Ayurveda Market Summary

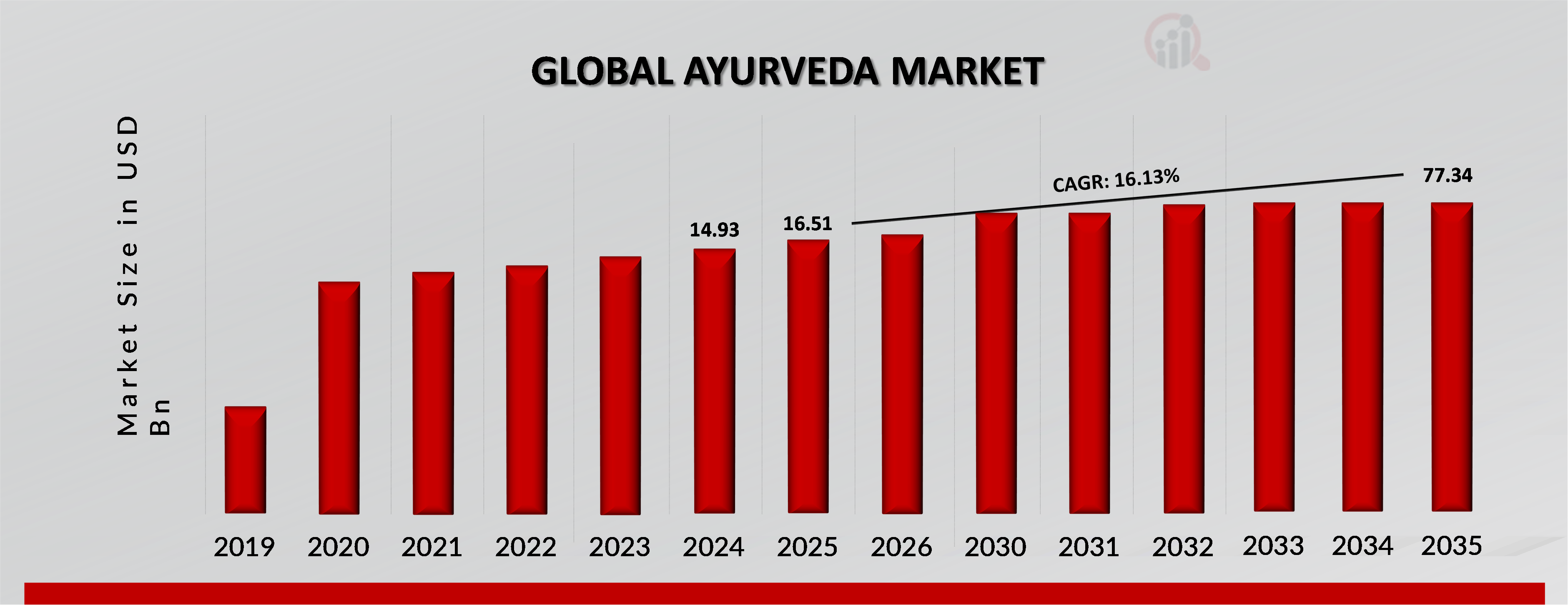

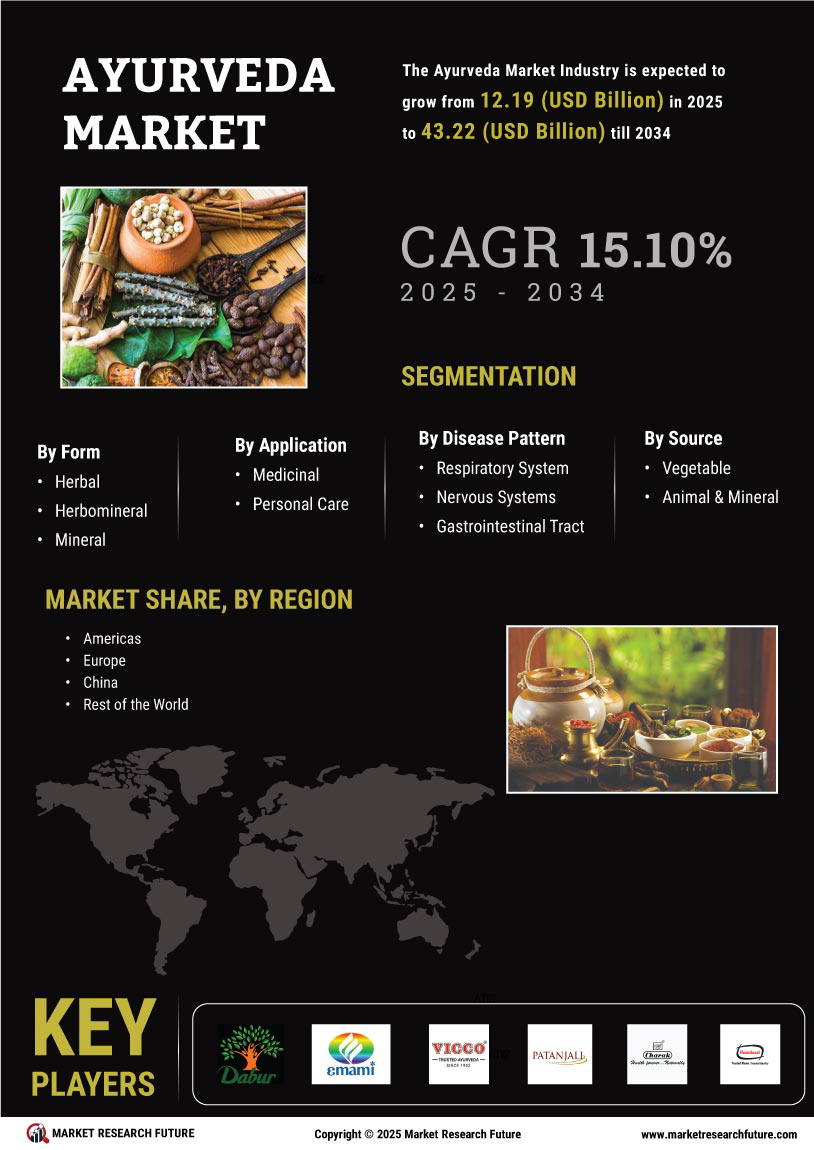

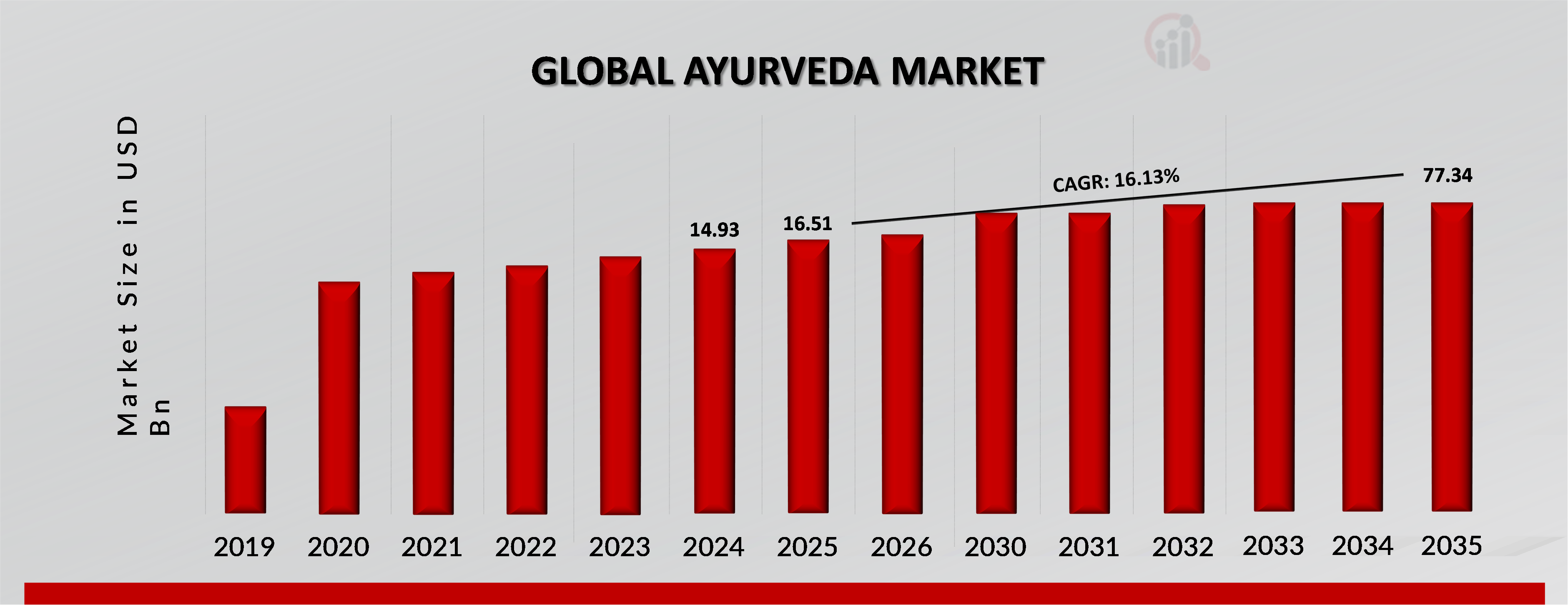

As per Market Research Future Analysis, the Ayurveda Market was valued at USD 14.93 Billion in 2024 and is projected to reach USD 77.34 Billion by 2035, growing at a CAGR of 16.13% from 2025 to 2035. The growth is driven by increasing awareness of health benefits associated with Ayurveda, government support, and a rising demand for natural alternatives to conventional medicine. Campaigns by companies like Maharishi Ayurveda and Dabur are enhancing public awareness and appealing to younger audiences, while the growing geriatric population is creating opportunities for Ayurvedic products targeting chronic conditions. The market is characterized by a diverse range of products, including herbal supplements and skincare items, with a notable trend towards sustainability and organic ingredients.

Key Market Trends & Highlights

The Ayurveda Market is witnessing significant growth driven by various factors.

- Market size in 2024: USD 14.93 Billion; projected to reach USD 77.34 Billion by 2035.

- CAGR of 16.13% during the forecast period (2025-2035).

- Healthcare segment dominated the market in 2024; Personal Care projected as the fastest-growing segment.

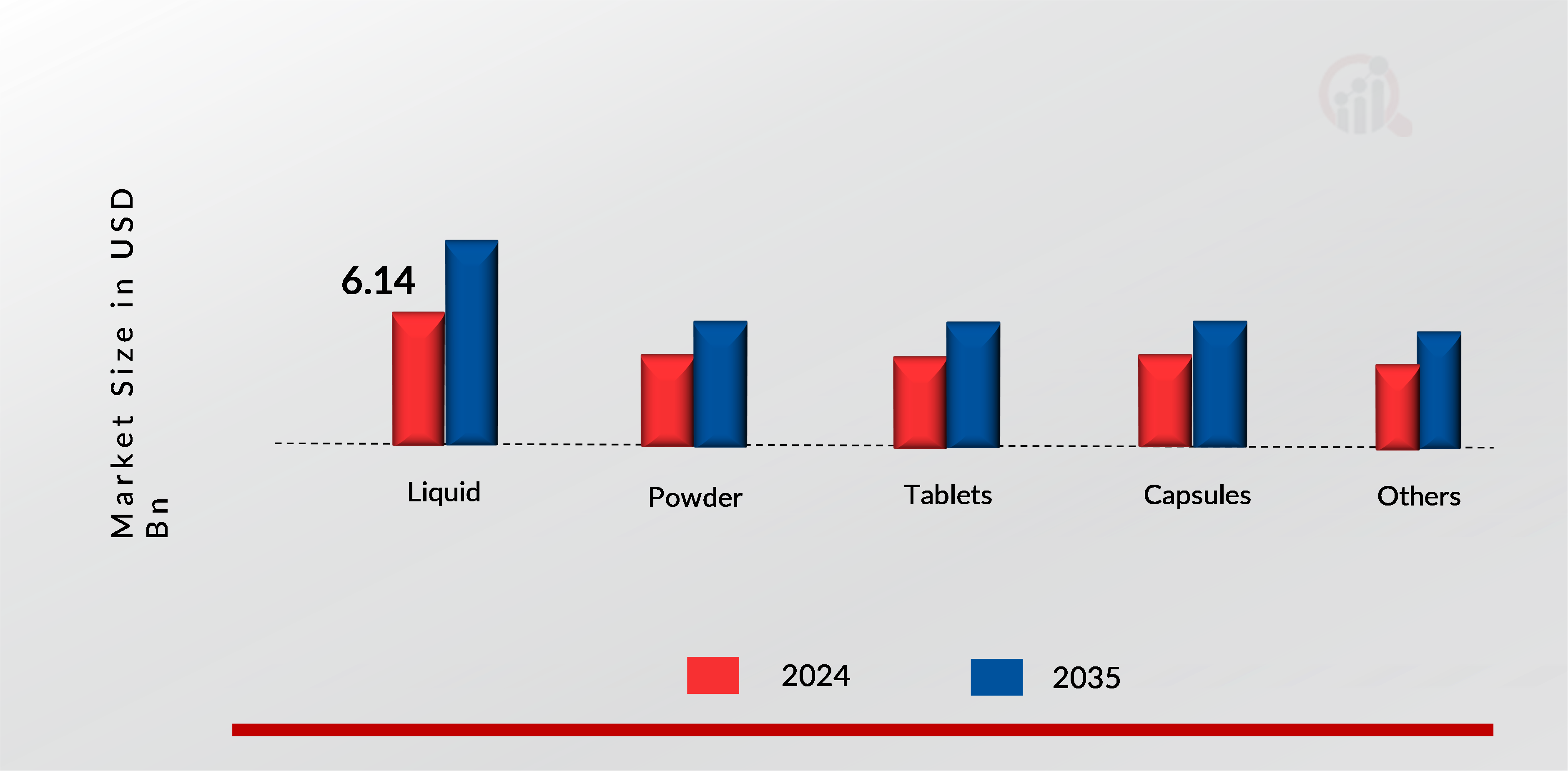

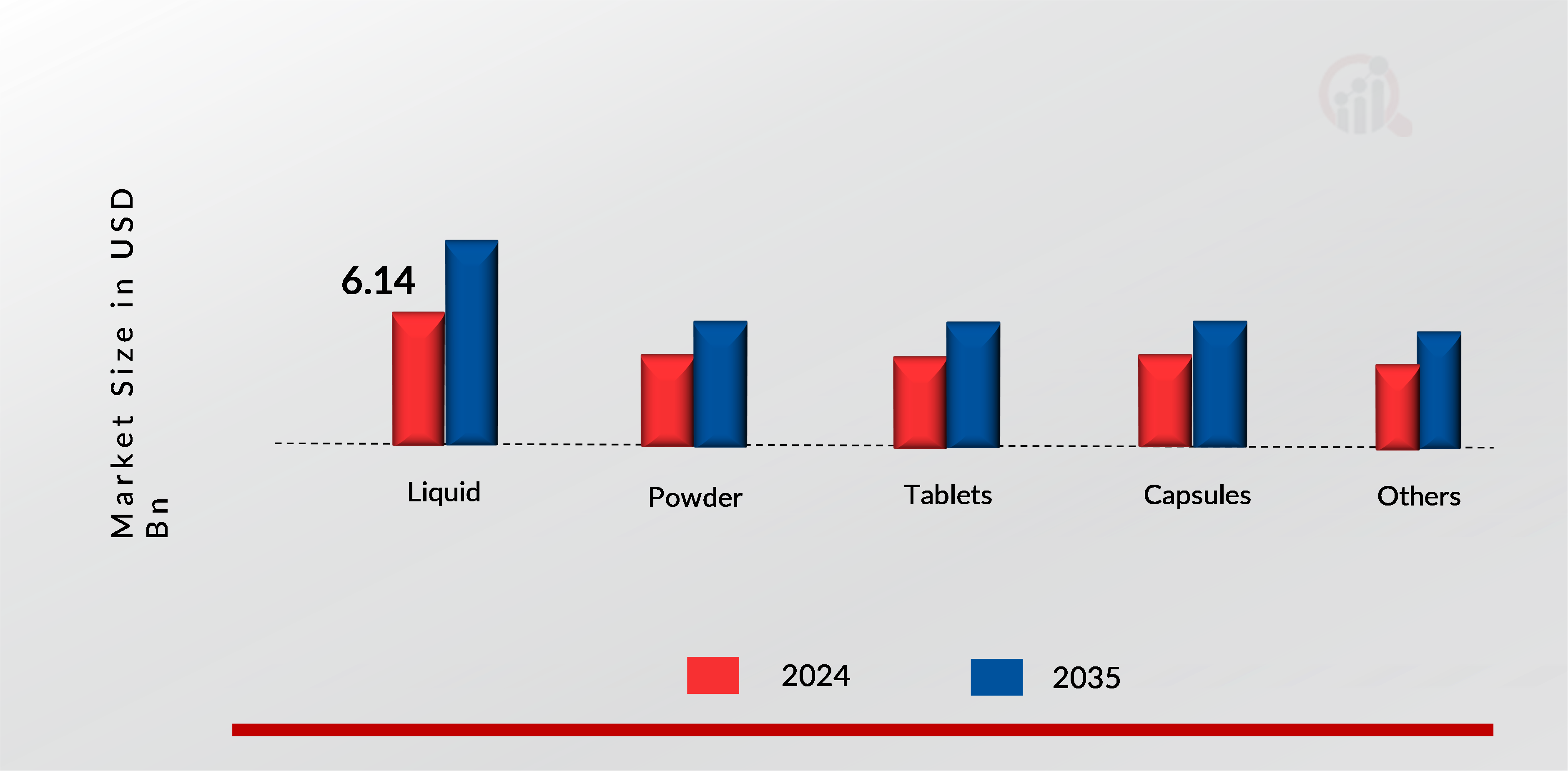

- Liquid products led the market in 2024; Capsules expected to grow the fastest.

Market Size & Forecast

2024 Market Size: USD 14.93 Billion

2035 Market Size: USD 77.34 Billion

CAGR: 16.13%

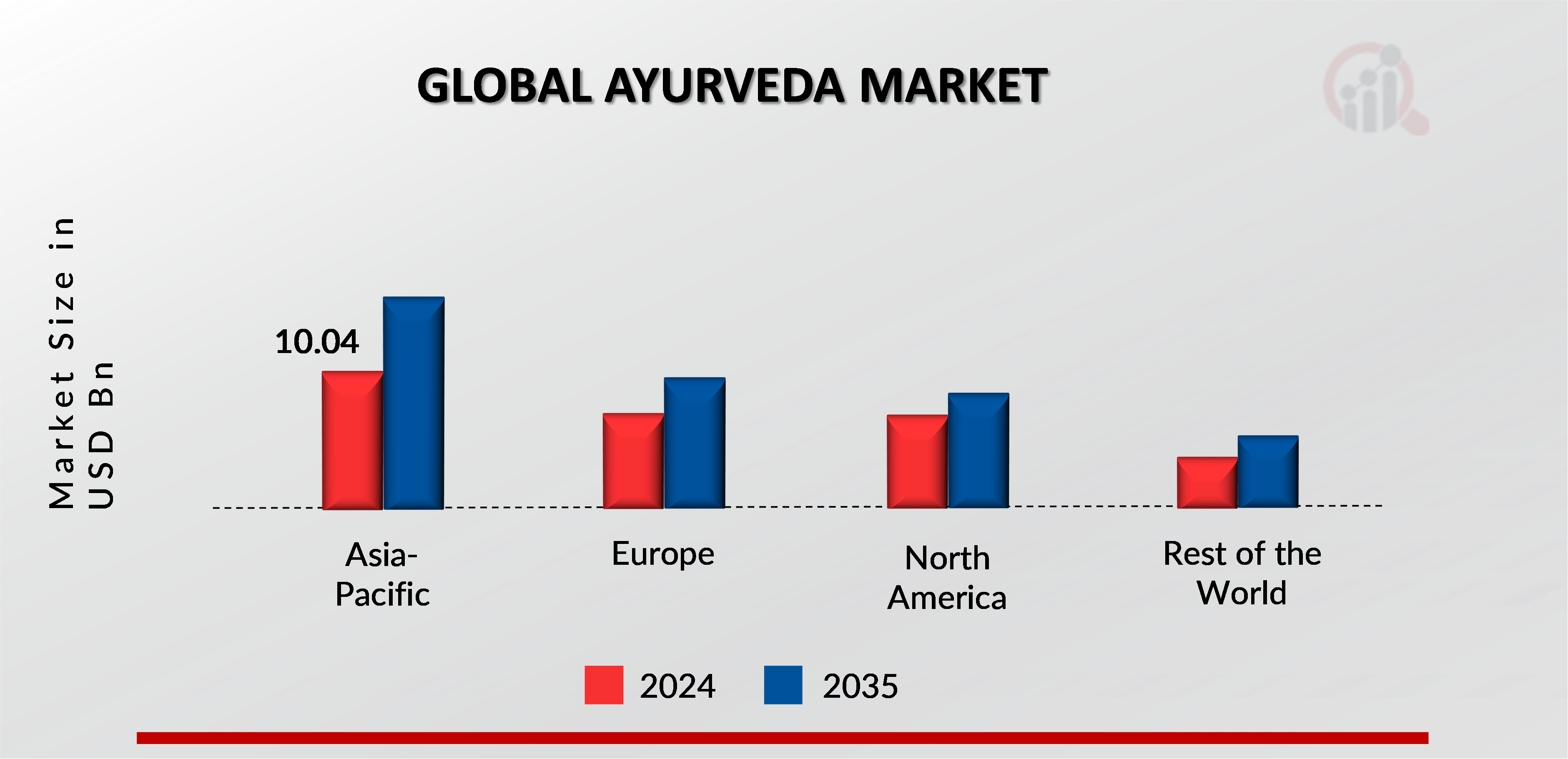

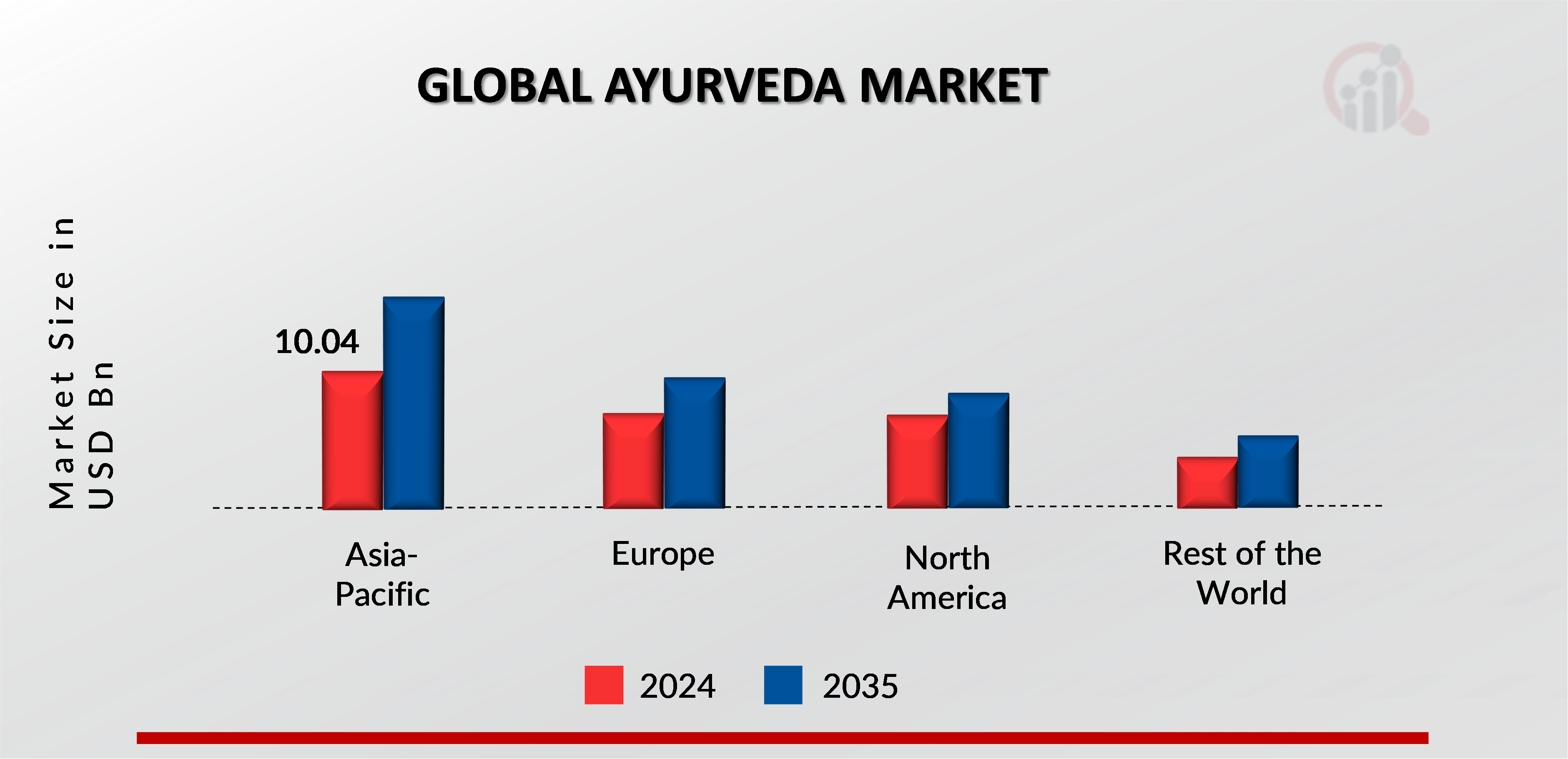

Largest Regional Market Share in 2024: Asia-Pacific

Major Players

Emami Limited, Vicco Laboratories, Baidyanath, Hamdard Laboratories, Kerala Ayurveda Limited, Dabur Ltd., Patanjali Ayurved Limited, Himalaya Wellness Company, Maharishi Ayurveda, Lotus Herbals

The growing awareness of health and wellness benefits associated with ayurveda and increasing government support for ayurveda products and growing adoption for ayurvedic products across the globe are driving the growth of the Ayurveda Market.

As per the Analyst at MRFR, the growing awareness of health and wellness benefits associated with Ayurveda is significantly boosting the global ayurveda market. As more individuals seek holistic and natural alternatives to conventional medicine, the ancient principles of Ayurveda—emphasizing balance, prevention, and personalized treatment—are gaining traction. This increasing interest is driven by a rising consumer focus on preventive health measures and the desire for sustainable, plant-based remedies. Consequently, a diverse range of Ayurvedic products, from herbal supplements to skincare items, are experiencing heightened demand. Furthermore, the increasing campaign across the globe is boosting the growth of the market.

As consumers increasingly seek holistic and natural alternatives to conventional medicine, campaigns like Dabur's "Science in Action" and Maharishi Ayurveda's #RightYourWrongs are effectively promoting Ayurvedic principles. These initiatives not only educate the public but also resonate with younger audiences, enhancing the appeal of Ayurvedic products. This rising demand, fueled by a focus on preventive health and sustainable remedies, positions Ayurveda as a vital player in the evolving healthcare landscape.

FIGURE 1: AYURVEDA MARKET VALUE (2019-2035) USD BILLION

Source: Secondary Research, Primary Research, MRFR Database, and Analyst Review

Ayurveda Market Opportunity

GROWING GERIATRIC POPULATION

The growing geriatric population is creating lucrative growth opportunities for the Ayurveda Market by driving demand for natural and holistic health solutions. As older adults increasingly seek alternatives to synthetic medications, the appeal of Ayurveda's emphasis on preventive care and natural remedies becomes more pronounced. This demographic shift leads to heightened interest in products aimed at managing chronic conditions common among seniors, such as arthritis, diabetes, and cardiovascular issues.

The National Poll on Healthy Aging highlights the significant impact of arthritis and joint pain on older adults, affecting Billions and contributing to reduced physical activity, increased disability, and higher rates of associated issues such as sleep disturbances, depression, anxiety, and falls. Conducted by the University of Michigan in early 2022, the poll surveyed a national sample of adults aged 50 to 80, exploring their experiences with arthritis and joint pain, as well as their management strategies.

Furthermore, the increasing geriatric population in North America, Europe, and Asia-Pacific will create lucrative growth opportunities in the upcoming years. As per America’s Health Rankings, approximately 58 million adults ages 65 and older were living in the US in 2022, and this number was projected to grow nearly 22% in the US in 2040. According to the European Commission, there were 448.8 million people, and more than one fifth of them were aged 65 years and over in Europe.

As per the Asia-Pacific Report on Population Ageing 2022, there were approximately 670 million people aged 60 or older in Asia-Pacific in 2022. Also, it has been estimated that the number will double to approximately 1.3 billion people by 2050 in Asia-Pacific.

Additionally, the expansion of e-commerce platforms allows for easier access to Ayurvedic products, further boosting sales. Companies are responding with innovative offerings tailored to the specific health needs of older adults, positioning themselves to capitalize on this trend in a rapidly evolving market.

Ayurveda Market Segment Insights

Ayurveda System by Product Insights

Based on Product, this segment includes Drugs, Skin Care Products, Hair Care Products, Health Care Products, Oral Care Products, and Others. The Health Care Products segment dominated the global market in 2024, while the Skin Care Products is projected to be the fastest–growing segment during the forecast period. Ayurveda emphasizes balance and holistic well-being, utilizing natural ingredients to promote health and prevent illness. Key product categories include herbal supplements, such as ashwagandha for stress relief and triphala for digestive health, along with medicinal oils for therapeutic benefits and herbal teas for soothing effects.

The market is also witnessing a trend towards sustainability, with an emphasis on organic and ethically sourced ingredients.

Notable brands like Himalaya and Baidyanath blend traditional knowledge with modern production methods, catering to a broader audience. However, challenges such as regulatory hurdles and the need for scientific validation of claims persist. Overall, the Ayurvedic healthcare market is well-positioned for continued growth as more individuals embrace natural, holistic approaches to health and wellness.

Ayurveda System by Form Insights

Based on Form, this segment includes Powder, Tablets, Capsules, Liquid and Others. The Liquid segment dominated the global market in 2024, while the Capsules segment is projected to be the fastest–growing segment during the forecast period. Liquid extracts and tonics, such as Amla juice, not only deliver potent health benefits but also function as appealing beverages, tapping into the wellness beverage trend. Moreover, the popularity of herbal teas that target specific health concerns—such as relaxation, digestion, or detoxification—further enhances the market's appeal.

The integration of Ayurvedic ingredients into functional foods like energy bars and protein powders presents an innovative avenue for brands to reach health-focused consumers seeking convenient, on-the-go options.

FIGURE 2: AYURVEDA MARKET SHARE BY FORM 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Ayurveda System by Application Insights

Based on Application Type, this segment includes Healthcare (Respiratory System, Gastrointestinal Care, Cardiovascular Health, Infectious Diseases, Orthopedic Health, Others) and Personal Care (Oral Care, Skin Care (Moisturizers, Lotions, Tablets, Capsules, Soaps & Bodywash, Facewash, Others), Hair Care (Hair Shampoo, Hair Masks, Tablets & Capsules, Hair Serums, Hair Conditioners, Others), Others). The Healthcare segment dominated the global market in 2024, while the Personal Care segment is projected to be the fastest–growing segment during the forecast period. The haircare segment in the Ayurveda market is experiencing significant growth as consumers increasingly seek natural and holistic solutions for hair health.

This sector emphasizes the use of traditional herbs and natural ingredients that align with Ayurvedic principles, promoting not only external beauty but also internal wellness. Products often feature potent herbs such as amla (Indian gooseberry) for strengthening hair, bhringraj for promoting growth, and hibiscus for enhancing shine and moisture. These ingredients are chosen for their therapeutic properties and efficacy. Natural oils, including coconut, sesame, and castor oil, are commonly used for their nourishing and conditioning benefits, helping to combat dryness and promote scalp health. Moreover, further product launches and expansions drive the segment in the forecast period.

For instance, Rajshree Pathy has created a new holistic beauty brand in India called Qi Ayurveda. Qi combines millennia of Ayurvedic heritage with cutting-edge Swiss scientific research. The formulas act on the cellular level to alter, heal, renew, and replenish skin.

Ayurveda System by Distribution Channel Insights

Based on Distribution Channel, this segment includes Business to Business (B2B) (Wholesalers, Pharmacies, Supermarkets, Others) and Business to Consumer (B2C). The Business to Business (B2B) segment dominated the global market in 2024, while it is projected to be the fastest–growing segment during the forecast period. In the global Ayurveda market, the Business to Business (B2B) distribution channel involves the selling of ayurvedic products by manufacturers or suppliers to other businesses, such as wholesalers, distributors, retailers, and spa or wellness facilities.

In this approach, businesses focus on developing partnerships with bulk buyers, who then sell the products to end users or include them in their own services.

Ayurvedic companies frequently work with wholesalers to purchase big amounts of products and distribute them across multiple markets or countries, allowing smaller merchants to get these products without dealing directly with manufacturers. Wholesalers enable Ayurvedic brands to access a broader range of retail outlets, including pharmacies, supermarkets, beauty salons, and specialty stores. This expanded distribution network helps brands increase their visibility and market presence. By purchasing products in large quantities, wholesalers can offer competitive pricing to retailers, making Ayurvedic products more accessible to a wider audience. This pricing strategy can help drive sales volume for both wholesalers and retailers.

Wholesalers manage inventory levels for Ayurvedic products, ensuring that retailers have a consistent supply without overstocking. This logistical support is vital for maintaining the flow of products in the market

Ayurveda System Regional Insights

Based on the Region, the global Ayurveda is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, South & Central America. Major demand factors driving the Asia-Pacific market are the growing awareness of health and wellness benefits associated with ayurveda and increasing government support for ayurveda products and growing adoption for ayurvedic products across the globe. The deep-rooted traditions of Ayurveda in countries like India, Sri Lanka, and Nepal are influencing consumer preferences, leading to a resurgence in the popularity of Ayurvedic products both locally and internationally.

The rising merger and acquisition (M&A) activity among the market players, which is driven by rising demand for natural and organic products, industry consolidation, and the need to broaden geographical reach. for instance, in November 2022, Mankind Pharma, an Indian pharmaceutical business, acquired Upakarma Ayurveda Private Limited, which manufactures, develops, and sells Ayurvedic and herbal medicines. This acquisition is intended to broaden Upakarma Ayurveda's product and service offerings by using Mankind Pharma's extensive distribution network.

FIGURE 3: AYURVEDA MARKET VALUE BY REGION 2024 AND 2035 (USD BILLION)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Further, the countries considered in the scope of the Application Tracking System Market are the US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Middle East & Africa, South America and others.

Global Ayurveda Key Market Players & Competitive Insights

Many global, regional, and local vendors characterize the Ayurveda Market. The market is highly competitive, with all the players competing to gain market share. Intense competition, rapid advances in technology, frequent changes in government policies, and environmental regulations are key factors that confront market growth. The vendors compete based on cost, product quality, reliability, and government regulations. Vendors must provide cost-efficient, high-quality products to survive and succeed in an intensely competitive market.

The major players in the market include Emami Limited, Vicco Laboratories, Baidyanath, Hamdard Laboratories, Kerala Ayurveda Limited, Dabur Ltd., Patanjali Ayurved Limited, Himalaya Wellness Company, Maharishi Ayurveda, Lotus Herbals are among others. The Ayurveda Market is a consolidated market due to increasing competition, acquisitions, mergers and other strategic market developments and decisions to improve operational effectiveness.

Key Companies in the Ayurveda Market include

- Patanjali Ayurved Limited

- Himalaya Wellness Company

Ayurveda Market Industry Developments

For instance,

August 2024, Maharishi Ayurveda launched an engaging oral care campaign titled #RightYourWrongs, featuring National Award-winning actress Kalki Koechlin. This innovative initiative combines humor and user insights to raise awareness about oral health ahead of the festive season. Kalki, stepping into the role of a standup comic for the first time, will star in a series of three video commercials aimed at connecting with Gen-Z audiences on platforms like Instagram and YouTube. The campaign capitalizes on the resurgence of interest in Ayurveda, as health experts and influencers increasingly advocate for its holistic, root-cause solutions.

April 2024: Lotus Herbals has introduced the UltraRx Sunscreen Serum SPF 60++++, designed to meet various skin needs while providing enhanced UV protection through an effective water-based formula. Passi noted that this product was developed in response to current trends favoring soothing ingredients in sunscreens, as well as the growing consumer preference for multi-functional, organic, and natural products.

December 2023, Dabur India Ltd launched its innovative "Science in Action" campaign, aimed at educating consumers about Ayurveda and promoting healthier lifestyles. This initiative seeks to highlight scientifically tested facts about Ayurveda, enabling families to make informed choices for their well-being. The campaign is a significant move by Dabur to share research-based insights on Ayurveda through various channels, including digital videos on social media, print promotions, and on-ground activations like the Dabur Chyawanprash Immune India Campaign. Notably, it features conversations with esteemed Ayurvedic practitioners, providing unique perspectives on the holistic benefits of Ayurveda. Through this effort, Dabur aims to reinforce the scientific foundation of Ayurveda and encourage its integration into daily health practices.

June 2023: Patanjali Foods has introduced 14 new products as part of its strategy to premiumize its offerings. These products span various segments, including nutraceuticals, health biscuits, Nutrela millet-based cereals, and dry fruits. This move reflects the company's focus on catering to health-conscious consumers and tapping into the growing demand for nutritious and premium food options. The emphasis on millet-based cereals also highlights a trend towards more sustainable and traditional food sources.

October 2023: Himalaya Wellness has launched a new turmeric range featuring products like face wash, face pack, face scrub, face serum, face cream, and sheet masks. These items harness the benefits of turmeric, a traditional ingredient in Ayurveda, using the Svarasa extraction method. This range aims to promote natural skincare and enhance the overall wellness experience.

Ayurveda Market Segmentation

Ayurveda by Product Outlook

Ayurveda by Form Outlook

Ayurveda by Application Outlook

- Respiratory System

- Gastrointestinal Care

- Cardiovascular Health

- Infectious Diseases

- Orthopedic Health

- Others

- Oral Care

- Skin Care

- Moisturizers

- Lotions

- Tablets

- Capsules

- Soaps & Bodywash

- Facewash

- Others

- Hair Care

- Hair Shampoo

- Hair Masks

- Tablets & Capsules

- Hair Serums

- Hair Conditioners

- Others

- Others

Ayurveda by Distribution Channel Outlook

- Business to Business (B2B)

- Wholesalers

- Pharmacies

- Supermarkets

- Others

- Business to Consumer (B2C)

Ayurveda Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2024 |

USD 14.93 Billion |

| Market Size 2025 |

USD 16.51 Billion |

| Market Size 2035 |

USD 77.34 Billion |

| Compound Annual Growth Rate (CAGR) |

16.13% (2025-2035) |

| Base Year |

2024 |

| Forecast Period |

2025-2035 |

| Historical Data |

2019-2023 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Product, By Form, By Application, By Distribution Channel |

| Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, Middle East & Africa, South America |

| Key Companies Profiled |

Emami Limited, Vicco Laboratories, Baidyanath, Hamdard Laboratories, Kerala Ayurveda Limited, Dabur Ltd., Patanjali Ayurved Limited, Himalaya Wellness Company, Maharishi Ayurveda, Lotus Herbals |

| Key Market Opportunities |

· Growing Geriatric Population · Increasing funding and investment associated with ayurveda products · Increasing launch of ayurveda products on e-commerce websites |

| Key Market Dynamics |

· Growing awareness of health and wellness benefits associated with Ayurveda · Increasing government support for Ayurveda products · Growing adoption of ayurvedic products across the globe |

Ayurveda Market Highlights:

Frequently Asked Questions (FAQ):

USD 14.93 Billion is the Ayurveda Market in 2024

The Health Care Products segment by material holds the largest market share and grows at a CAGR of 16.22% during the forecast period.

Asia-Pacific holds the largest market share in the Global Ayurveda Market.

Emami Limited, Vicco Laboratories, Baidyanath, Hamdard Laboratories, Kerala Ayurveda Limited, Dabur Ltd., Patanjali Ayurved Limited, Himalaya Wellness Company, Maharishi Ayurveda, Lotus Herbals are the prominent players in the Global Ayurveda Market.

The Liquid segment dominated the market in 2024.