Foamed Plastics Size

Foamed Plastics Market Growth Projections and Opportunities

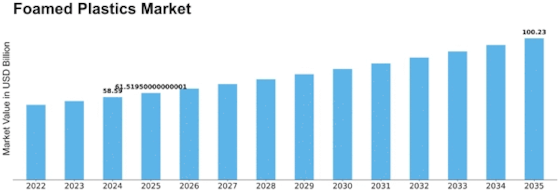

Foamed Plastics market size was worth USD 53.1 Billion in 2022. The Foamed Plastics industry is expected to increase from USD 55.8 Billion in 2023 to USD 82.4 Billion in 2032, at the compound annual growth rate (CAGR) of 5.00%.

The market of Foamed Plastics is greatly affected by various aspects which cumulatively determine the market dynamics. Foamed plastics, e.g. expanded polystyrene (EPS) and polyurethane and polyethylene foams, are frequently used in packaging, construction, automotive, and consumer goods manufacturing industries. The Foamed Plastics market is largely driven by the consequent demand for lighter and more energy-efficient materials. The market considers companies which would like to bring innovations to reduce weight, improve insulation properties, and increase the energy efficiency in areas of packaging materials and construction insulation.

Technological advancements in foam producing is the core factor for Foamed Plastics market trends. An important part of the ongoing research and development process is to keep optimizing foaming processes, improving material properties, and coming up with eco-friendly and sustainable foam formulations. Innovations in blowing agents, manufacturing equipment, and recycling techniques target resolving environmental problems, improving performance and meeting the wants of the markets using foamed plastics.

The Foamed Plastics market is greatly impacted by government regulations and environmental rules. Compliance with regulations concerning material safety, recycling, and emissions is crucial in foam manufacturers. Changes in regulations are likely to particularly target single-use plastics and recyclability and eventually cause the integrating of environmental friendly foamed plastic solutions into the market.

The Foamed Plastics market is highly influenced by the construction industry, mainly through the employing of foamed insulation materials. The growing trend of smart building practices and the sustainable construction contribute to the demand for foamed plastics in insulation applications. Increasingly, innovative construction methods, together with more knowledge of insulation benefits for the environment, lead the market to rise.

Economic factors, including consumer spending and the industrial activities affect the Foamed Plastics market. Economic expansion and income are some of the factors that lead to the demand for consumer goods and unexpanded plastics. While economic downturns may affect the market as consumers and industrial production adjust with the changing economic conditions, the market gets supported by rising stock prices.

Competition between the plastics and materials industry influences the dynamic force of the Foamed Plastics market. The companies spends money on the research and development in order to come up with the different foam formulas, improve the manufacturing efficiency and satisfy the different needs of the end-users.

Leave a Comment