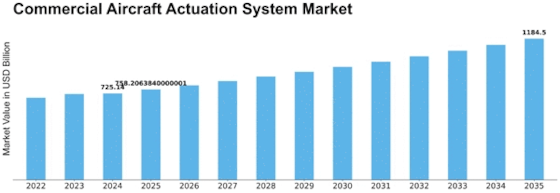

Commercial Aircraft Actuation System Size

Commercial Aircraft Actuation System Market Growth Projections and Opportunities

The Commercial Aircraft Actuation System Market is characterized by dynamic market dynamics shaped by a multitude of factors influencing the aerospace and aviation industry. One of the key market dynamics is the continuous evolution of aircraft design and technology. As commercial aircraft manufacturers strive to enhance fuel efficiency, reduce emissions, and improve overall performance, actuation systems play a crucial role. Market dynamics are influenced by the ongoing development of more electric aircraft (MEA) and advanced fly-by-wire systems, which rely heavily on sophisticated actuation systems to control various flight surfaces and systems.

Regulatory standards and safety requirements represent pivotal market dynamics in the Commercial Aircraft Actuation System Market. Stringent regulations set by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), dictate the design, manufacturing, and certification processes for aircraft actuation systems. Market dynamics are shaped by the need for manufacturers to comply with these stringent safety standards, ensuring the reliability and airworthiness of actuation systems, which are fundamental to the overall safety of commercial aircraft.

The demand for fuel-efficient and environmentally friendly aircraft is a driving force in the Commercial Aircraft Actuation System Market. With the aviation industry facing increasing pressure to reduce carbon emissions and improve fuel efficiency, the market dynamics are influenced by the adoption of advanced actuation systems that contribute to the overall eco-friendly profile of modern commercial aircraft. Actuation systems designed for optimal energy efficiency and reduced environmental impact are integral to addressing industry-wide sustainability goals.

Technological advancements and innovations in materials are significant market dynamics in the Commercial Aircraft Actuation System Market. The quest for lighter, more durable materials, such as composites and advanced alloys, directly impacts the design and manufacturing of actuation systems. Market dynamics are shaped by the continuous pursuit of materials and technologies that enhance the performance of actuation systems while reducing weight and maintenance requirements, contributing to the overall efficiency and competitiveness of commercial aircraft.

Economic factors, including airline profitability and global economic conditions, play a vital role in market dynamics. The Commercial Aircraft Actuation System Market is influenced by airlines' financial health and their willingness to invest in new aircraft and technologies. Economic downturns or fluctuations in air travel demand can impact the market dynamics, affecting the pace of new aircraft acquisitions and, consequently, the demand for advanced actuation systems.

Market consolidation and partnerships among key players contribute to the dynamics of the Commercial Aircraft Actuation System Market. The industry is characterized by collaborations, acquisitions, and strategic alliances among major aerospace companies. Market dynamics are influenced by the efforts of manufacturers to strengthen their market position, expand their product portfolios, and offer comprehensive actuation system solutions. These strategic moves shape the competitive landscape and influence the overall market dynamics as companies seek to enhance their capabilities and meet the evolving needs of commercial aircraft manufacturers.

Global geopolitical events and regulatory changes also impact the Commercial Aircraft Actuation System Market. Trade tensions, international agreements, and shifts in geopolitical alliances can influence market dynamics by affecting the flow of components, technologies, and investments across borders. Regulatory changes, particularly those related to safety standards and certification processes, play a crucial role in shaping market dynamics as manufacturers adapt to new requirements and standards set by aviation authorities worldwide.

The aftermarket segment is a noteworthy market dynamic in the Commercial Aircraft Actuation System Market. The ongoing need for maintenance, repair, and overhaul (MRO) services for existing aircraft fleets drives market dynamics in the aftermarket segment. As airlines seek cost-effective solutions and upgrades for their aging fleets, the demand for replacement parts and upgraded actuation systems remains substantial. Market dynamics are influenced by the aftermarket's role in sustaining the longevity and performance of commercial aircraft actuation systems throughout their operational lifecycle.

Leave a Comment