. EID Parry Limited

6.2.4. Shree Renuka Sugars Ltd.

7. SUGAR RFP Builder

8. Sustainability Initiatives & Best Practices