Market Analysis

In-depth Analysis of North America Solar Panel Market Industry Landscape

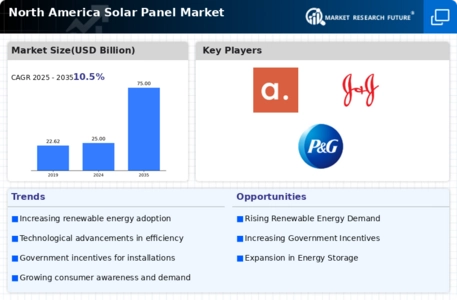

North America solar panels market is set to reach a significant value by 2032, at a 22.00% CAGR between years 2023-2032. Over the past few decades, solar panels have transformed market dynamics throughout North America as a result of technological advances coupled with economic incentives and increased awareness on renewable energy. The area has also seen an increased adoption of solar energy utilization, where the panels have turned out to be integral in building a renewable power base. Among the key factors driving the market dynamics, increasing focus on clean energy and commitment towards carbon reduction play an important role. Various levels of government in North America have put policies and incentives to increase the adoption of solar energy development, allowing a conducive environment for the futuristic growth of market value from addition. The reduction in costs of solar technology, notably the PV cells used with solar panels have been a critical driving factor behind the popularity growth rate for using this form of alternative energy. Furthermore, the development of new technologies in this field has greatly reduced overall solar panel cost due to economies of scale and improved manufacturing efficiency. This cost has made solar energy attractive, both the residential as well as commercial consumers have invested in various types of installations. North America also hastens the acceptance of solar panels through various governmental incentives and subsidies. Federal tax credits, state- level incentives and rebates are financial mechanisms that came to the aid of individual investors or those who invest in solar energy systems. Such incentives not only help to bring the cost of solar installations down but also supplements in promoting growth within the industry. Besides, there are several states that have adopted policies of renewable energy targets which also provides a regulatory framework for solar projects and drives market demand. Net metering policies, which allow consumers to sell back their excess electricity generated from solar panels into the grid have been among leading forces in increasing adoption of renewables. This motivates people and companies to install solar panels not only for personal needs, but also in order to contribute their energy quotas as part of the general network. Alternatively, a way of increasing solar panel installation economic viability would be in its capacity not only to eliminate power cost but also generate revenue off possible energy surplus.

Leave a Comment