Robot Tax Implementation in the United States

Robots and automation have set up their base in the technologically evolving market, thus impacting the job market. The market is expected to grow in robots and automation soon. A new question has arisen in the United States on whether to implement a robot tax.

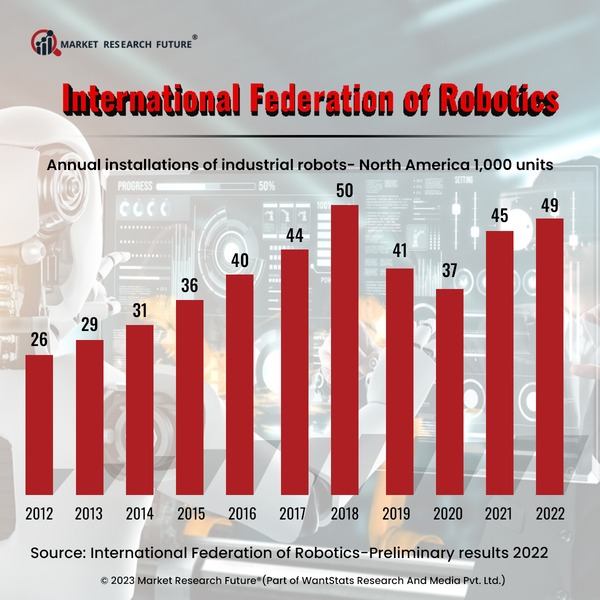

As per 2023 estimation, the manufacturing of robots in the North American region has increased to more than 12 percent in 2022. The growing advancements in robotics and automation have given concerns over the impact on the employment sector and specific jobs. The robot tax idea means that every time the company chooses robots over human workers, it must pay a tax. The robot tax has two aims: to discourage companies as they replaced human workers with robots and to produce a tax for the government to compensate for the loss of payroll taxes. According to the data from trusted sources, a 37 percent drop is seen in the number of ordered industrial robots in the North American region from April to July 2023 than the same period in 2022. For the first half of 2023, 16,865 robots were ordered, which accounted for a fall of 29 percent in the robotics market in North America.Some experts view robot tax as the medium to lower the inequality in the job market, and the rest of them suggest altering the labor laws or making reforms in the labor market to address the issue. The experts note that robot tax should not hinder the innovation and manufacturing sector enhanced due to robotics and automation. Based on a study report conducted in 2023, the best taxing range falls between 1 to 3.7 percent of the robots' value. If implemented, the robot tax can support workers from falling victim to inequality and losing their jobs, as robotics and automation pave the way for more effortless functioning of manufacturing, technical support, and others.