Freeze Drying Equipment Size

Market Size Snapshot

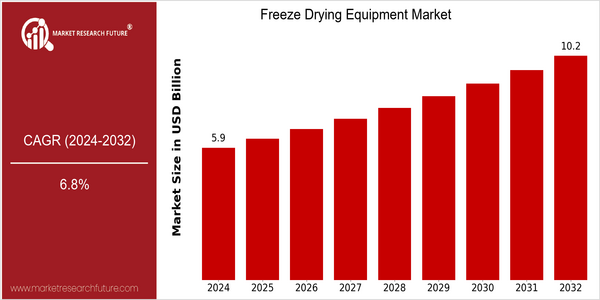

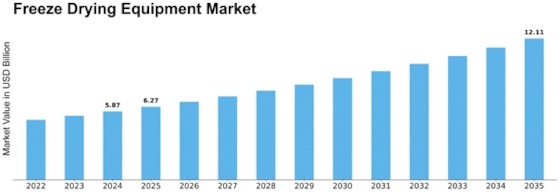

| Year | Value |

|---|---|

| 2024 | USD 5.9 Billion |

| 2032 | USD 10.18 Billion |

| CAGR (2024-2032) | 6.8 % |

Note – Market size depicts the revenue generated over the financial year

The Freeze Drying Equipment Market is a promising market. The current market is valued at $ 5.89 billion in 2024, and is expected to reach $ 10.18 billion by 2032. The growth rate is 6.8 CAGR. The main reason for this is the growing demand for freeze-dried products in the food and pharmaceutical industries. As consumers are looking for products with longer shelf lives and higher quality, more and more industries are adopting freeze drying technology. In addition, the development of freeze-drying technology, such as energy saving and automation, has also led to the development of this industry. The key players in this industry, such as GEA Group, SP Scientific, and Labconco, have been actively involved in research and development, and have established long-term cooperative relations with other companies, so as to enhance their market position and meet the needs of customers.

Regional Market Size

Regional Deep Dive

Freeze-Drying Equipment Market is undergoing a significant growth in various regions. This growth is mainly driven by the increasing demand for freeze-dried food, pharmaceuticals and biotechnology applications. In North America, the market is characterized by technological innovations and a strong presence of key players. On the other hand, Europe is witnessing an increase in demand due to the stringent government regulations regarding food safety and quality. The Asia-Pacific region is characterized by rapid industrialization and growing investments in the food industry. The Middle East and Africa are slowly adopting the technology, especially in the food and pharmaceutical industries. On the other hand, Latin America is characterized by an increase in the demand for freeze-dried products due to changing consumer preferences and lifestyles.

Europe

- The European Union has implemented stricter regulations on food preservation methods, leading to increased adoption of freeze-drying technology among food manufacturers to comply with safety standards.

- Companies such as Martin Christ and Telstar are innovating with hybrid freeze-drying systems that combine traditional methods with modern technology, enhancing efficiency and product quality.

Asia Pacific

- China is rapidly expanding its freeze-drying capabilities, with government initiatives aimed at boosting the food processing industry, which is expected to drive demand for freeze-drying equipment.

- Japanese companies are leading in the development of compact freeze-drying machines tailored for small-scale producers, catering to the growing artisanal food market in the region.

Latin America

- Brazil is witnessing a rise in demand for freeze-dried fruits and vegetables, driven by changing consumer preferences towards healthy snacking options, prompting local manufacturers to invest in freeze-drying technology.

- Government programs aimed at promoting sustainable agriculture are encouraging farmers to adopt freeze-drying as a method to preserve surplus produce, thereby reducing food waste.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated guidelines for freeze-dried pharmaceuticals, encouraging manufacturers to adopt advanced freeze-drying technologies to enhance product stability and efficacy.

- Key players like GEA Group and SP Scientific are investing in R&D to develop more energy-efficient freeze-drying systems, which are expected to reduce operational costs and improve sustainability in the market.

Middle East And Africa

- The UAE is investing in advanced food processing technologies, including freeze-drying, as part of its National Food Security Strategy, which aims to enhance food preservation and reduce waste.

- Local companies are collaborating with international firms to introduce state-of-the-art freeze-drying equipment, which is expected to improve the quality of pharmaceutical products in the region.

Did You Know?

“Freeze-drying was originally developed during World War II to preserve blood plasma for medical use, showcasing its critical role in both food and pharmaceutical industries.” — National Institute of Health

Segmental Market Size

Freeze-drying machines are presently enjoying a steady growth, driven by the increasing demand for high-quality preservation methods in various industries. The preference of consumers for natural and preservative-free products is complemented by the stricter regulations on food safety and quality. In addition, developments in freeze-drying technology, which have improved the efficiency and quality of products, are a further driver of the market. The freeze-drying machine market has reached a stage of maturity, with GEA Group and SP Scientific implementing large-scale operations in North America and Europe. The main application areas are the pharmaceutical industry, where freeze-drying is a crucial method of preserving sensitive biological materials, and the food industry, where the machines are used to produce light, shelf-stable and shelf-stable products. In addition, macro-economic trends such as the COVID pandemic have increased the demand for freeze-dried food products, which are in high demand among consumers who are looking for long-lasting food products. The development of energy-efficient freeze-drying technology is also a major driver of the future development of this market.

Future Outlook

Freeze drying equipment is a market that will grow at a fast pace between 2024 and 2032. The market value is expected to rise from $ 5.9 billion to $ 10.17 billion, at a CAGR of 6.8 percent. The demand for freeze-dried products is increasing in various industries, such as pharmaceuticals, food and beverages and biotechnology. As the consumers are looking for more convenient and durable food, the food industry will be able to increase the use of freeze-drying. It is expected that by 2032, the freeze-drying technology in food preservation will reach about 25 percent of the total food preservation market, up from about 15 percent in 2024. The development of energy-efficient and automation-oriented freeze-drying equipment will also drive market growth. Also, the government's policy to ensure food security and reduce food waste will create a favorable environment for the use of freeze-drying equipment. The trend of health-conscious consumers and the development of sustainable development will also affect the development of the market. The industry will have to move forward with the times, relying on the development of new technology to enhance product quality and improve production efficiency.

Leave a Comment