Hiv Diagnostics Size

Market Size Snapshot

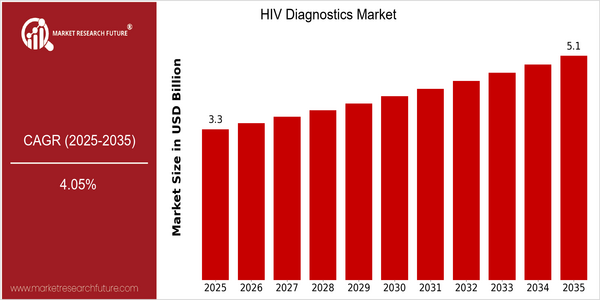

| Year | Value |

|---|---|

| 2025 | USD 3.29 Billion |

| 2035 | USD 5.1 Billion |

| CAGR (2025-2035) | 4.05 % |

Note – Market size depicts the revenue generated over the financial year

The HIV diagnostics market is expected to reach a value of $ 3,293,518,000 in 2025, and is expected to grow at a CAGR of 4.05 per cent during the forecast period. The increasing demand for diagnostic solutions in the field of HIV/AIDS is a sign of the growing demand for diagnostic solutions. The market is driven by the growing number of HIV patients, the advancement in diagnostics, and the increasing awareness and screening activities. The development of point-of-care testing, rapid diagnostic tests, and the integration of artificial intelligence in diagnostics processes is also driving market growth. These developments not only increase the speed and accuracy of HIV diagnosis, but also allow early intervention, which is crucial for managing the disease. During the forecast period, the market is expected to be dominated by companies such as Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers. These companies are actively involved in strategic initiatives such as collaborations, new product launches, and research and development to strengthen their market presence and meet the changing needs of both patients and health care professionals.

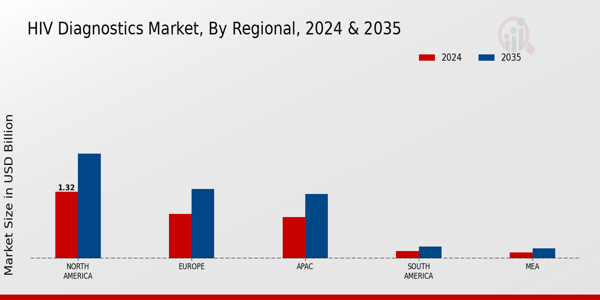

Regional Market Size

Regional Deep Dive

The market for HIV diagnostics is characterized by a dynamic growth across the different regions of the world, driven by the increasing awareness, technological advancements, and supportive government initiatives. In North America, the market is characterized by high health care expenditure and strong emphasis on research and development. In Europe, the market is characterized by stringent regulatory framework and a strong health care system, whereas in Asia-Pacific, the market is characterized by increasing infection rates and improving access to health care. The Middle East and Africa face the unique challenges of low resources and uneven access to health care, but also of a growing interest in finding new solutions. Latin America has a growing focus on public health initiatives against HIV, which further increases the market potential.

Europe

- The European Medicines Agency (EMA) has introduced new guidelines for the approval of HIV diagnostic tests, streamlining the process and encouraging innovation in the market.

- Countries like the UK and France are implementing national strategies to eliminate HIV transmission by 2030, which includes increasing access to diagnostic testing and treatment, thereby driving market growth.

Asia Pacific

- The World Health Organization (WHO) has launched initiatives to improve HIV testing in countries like India and China, focusing on integrating testing into primary healthcare services, which is expected to significantly increase testing rates.

- Innovative mobile health (mHealth) solutions are being developed in countries such as Thailand and Australia, allowing for remote testing and results delivery, thus enhancing accessibility and convenience for patients.

Latin America

- Brazil has launched a national campaign to increase HIV testing among high-risk populations, which is expected to lead to earlier diagnosis and treatment, positively impacting the market.

- Innovative partnerships between NGOs and local governments in countries like Mexico are focusing on mobile testing units to reach underserved communities, thereby expanding access to HIV diagnostics.

North America

- The U.S. Food and Drug Administration (FDA) has recently approved several rapid HIV testing kits, which are expected to enhance early detection and treatment options, significantly impacting the market dynamics.

- The CDC is doing a lot of work to educate people about the importance of getting tested for HIV and to reduce the stigma of getting tested.

Middle East And Africa

- The African Society for Laboratory Medicine (ASLM) is working on improving laboratory capacity and diagnostic capabilities across the continent, which is crucial for enhancing HIV testing and treatment outcomes.

- Government programs in South Africa are focusing on increasing the availability of point-of-care testing, which is expected to improve early diagnosis and treatment adherence among populations at risk.

Did You Know?

“Approximately 38 million people globally are living with HIV, and nearly 25% of them are unaware of their infection, highlighting the critical need for improved diagnostic solutions.” — World Health Organization (WHO)

Segmental Market Size

The market for diagnostics for hepatitis is a critical segment of the broader health care diagnostics market, and is currently experiencing stable growth, driven by increased awareness and advances in testing technology. In addition, the increasing prevalence of HIV around the world, especially in sub-Saharan Africa, is a major driver of the market. Earlier diagnosis of HIV is key to improving treatment outcomes. And the global policy guidelines, such as the World Health Organization’s (WHO) advocacy for universal testing, are further enhancing market dynamics. The market is currently in a mature stage of development, with Roche and Abbott Laboratories offering the most advanced testing solutions. The most important applications are point-of-care testing, laboratory-based diagnostics and self-testing, which are critical in a variety of health care settings, from clinics to the home. The global health initiatives, the impact of the influenza pandemic and the rise of new diseases, such as CoV, are boosting the market as they underscore the need for accessible health care solutions. CRISPR and rapid antigen tests are reshaping the market as they enable faster and more accurate HIV diagnosis.

Future Outlook

The HIV diagnostics market is expected to experience significant growth from 2025 to 2035, with a CAGR of 4.05%. This growth is driven by the growing global prevalence of HIV, increasing awareness and testing, and technological advances. Among high-risk populations, the penetration of HIV testing is expected to be around 70% in 2035, mainly due to the implementation of government policies promoting routine screening and the integration of HIV diagnostics into primary care. The development of rapid diagnostics and point-of-care testing is expected to increase access to these tests, especially in low-income countries. Meanwhile, ongoing research into new biomarkers and the use of artificial intelligence in the diagnostics process are expected to improve the speed and accuracy of HIV diagnosis. Also, the growing importance of personalised medicine and the integration of HIV diagnostics with other sexually transmitted infection (STI) testing will impact the market. As health systems around the world continue to prioritise early detection and treatment, the HIV diagnostics market will evolve and present opportunities for industry players to expand their presence.

Leave a Comment