Capital Flight of Credit Suisse Continues Amid Collapse in First Quarter

Credit Suisse became worse from bad in late March of 2022, this resulted in the state-brokered takeover by the rival UBS. The 167-year-old bank’s customers rushed for the exits along with their money.

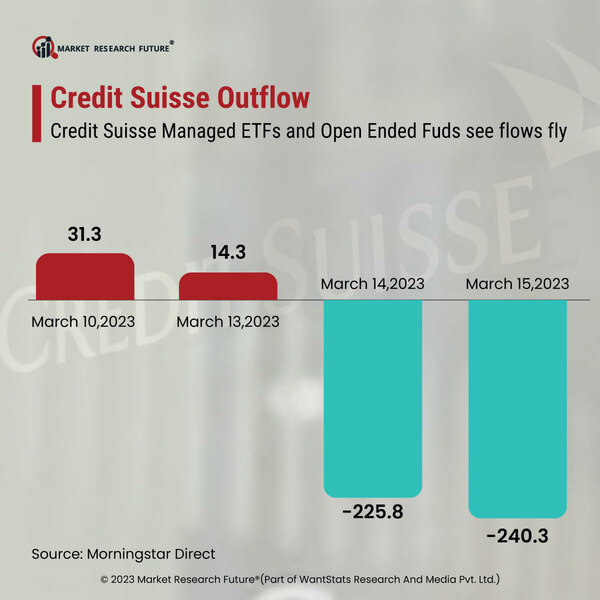

According to the bank’s latest report on the latest earnings, it showed outflow of net asset of CH 61 billion (69 billion) in the first three months pf the year, as the customer deposits declined by CHF 67 billion that is $75 billion. Also, before the collapse of Silicon Valley Bank across the financial sector. Credit Suisse suffered the apparent loss of confidence from the clients. After several scandals and failed investment, the Swiss banking group suffered a huge outflow of the deposits and assets under the management in 2022. It happened particularly in the fourth quarter and forced the group to partially utilize liquidity buffers.

Questioning the banks stability and restructuring efforts, the clients withdrew billions of dollars in the first week of October. It ultimately resulted in a CHF 138 billion ($155 billion) decline in the customer deposits by the end of first quarter in 2022. The assets under the management also declined as the Credit Suisse reported the net asset outflows of CHF 111 billion ($124 billion) for the fourth quarter in 2022. As per the reports, the group’s wealth management arm alone also saw clients withdraw CHF 93 billion ($104 billion) in the last quarter of 2022.

According to the Monday’s earnings release, the capital outflows have moderated but not yet reversed or changed as per the date of the report. By this they mean to say the exact meaning of the capital flight as it continues despite the takeover by UBS. It is expected to be completed later in 2022.