More Number of Chinese Banks Contributing Towards Carbon Dioxide Emissions

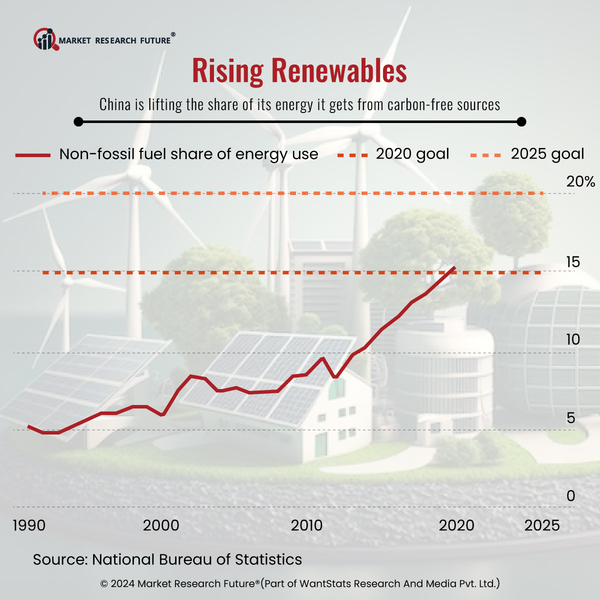

The carbon dioxide emissions from different sources in the environment are contributing to climate change, extreme weather, and other disadvantages. Carbon dioxide emissions worldwide from fossil fuels are reported to be the highest in 2023. The banks globally producing the carbon dioxide emissions are more in numbers in China for 2023.The data provided by a survey shows that China tops the list of countries emitting carbon dioxide, with four banks from the top in 2023. The survey reports for 2023 show that Agricultural Bank of China Limited is reported to generate over two million tonnes of carbon dioxide in 2022. The Agricultural Bank of China Limited tops the list of banks recorded for emitting more carbon dioxide, and two other Chinese banks follow it in the second and third ranks, the Industrial Commercial Bank of China Limited and the China Construction Bank Corporation, respectively. Six Chinese banks are on the list of banks worldwide producing carbon dioxide emissions, as reported by the survey in 2023. The United States JP Morgan stands out as producing around 961,000 tonnes of carbon dioxide. JP Morgan is producing more carbon emissions among the list of banks reported worldwide after excluding Chinese banks in 2023. The banks considered for the study were measured by their total assets. The Bank of America said it produced approximately 773,000 tonnes of carbon dioxide. The surveys show that most greenhouse gas emissions are from indirect emissions, including business travel. JPMorgan, Bank of America, and France's BNP Paribas reported such indirect carbon dioxide emissions with the highest figures. According to another survey, China produces around 31 percent of the carbon dioxide emissions of global fossil fuels in 2023. The country simultaneously holds the record for a more significant number of banks in the list of carbon dioxide-emitting banks globally for 2023. However, researchers cite that China's greenhouse emissions can go downward due to the increasing number of renewable energy installations in the county in 2023. Increased carbon emissions from the big banks worldwide are hurdles in transitioning to clean energy. Therefore, it is necessary to reduce carbon emissions to achieve net zero by 2050 as per the target.