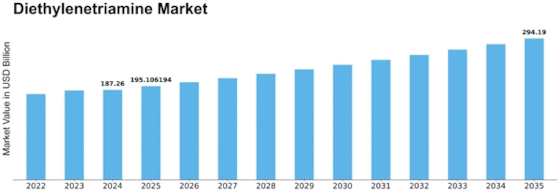

Diethylenetriamine Size

Diethylenetriamine Market Growth Projections and Opportunities

The Diethylenetriamine (DETA) Market is influenced by a variety of factors that collectively shape its dynamics, growth trends, and overall competitiveness. These factors encompass both industry-specific considerations and broader economic and environmental influences. Here's a succinct breakdown of key market factors defining the landscape of the Diethylenetriamine Market:

End-Use in Epoxy Resins:

Diethylenetriamine is a vital component in the production of epoxy resins, which are extensively used in coatings, adhesives, and composites.

The demand for epoxy-based products in construction, electronics, and automotive applications significantly impacts the consumption of DETA.

Corrosion Inhibition in Oil and Gas Industry:

DETA finds applications in the oil and gas industry as a corrosion inhibitor in pipelines and equipment.

The growth in oil and gas exploration and production activities contributes to the demand for DETA as a protective additive.

Versatility in Polyamides Production:

The polyamides industry utilizes DETA as a key building block in the production of various polyamide resins.

The versatility of polyamides in applications such as textiles, automotive parts, and industrial components influences the DETA market.

Paper and Textile Industry Utilization:

DETA is employed in the paper and textile industries as a wet-strength resin and as a cross-linking agent in textile finishing.

The demand for improved paper quality and durable textiles contributes to the market's presence in these industries.

Chelating Agent in Agrochemicals:

DETA serves as a chelating agent in the formulation of agrochemicals, enhancing the effectiveness of certain pesticides and fertilizers.

The agricultural sector's demand for efficient and high-performance agrochemical formulations impacts the DETA market.

Growth in Water Treatment Applications:

DETA is used in water treatment processes as a chelating and complexing agent to control metal ions in water.

Increasing awareness of water quality and the need for effective water treatment solutions contribute to the demand for DETA in this sector.

Adoption in Personal Care Products:

DETA finds applications in the personal care and cosmetics industry as a component in certain formulations.

The cosmetic sector's demand for innovative and functional ingredients influences the market presence of DETA in personal care products.

Regulatory Compliance and Safety Standards:

Stringent regulatory standards and safety considerations impact the production and use of DETA.

Adherence to regulations regarding the handling, transportation, and disposal of DETA is essential for market players to ensure compliance and safety.

Technological Advancements in Production Processes:

Ongoing technological advancements in DETA production processes aim to enhance efficiency, reduce costs, and improve the quality of the final product.

Innovations in production technologies contribute to the competitiveness of DETA in various applications.

Fluctuations in Raw Material Prices:

The DETA market is susceptible to fluctuations in the prices of raw materials, such as ethylene dichloride and ammonia, impacting the production costs.

Price volatility poses challenges for manufacturers in maintaining stable pricing strategies and profit margins.

Global Economic Trends:

Economic factors, including GDP growth, industrial output, and infrastructure investments, impact the overall demand for DETA across various end-use industries.

Economic trends influence investment decisions and consumption patterns in key markets, shaping the trajectory of the DETA market.

Research and Development Initiatives:

Continuous research and development efforts drive innovations in DETA applications, formulations, and product performance.

Market players investing in R&D initiatives gain a competitive edge by introducing improved DETA products to meet evolving industry needs.

Leave a Comment