Luxury Goods Size

Luxury Goods Market Growth Projections and Opportunities

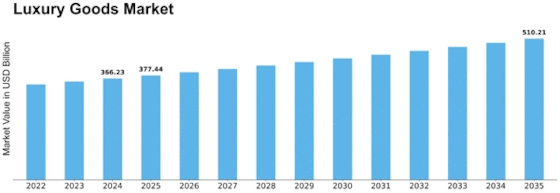

In 2022, the luxury goods market was estimated to be worth USD 288.5 billion. Over the projection period (2023 - 2032), the Luxury Goods market industry is expected to increase at a compound annual growth rate (CAGR) of 5.20 percent, from USD 303.5 billion in 2023 to USD 455.29 billion by 2032. Propensity for sustainable products and an aging population are the main factors propelling the market's expansion.

The luxury goods market is influenced by a multitude of factors that collectively shape the dynamics of this high-end industry. Consumer purchasing power is a significant driver, with economic conditions playing a crucial role in determining the demand for luxury goods. During periods of economic growth and increased disposable income, consumers often exhibit a higher appetite for premium and luxury products, leading to a surge in sales for items such as designer clothing, high-end accessories, and luxury automobiles. Conversely, economic downturns may result in a more cautious approach to spending on luxury items.

Cultural and social factors are integral in the luxury goods market. The perception of luxury is deeply intertwined with cultural values and societal trends. Consumer preferences and the definition of what is considered prestigious or fashionable can vary across different regions and demographics. Social media and celebrity endorsements also play a pivotal role in shaping consumer perceptions of luxury, influencing purchasing decisions and driving trends in the market.

Brand image and exclusivity are key factors that contribute to the success of luxury goods. Established brands with a rich heritage and a reputation for craftsmanship and quality often command a loyal customer base. Exclusivity, limited editions, and unique offerings further enhance the desirability of luxury products. Consumers often seek brands that not only signify status and prestige but also align with their personal values and lifestyle choices.

Innovation and design excellence are critical market factors in the luxury goods industry. Luxury brands must continually innovate to stay ahead of changing consumer tastes and preferences. Cutting-edge design, use of premium materials, and technological advancements contribute to the allure of luxury products. Consumers are drawn to items that showcase creativity and offer a sense of uniqueness, setting them apart from mainstream offerings.

Globalization has significantly impacted the luxury goods market. With the rise of affluent consumers in emerging markets, luxury brands have expanded their reach to cater to a more diverse and geographically dispersed clientele. The accessibility of luxury goods through e-commerce and international retail channels has further accelerated this trend, making luxury products available to a broader audience while also presenting challenges in maintaining an aura of exclusivity.

Economic inequality and income distribution also influence the luxury goods market. The concentration of wealth among a small segment of the population can create a robust market for high-end products. Conversely, efforts to address income inequality and shifts in wealth distribution may impact the purchasing power of traditional luxury consumers. Luxury brands must navigate these economic dynamics to sustain growth and adapt to changing market conditions.

Regulatory and legal considerations are important in the luxury goods market. Intellectual property protection, anti-counterfeiting measures, and adherence to ethical and sustainable practices are key factors that shape the regulatory landscape. Compliance with industry standards and regulations ensures that luxury brands maintain their reputation for quality and authenticity.

Leave a Comment