Commodity Price Increases will Adversely Affect the Building Industry

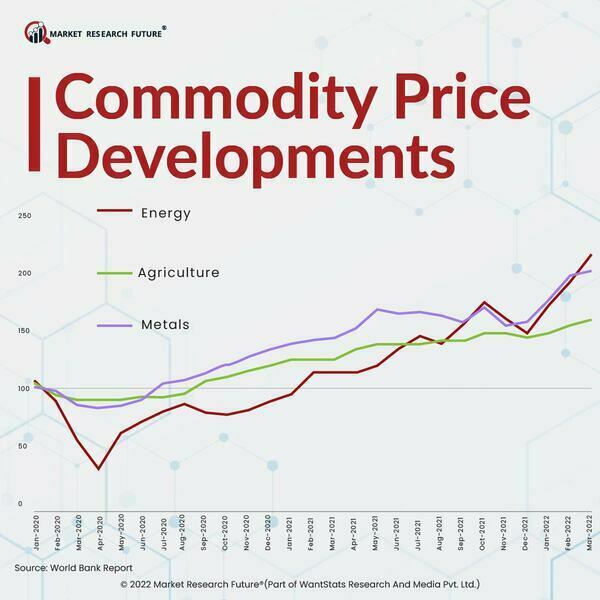

According to a domestic rating agency, ICRA, a sharp rise in commodity prices and increasing competition will hurt the building industry's profitability. due to the significant increase in the prices of essential commodities, particularly steel, bitumen, and cement, the industry is struggling with pressure on input costs.

ICRA stated that "sharp increases in commodity costs, coupled with increased competition, will have a detrimental impact on industry profitability, with a projected drop in operating profitability of 100-200 basis points in the current year."

If maintained, a high increase in commodity prices seen in FY22 could lower participants' profitability in the current fiscal year by 100 to 200 basis points.

Moreover, the stringent COVID-19 lockdown in Asian countries such as China, Japan, India, and the European Union has induced severe energy crises and disruption in the supply chain. This scenario increases construction materials and equipment prices even if the year-by-year price increases are moderate.

However, improving automation in manufacturing and construction processes and focusing on infrastructure favor industrial growth. The expansion of road development initiatives carried out by various central and state governments has led to a significant increase in the market for road construction machinery in recent years.

For instance, in May 2022, Volvo construction equipment and World RX worked on developing the next generation of rallycross tracks. Volvo CE announced it would expand its commitment by becoming the series' official track-build partner.

Tata Hitachi launched the 5-tonne wheel loader ZW225- touted as the epitome of reliability and productivity that is Made-in-India with Japanese technology.