Flexible Insulation Size

Flexible Insulation Market Growth Projections and Opportunities

The flexible insulation market is influenced by various market factors that shape its growth and dynamics. One crucial factor is the increasing demand for energy-efficient solutions across industries. As businesses and consumers alike become more conscious of their environmental footprint, there's a growing emphasis on insulation materials that can improve energy efficiency in buildings, appliances, and industrial processes. This demand is driving manufacturers to innovate and develop flexible insulation solutions that offer superior thermal performance while also being lightweight and easy to install.

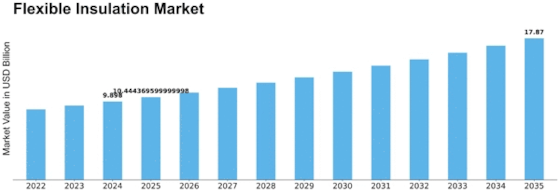

The flexible insulation market is projected to grow from USD 9.38 Billion in 2023 to USD 14.4 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 5.5% during the forecast period (2023 - 2032).

Moreover, regulatory initiatives aimed at reducing greenhouse gas emissions and promoting sustainable practices are also significant market drivers. Governments around the world are implementing stricter building codes and standards that require better insulation in new constructions and renovations. These regulations push the adoption of flexible insulation materials that meet the required performance criteria and contribute to overall energy savings.

The construction industry plays a pivotal role in driving the demand for flexible insulation products. With the construction sector experiencing steady growth globally, particularly in emerging economies, there's a rising need for insulation materials to enhance the energy efficiency and comfort of buildings. Flexible insulation, with its versatility and ability to conform to irregular surfaces, is increasingly preferred in both residential and commercial construction projects.

Another key market factor is technological advancements in insulation materials and manufacturing processes. As research and development efforts continue to improve the performance and durability of flexible insulation products, manufacturers can offer solutions that meet the evolving needs of customers. Advanced materials such as aerogels and nano-insulation are gaining traction in the market due to their exceptional thermal properties and compactness.

The automotive industry is also contributing to the growth of the flexible insulation market. With the increasing focus on electric vehicles (EVs) and the need to optimize battery performance and range, there's a growing demand for lightweight insulation materials that can effectively manage thermal conductivity within the vehicle's components. Flexible insulation plays a crucial role in maintaining the temperature stability of EV batteries and electronic systems, driving its adoption in the automotive sector.

Furthermore, economic factors such as fluctuations in raw material prices and currency exchange rates can impact the flexible insulation market. Since many insulation materials are derived from petrochemicals, changes in oil prices can influence production costs and ultimately product pricing. Currency fluctuations can also affect the competitiveness of manufacturers operating in global markets, leading to strategic adjustments in pricing and distribution channels.

Consumer preferences and awareness regarding indoor air quality and health considerations are additional factors shaping the flexible insulation market. As people become more informed about the potential health risks associated with traditional insulation materials such as fiberglass, there's a growing demand for alternatives that are non-toxic and eco-friendly. Flexible insulation products made from recycled or bio-based materials are gaining popularity among environmentally conscious consumers.

Leave a Comment