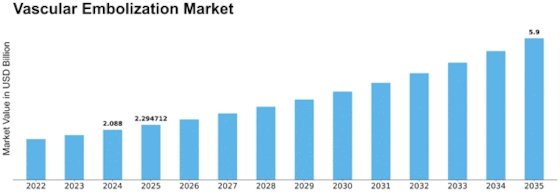

Vascular Embolization Size

Vascular Embolization Market Growth Projections and Opportunities

The market for vascular embolization is driven by many factors that work together to promote its growth and expansion. Among the major factors driving the market are rising incidence of vascular disorders and conditions. With the growing population worldwide, the number of aneurysms and diseases such as arteriovenous malformations also increase resulting to a high demand for vascular embolization procedures. On the other hand, this demand is met by embolic agents and devices that target a wide array of vascular defects. The growth in medical devices has been instrumental towards understanding the vascular embolization market. Constant innovation results in the rise of more advanced embolic products, delivery systems and imaging technology. Such innovations make vascular embolization procedures more precise, safe, and effective; this is why healthcare professionals have better opportunities to treat complex vascular disorders. The vascular embolization market landscape is shaped by the regulatory framework surrounding medical devices and interventional procedures. The specific regulatory standards guarantee the security, effectiveness, and quality of embolic agents along with devices that play some role in their acceptance for clinical use. The ability to comply with the regulatory requirements is one of the fundamental criteria for market entry and trust building among health care providers, patients’ population, and regulators. The socio-economic climate and health care infrastructure of various regions governs the implementation of vascular embolization procedures. Variations in health care access, reimbursement policies and economic conditions have an impact on embolization treatment prevalence. It is within these contrasting environments that market players must develop their products to meet the challenges provided by different healthcare systems. In vascular embolization market, the competitive landscape is dynamic with constant innovation and differentiation. Companies conduct research and development to develop embolic agents and devices with new features including specific delivery, less invasiveness, as well as visualization during procedures. This competitive landscape promotes an innovation cycle, where market participants sought to maintain technological leadership. The vascular embolization market has been affected by global health events like COVID-19. The pandemic resulted to elective medical procedures were disrupted meaning that the demand for vascular embolization was also impacted. Nevertheless, the enhanced adoption of embolization as a minimally invasive treatment method leads to market recovery and growth despite inevitable challenges for health care systems.

Leave a Comment