Active Oxygens Size

Active Oxygens Market Growth Projections and Opportunities

The Active Oxygens Market is influenced by a variety of market factors that collectively contribute to its growth and evolution. One significant factor is the increasing awareness and emphasis on health and hygiene across the globe. As consumers become more conscious of the importance of maintaining a clean and sanitized environment, the demand for active oxygens, such as hydrogen peroxide and ozone, has witnessed a notable surge. These compounds are known for their strong oxidizing properties, making them effective in disinfection and sterilization applications, which is particularly crucial in healthcare, water treatment, and food processing industries.

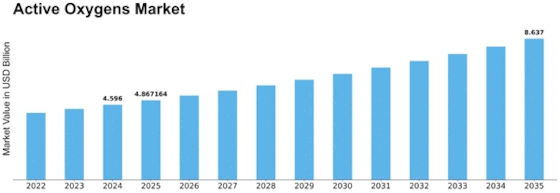

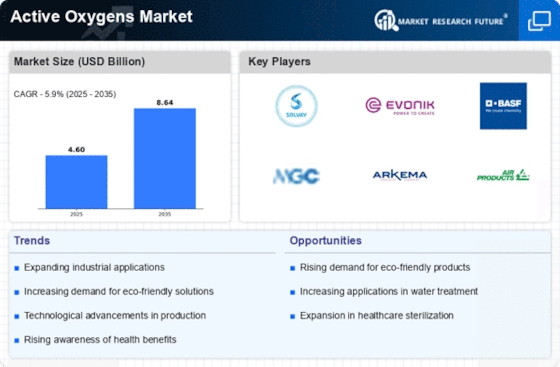

The global Active Oxygens market is registered at a CAGR of 5.90% during the forecast period and is estimated to reach USD 6.86 billion by 2032.

Environmental concerns also play a pivotal role in shaping the Active Oxygens Market. As compared to traditional chemical disinfectants, active oxygens are often considered more environmentally friendly. They decompose into harmless by-products, reducing the impact on ecosystems. This eco-friendly characteristic aligns with the growing global focus on sustainable practices and drives the adoption of active oxygens as an alternative to conventional disinfectants and bleaching agents.

Technological advancements contribute significantly to the market dynamics of active oxygens. Ongoing research and development activities lead to innovations in manufacturing processes and the formulation of active oxygen products. This continuous improvement not only enhances the efficacy of active oxygens but also expands their applicability across various industries. For instance, advancements in packaging technology enable the development of stable and concentrated formulations, extending the shelf life of active oxygen products and making them more convenient for end-users.

Regulatory factors are integral to the Active Oxygens Market, as the use of these compounds in different industries is subject to stringent regulations and standards. Compliance with safety and environmental regulations is essential for manufacturers to ensure the quality and safety of active oxygen products. Regulatory bodies play a crucial role in setting guidelines that govern the production, storage, transportation, and use of active oxygens, contributing to the overall market structure and influencing the strategies of industry participants.

The COVID-19 pandemic has also significantly impacted the Active Oxygens Market. The heightened awareness of the importance of disinfection and hygiene practices to prevent the spread of infectious diseases has led to an increased demand for active oxygens. These compounds have found extensive use in sanitization efforts, from disinfecting surfaces to purifying air and water. The pandemic has accelerated the adoption of active oxygens as a key component of public health measures, creating new opportunities for market players.

Cost considerations are another important factor in the Active Oxygens Market. While the demand for active oxygens is on the rise, manufacturers are under pressure to offer cost-effective solutions. The pricing of active oxygen products plays a critical role in their market penetration, particularly in industries with high volume consumption, such as water treatment and agriculture. Balancing affordability with the need for effective disinfection solutions is essential for market players to remain competitive.

Consumer preferences and education also contribute to the market dynamics of active oxygens. As consumers become more informed about the benefits of active oxygens in maintaining a clean and healthy environment, there is a growing preference for products that incorporate these compounds. Marketing efforts that emphasize the safety, efficacy, and environmental friendliness of active oxygens play a crucial role in shaping consumer perceptions and driving market demand.

In conclusion, the Active Oxygens Market is influenced by a combination of factors, including the global emphasis on health and hygiene, environmental concerns, technological advancements, regulatory compliance, the impact of the COVID-19 pandemic, cost considerations, and consumer preferences. The intersection of these factors creates a dynamic market landscape where manufacturers and suppliers need to navigate evolving trends and demands to capitalize on the growing opportunities in the active oxygens sector. As industries continue to prioritize cleanliness and sustainability, the Active Oxygens Market is poised for sustained growth and innovation.

Leave a Comment