Europe’s Clean Energy Transition Funds May Suffer From Dip In Carbon Prices

Carbon dioxide prices are changing due to fluctuating market conditions in 2024. The trading markets of the European Union experienced a lower carbon emissions rate in 2024. This indicates that the harmful carbon emissions have lowered in the industries. Hence, it is a good sign for the ongoing clean energy transition.

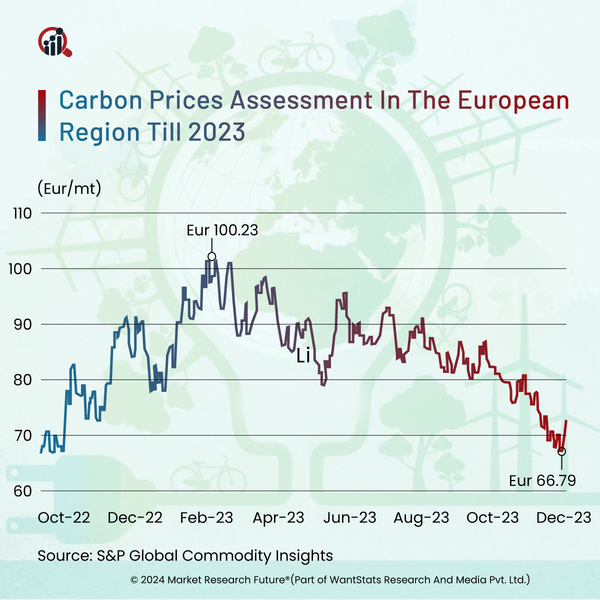

Based on a survey, carbon emissions are decreasing, indicating that industries following the net zero emissions rules emit less carbon dioxide. The survey was conducted at the beginning of 2024. However, the results of less carbon emissions may lead to less funds needed for the green energy transition. At the beginning of 2024, the price per carbon permit on the Emissions Trading Systems (ETS) was at USD 58. It is the lowest carbon price in the past two years from 2024. This lowering of the carbon prices leads to tension for the officials at the ETS as they have to drop the plans for higher emissions prices. To fill the clean energy transition funds, the ETS officials have planned for higher emission prices in 2024.

Experts say that ETS aimed to monitor the emissions rate from the power generating companies they produce during their production mechanism. However, companies are supposed to buy specific carbon permits at market rates. Therefore, companies in the European region are bound to pay according to their emission rates. It started with the idea of collecting funds from the companies according to their carbon emissions to reduce the rate of emissions. This collected fund was expected to be used to set up renewable energy sources. Simultaneously, another idea is that this process could end up with companies being aware of their emissions and higher prices to pay according to their emissions. Officials from ETS expected carbon emissions to go down, and the initial phase of 2024 proved this. The European Union believes there will be up to 90 percent reductions in carbon emissions by the end of 2040.