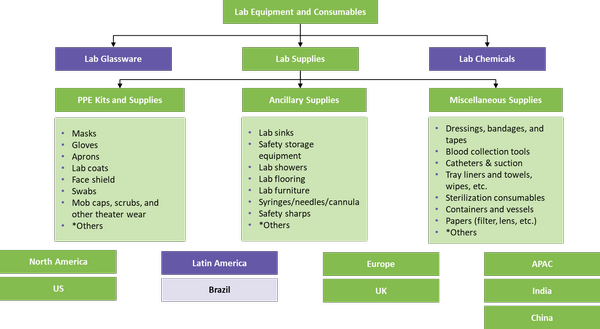

The global market for lab supplies globally is $33.76 billion as of 2022 and is expected to show a continuous growth rate of 5-6 percent (Y-o-Y). Due to the increasing analytical testing needs and drug development solutions increase, which is creating a high demand of lab supplies across the globe, the supply–demand gap is increasing Lab Supplies Market Outlook The lab supplies global market has witnessed a stable growth due to continuous demand from diversified end-user segment. The lab supplies global market has witnessed a stable growth due to continuous demand from diversified end-user segment Pharmaceutical/biotech companies constitute 30 percent of the overall demand for lab supplies. Suppliers view the pharmaceutical industry buyers as core accounts with whom they are willing to engage in a strategic partnership and offer better options for technology updates and regular support. Apart from lab consumables, higher percentage of demand increase is observed for personal protective equipment The supply market is highly concentrated, and the competition is very intense. However, there will be higher price fluctuations owing to the increased demand for consumables for research and testing purposes Sourcing from regional players has been the usual strategy adopted for low-cost supplies however with high export and import implications, regional suppliers are gaining strength Vendors team up with resellers or specific tech players, in order to strengthen their market access and logistics. This gives them the power to reach multiple markets and devises a rapid delivery system COVID-19, Russia-Ukraine Crisis, and Economic Headwinds Impact on Lab supplies Due to the increased demand of lab chemicals, manufacturers are expanding their facilities, innovating their product development, and working practices to accommodate the excess demand of chemicals. Manufacturers expanded their facilities and ramped up their production to cope with the demand across various markets. The demand for PPE kits was high due to COVID-19 and a balance was being brought about slowly. However, virtual tools and e-commerce support enable a better situation to pharma companies Lab Supplies Pricing Insights Raw materials and packaging, logistics are the major contributors to the cost structure of lab supplies, followed by utilities. Thus, procuring near-shore avoids issue related to logistics, saves time, and cost Disposable items usually add up to lesser operational costs and help in preventing manual errors. Also, enables buyer to save on sterilization costs and reduce the chances of cross-contamination. Lab Supplies Supply Outlook More reliance on local/regional suppliers to overcome the demand. The situation has become better, and the vendors have increased production with more players providing better logistics support to sponsors. Suppliers are setting up regional plants and hiring resources to increase the production of the PPE kits and other supplies to meet the demand in addition to the existing plants Lab Supplies- Value Chain Regional Market Insights The US and Europe contributed 48 percent and 32 percent respectively to the global lab supplies market. Increasing trials in the US would continue to influence lab supplies’ purchases by academic, research, and federal institutions Impact of the crisis has increased regional demand and pharma companies are looking to source internally from the regional suppliers and at the also are keen on quality. Import and export regulations and shipment timelines pose a major threat to reaching global markets. Supplier Intelligence The category intelligence covers some of the key global and regional players such as Thermofisher Scientific, Agilent, Avantor, Perkinelmer, Sigma- Aldrich, Bio-Rad, Eppendorf Mettler-Toledo International, Inc. and Boekel Scientific among others. Key global players have announced the reduction plant of carbon footprint. For instance, GREEN-DEX™ Biodegradable Single-Use Green Nitrile Gloves using its Eco Best Technology. These gloves are ideal for usage during intermittent contact with chemicals including certain acids, alcohols, alkalies and ketones. Segmentation Overview

1. Executive Summary/ COVID-19 UPDATE

1.1. Regional Overview

1.2. Supply Market Outlook

1.3. Demand Market Outlook

1.4. MRFR’s Recommendations for an Ideal Category Strategy

1.5. Category Opportunities and Risks

1.6. Negotiation Leverage

1.7. Talking Points: Lab supplies

1.8. Impact of COVID-19 on Lab Supplies

1.9. COVID-19 Update

1.9.1. Category Summary

1.9.2. Impact of COVID-19

1.9.3. Industry Watch

1.9.4. Sourcing Location Watch

1.9.5. Supplier Watch

2. Global Market Analysis

2.1. Market Landscape

2.2. End User Segmentation

2.3. Regional Demand

2.4. Market Trends

2.5. Procurement Centric Five Forces Analysis

3. Market monitoring insights

3.1. Cost Structure Analysis

4. sourcing practices

4.1. Sourcing Practices

5. purchasing process (rfp/rfi builder)

5.1. RFP Builder

6. sustainability

6.1. Sustainability Initiatives

6.2. Sustainability Best Practices- Case Studies

7. Supplier base Analysis

7.1. Global Supplier List and Capabilities

7.2. Regional Supplier List and Capabilities

7.3. Key Global Supplier Profile

7.3.1. Agilent Technologies

7.3.2. Avantor

7.3.3. Perkin Elmer

7.3.4. Sigma - Aldrich

7.3.5. Thermo Fisher Scientific

8. InNOVATION FRAMEWORK

8.1. Innovations

9. SUSTAINABILITY

9.1. Sustainable Initiatives