Market Trends

Key Emerging Trends in the Nanofiltration Membrane Market

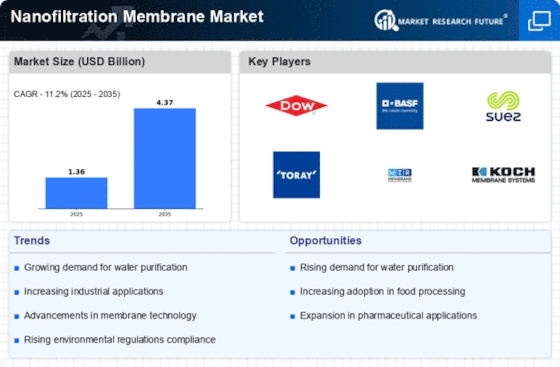

The production of nanofiltration membrane market is currently seeing some of the key trends, which reflect the state of this technology importance in different industries. Nanofiltration membranes distinguished by their capability of size-selective filtration of the particles are being used in many fields such as water treatment, food and beverage, pharmaceutical sector, etc. The trending factor of water purification system supplies increasingly due to growing requirements of pure water and clean water planetwide. Vital to water treatment processes, nanofiltration membranes become effective in the process of removing contaminants and impurities to meet the high water quality standards.

The fact that nanofiltration membranes are used in the food and beverage sector for separation and concentration purposes is one of the world trends of today. These membranes facilitate the selective extraction of specific molecules, for instance, color and flavor constituents, thereby improving the quality of the product. Also, it is being seen that nowadays the pharmaceutical sector uses the nanofiltration technology for purifying the drugs and pharmaceutical products. The capability of nanofiltration membranes, which is to separate molecules with accuracy and precision, also makes them so invaluable in pharmaceutical drug making process and helps produce high-purity and safe medications.

Market tendencies additionally show that a rising number of consumers are putting more emphasis on ecologic sustainability, inspiring the companies to look for greener ways. Nanofiltration membranes, using their high efficiency in resource conservation, management and environmental friendliness, can well serve these sustainability needs. This way, businesses are turning to these membranes to optimize their operations, as well as to comply with environmental and regulatory standards.

Moreover, technological developments make substantial contributions to the market dynamics. Research and development ongoing activities are all around the improvement of nanofiltration membranes as well as increasing their durability and application spectrum in different industries. The advent of better membranes materials and made with them membranes that are characterized with higher selectivity, permeability, and also resistance to fouling is the one that drives the invention of membranes for multiple purposes.

Globalization as well as the elevated level of border trade are equally determining the progress of the nanofiltration membrane market trends. In the process of manufacturing, where companies are keen to uphold their products’ and processes’ high quality standards, nanofiltration membranes become a particularly useful tool for achieving consistency and dependability. The market is seeing the rise in interest from the areas where the industries are growing very fast and where the lack of a water access and environmental problems are the most acute.

Leave a Comment