Market Share

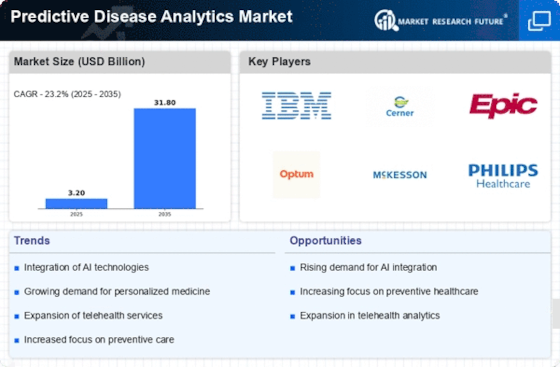

Predictive Disease Analytics Market Share Analysis

To fortify their position and gain competitive advantage in the highly dynamic Predictive Disease Analytics market, companies adopt different types of shareholder positions. The first significant strategy is the use of advanced technologies and data analytics abilities to create revolutionary predictive models. Companies capable of investing in state-of-the art machine learning algorithms, artificial intelligence and data processing techniques can provide better quality predictive analytics solutions that are error free which attracts healthcare providers, payers and pharmaceutical companies looking for the best insights available. The role of strategic partnerships and collaborations in the market share positioning is paramount. Companies can achieve a wide reach, diverse datasets, and robust predictive models by forming partnerships with healthcare organizations research bodies as well as technology providers. Implementation of collaborations also enables companies to combine their predictive disease analytics with the already established healthcare ecosystems, offering end-to-end solutions targeted at specific clinical needs. Factors reflecting in the market share position include customization and adaptability. Some enabling companies which provide customized predictive analytics solutions can meet the needs of different healthcare stakeholders. Customizing solutions based on the individual needs of healthcare providers, payers and pharmaceutical companies allows to capture a wide market share. Market positioning requires strong marketing and educational initiatives. By investing in marketing strategies that offer educational campaigns, webinars as well as thought leadership content solutions; companies can build awareness and credibility for the predictive disease analytics space. Through showcasing the quality and performance of their solutions, companies can acquire more customers which will make them leaders in market. Continued innovation is a key tenet of effective market share positioning within the predictive disease analytics market. Companies that practice research and development, keeping up with the emerging technologies, sudden scientific developments can introduce new features and functionalities. This innovation does not only improve the work of available solutions but also makes companies leaders in terms of predictive analytics environment. The two important strategies include designing a user-friendly interface and ensuring interoperability with other medical systems. Companies that create intuitive platforms and integrate them perfectly with EHRs, HIS and other healthcare IT solutions have also helped made it easier for providers to adopt predictive disease analytics. This user-centric approach can lead to a dramatic effect on market share by promoting the users’ satisfaction and adoption.

Leave a Comment