Market Analysis

In-depth Analysis of Ghost Kitchen Market Industry Landscape

The ghost kitchen market is influenced by a multitude of factors that collectively shape its growth and evolution. One of the primary drivers of this market is the changing consumer behavior and preferences, particularly the growing demand for food delivery and takeout options. As consumers increasingly seek convenience and variety in their dining experiences, especially in urban areas, the demand for ghost kitchens—also known as virtual kitchens, cloud kitchens, or dark kitchens—has surged. These kitchens operate solely for delivery or takeout orders, allowing restaurants to optimize their operations, reduce overhead costs, and reach a broader customer base without the need for a traditional dine-in space.

Furthermore, technological advancements play a significant role in driving the growth of the ghost kitchen market. The proliferation of online food delivery platforms and mobile apps has made it easier for consumers to order food from a wide range of restaurants and virtual brands. Ghost kitchens leverage these digital platforms to establish their presence, streamline order management, and reach customers directly through online marketing and delivery services. Additionally, advanced kitchen management software and analytics tools help ghost kitchen operators optimize their workflows, monitor inventory levels, and track customer preferences to improve efficiency and profitability.

Economic factors such as rising real estate costs and labor shortages also contribute to the growth of the ghost kitchen market. In high-rent urban areas, traditional brick-and-mortar restaurants face challenges in maintaining profitability due to expensive leases and operational expenses. Ghost kitchens offer a cost-effective alternative, allowing restaurant owners to operate in smaller, more affordable spaces or shared kitchen facilities without compromising on food quality or service. Moreover, labor shortages in the restaurant industry have prompted operators to explore alternative staffing models, such as outsourcing delivery services or partnering with third-party delivery platforms, further driving the adoption of ghost kitchens.

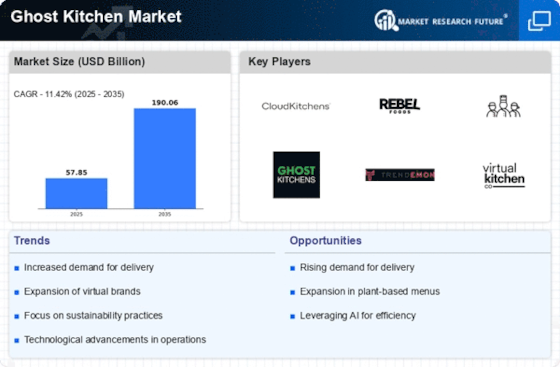

Market trends and competitive dynamics also shape the ghost kitchen market. As the food delivery market becomes increasingly crowded, ghost kitchen operators must differentiate themselves through unique concepts, cuisines, and branding to attract customers and stand out in a competitive landscape. This has led to the emergence of virtual restaurant brands and delivery-only concepts that cater to niche markets or capitalize on popular food trends. Additionally, established restaurant chains and foodservice companies are leveraging ghost kitchens to expand their footprint, test new concepts, and reach untapped markets without the risk and investment of opening physical locations.

Moreover, changing dietary preferences and health-conscious consumer trends influence the ghost kitchen market. As more consumers prioritize healthy eating and dietary restrictions, there is a growing demand for ghost kitchens offering nutritious, plant-based, gluten-free, or allergy-friendly menu options. Operators are responding by partnering with health-focused brands, celebrity chefs, or nutritionists to develop menu offerings that cater to these preferences and accommodate a wide range of dietary needs. Additionally, sustainability and eco-consciousness are becoming increasingly important factors for consumers, driving demand for ghost kitchens that prioritize locally sourced ingredients, eco-friendly packaging, and sustainable practices.

Government regulations and food safety standards also impact the ghost kitchen market. As the popularity of food delivery and takeout continues to grow, regulatory agencies are implementing stricter guidelines governing food handling, sanitation, and delivery practices to ensure consumer safety and compliance with health regulations. Ghost kitchen operators must adhere to these regulations to maintain public trust and confidence in their services, implementing robust food safety protocols, hygiene standards, and quality control measures to protect the health and well-being of their customers.

Leave a Comment