Market Trends

Key Emerging Trends in the Microbiome Sequencing Services Market

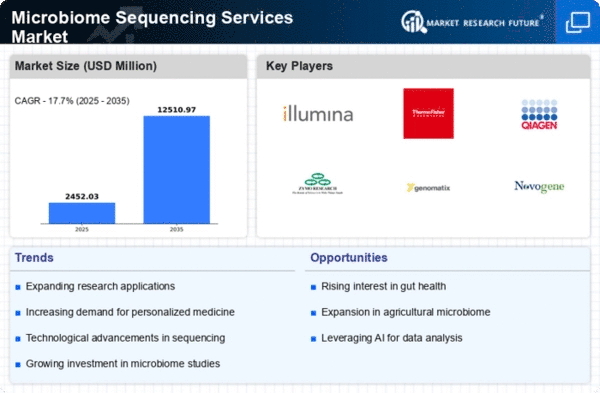

The market is expanding quickly because of genetic technology, more information about the role of the human microbiome in health, and a greater need for personalized treatment. Microbiome studies and other market changes are important. The study of how the human microbiome affects health and illness has made more people want microbiome sequencing services to learn more about microbial communities in the body and other places. Services for analyzing microbiomes are being used in medicine. As medicines based on microbiomes have been created to treat different illnesses, sequencing services have grown in popularity to help with treatment plans. More and more people are using multi-omics methods, which combine microbiome sequencing with data from genome, transcriptomics, and metabolomics. This combined study gives us a full picture of how bacteria and human function are connected, which leads to better research results. Microbiome-based tests are becoming more popular. Microbiome sequencing services may be able to help doctors find diseases earlier and more accurately by finding microbe fingerprints that are linked to certain illnesses. Bioinformatics can make more progress when there is more microbial genetic data. To find microbial species and functional pathways, we need better algorithms and analysis tools that can handle and make sense of complex microbiome data. Microbiome sequencing is useful for both farming and studying the environment. Studying the microbe communities in earth, plants, and ecosystems makes farming more sustainable and protects the environment. Service providers that do microbiome analysis, research schools, and drug makers are working together more. These agreements share knowledge and tools to speed up the search for drugs that affect microbiomes and increase the number of sequencing services available. It's important that microbial sequencing methods are standardized and that their quality is checked. Standardized methods and quality assurance methods are making microbial sequencing data more reliable and repeatable in both study and clinical settings. The market for microbe analysis services has to deal with changing rules and morals. As the field moves forward, problems with following the rules, protecting data ethically, and getting educated consent must be fixed. The world microbiome sequencing business is growing because more people know about it and use it. As more developing countries become interested in microbiome study, microbiome sequencing services are spreading around the world.

Leave a Comment