Refrigerated Display Cases Size

Market Size Snapshot

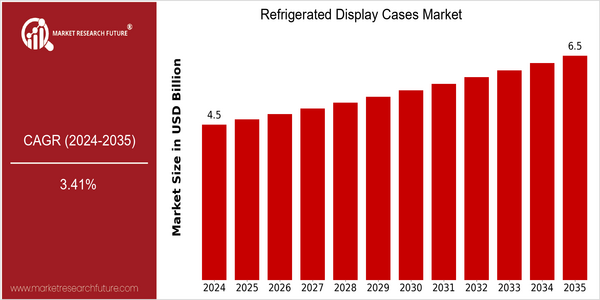

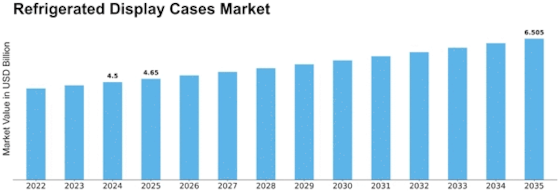

| Year | Value |

|---|---|

| 2024 | USD 4.49 Billion |

| 2035 | USD 6.5 Billion |

| CAGR (2025-2035) | 3.41 % |

Note – Market size depicts the revenue generated over the financial year

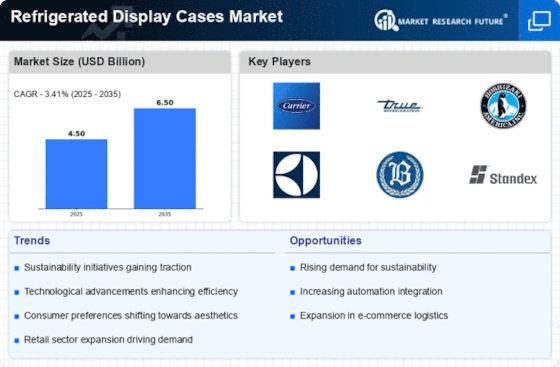

The global refrigerated display case market is expected to grow steadily, from an estimated market value of $ 4.49 billion in 2024, to $ 6.5 billion by 2035. This growth rate represents a CAGR of 3.41 per cent for the period 2025 to 2035. The growth is due to several factors, including the growing demand for fresh and perishable foods, the growth of organized retail formats and the advancements in refrigerating technology that make them more energy-efficient and sustainable. Moreover, the growing health consciousness of consumers is driving the demand for effective and hygienic display solutions. This, in turn, is driving the retail industry to invest in modern refrigerated display cases. The leading players in the market, including Carrier, Hussmann, and True, are constantly innovating and expanding their product portfolios to meet the changing demands of consumers. Strategic initiatives, such as partnership and investment in smart cooling technology, are also influencing the market. In the coming years, companies will focus on integrating IoT capabilities into their refrigerated display cases to optimize energy consumption and improve stock management. The future of the refrigerated display case market is therefore bright, driven by both demand and technological developments.

Regional Market Size

Regional Deep Dive

The refrigerated display case market is growing at a significant rate in many regions. It is driven by the increasing demand for fresh and perishable goods, advancements in cooling technology, and the increasing focus on energy efficiency. Each region has its own characteristics, which are influenced by local preferences, regulatory frameworks, and economic conditions. In the meantime, innovations in design and functionality are reshaping the competitive landscape.

Europe

- The European market is strongly influenced by the European Union’s commitment to sustainable development, and the resulting regulations that encourage the use of natural refrigerants and energy-saving technology. Frigoglass and AHT Cooling System are at the forefront of this transition, providing green solutions for refrigerated display cases.

- The increasing demand for organic food and fresh produce has forced retailers to place them in a more prominent position. This shift has increased the demand for refrigerated cabinets with an attractive appearance that improve the shopping experience.

Asia Pacific

- The region of Asia-Pacific is now undergoing rapid urbanization and the growth of the middle class, and this is causing a marked increase in the demand for refrigerated display cases in convenience stores and supermarkets. Daikin and Panasonic have been expanding their product lines to meet this demand.

- Smart refrigerators are gaining in popularity, and some companies are even integrating IoT functions into the display cabinet, in order to monitor the energy consumption in real time and achieve energy conservation. This trend will increase the efficiency of the operation and reduce the cost of the store.

Latin America

- Latin America is experiencing a shift towards modern shopping formats, with an increase in the use of refrigerated displays to enhance the product presentation. As a result, companies such as Frigidaire and Electra are increasing their presence in the region to meet the growing demand.

- The type of refrigerated cases that are in vogue are determined by the economic fluctuations and the purchasing power of the consumers. The aim is to offer the most cost-effective solution, without compromising on quality. This trend is expected to influence the product range in the region.

North America

- In the United States, the demand for energy-saving refrigerated cases has been stimulated by the stricter regulations on the reduction of carbon dioxide emissions. True and Hussmann are at the forefront of this development with their new products.

- Retailers have been forced by the rise of e-commerce and online shopping to invest in advanced refrigerated display solutions that enhance product visibility and availability. This is particularly true in urban areas, where space is at a premium and where compact, multi-purpose display cabinets are becoming the norm.

Middle East And Africa

- The markets of the Middle East and Africa are characterized by the expansion of the retail sector and by the growing importance of the modern retail formats. Companies such as Al Ain Dairy and Bidfood are investing in advanced refrigerated display solutions to meet the growing demand for fresh foods.

- The improvement of food hygiene has led to a growing demand for refrigerated display cabinets. The reluctance of retailers to waste food is particularly marked in regions where the food crisis is a major problem.

Did You Know?

“Did you know that refrigerated display cases can account for up to 50% of a supermarket's total energy consumption? This has led to a growing emphasis on energy-efficient designs and technologies in the market.” — Energy Star

Segmental Market Size

The refrigerated display cases segment plays a key role in the retail and foodservice industries, which are currently experiencing a stable growth driven by increasing consumer demand for fresh and convenient food. In particular, the growing trend towards ready-to-eat food and the increasing focus on food safety and quality are driving the demand for effective cooling solutions. Further growth drivers include regulatory initiatives to reduce food waste and improve energy efficiency. The refrigerated display cases market is currently in its mature stage of development, and the main players, such as Carrier and True, are focusing on developing new energy-efficient and customer-friendly solutions. These refrigerated display cases are essential in displaying perishable goods in supermarkets, convenience stores and restaurants. Meanwhile, the development of new technologies, such as the Internet of Things, is also enabling the industry to grow and ensures optimum performance and compliance with hygiene standards.

Future Outlook

In the period from 2024 to 2035, the global refrigerated display case market is expected to rise from USD 4.49 billion to USD 6.50 billion, at a CAGR of 3.41%. The main driving force behind this growth is the increasing demand for fresh and perishable goods, especially in the retail and food service industries. The growing urbanization will continue to affect the habits of consumers, and they will demand more efficient and attractive refrigerated display solutions. In 2035, it is expected that the penetration of advanced refrigerated display cases in large retail stores and convenience stores will reach about 60%, which is expected to be a significant shift towards the modernization of the retail environment. The development of the Internet of Things and smart refrigeration systems is expected to increase the operating efficiency and reduce energy consumption, which will also contribute to the growth of the market. In addition, stricter regulations on greenhouse gas emissions will drive manufacturers to adopt green refrigerants and energy-efficient designs. The rising e-commerce and the growing demand for sustainable packaging will also lead to the development of refrigerated display cabinets that can not only preserve the quality of the goods but also enhance the shopping experience. In a word, the refrigerated display case market will be greatly transformed by the combination of changing consumers' habits, technological innovation, and government policies.

Leave a Comment