Healthcare Artificial Intelligence (AI) Market Overview

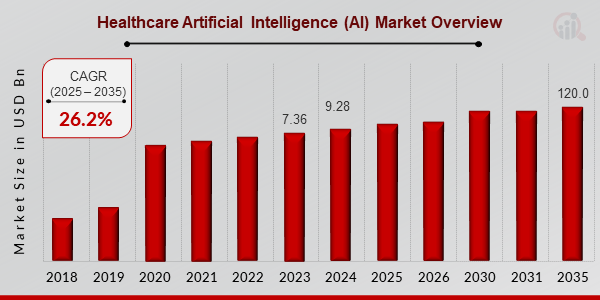

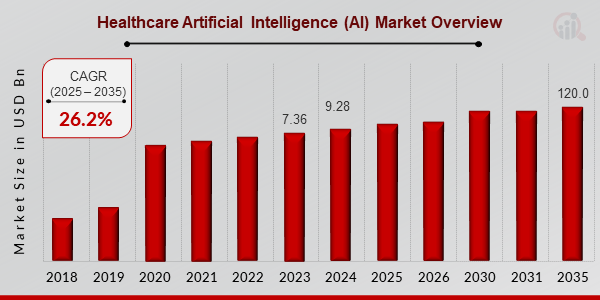

As per MRFR analysis, the Healthcare Artificial Intelligence (AI) Market Size was estimated at 7.36 (USD Billion) in 2023. The Healthcare Artificial Intelligence (AI) Market Industry is expected to grow from 9.28(USD Billion) in 2024 to 120 (USD Billion) by 2035. The Healthcare Artificial Intelligence (AI) Market CAGR (growth rate) is expected to be around 26.2% during the forecast period (2025 - 2035).

Key Healthcare Artificial Intelligence (AI) Market Trends Highlighted

A number of important market factors are propelling the notable expansion of the global healthcare artificial intelligence (AI) market. The growing need for customized medicine as medical professionals look for specialized treatment regimens to enhance patient outcomes is one of the primary motivators. Furthermore, improvements in data analytics and machine learning are making it easier to make better decisions in healthcare settings, which increases operational efficiency. The increasing amount of healthcare data is another significant factor, creating a wealth of opportunities for AI applications in predictive analytics and data management.

There are several opportunities in the global healthcare AI market, especially in the post-pandemic areas of telemedicine and remote patient monitoring.AI integration in various fields has the potential to improve underprivileged groups' access to healthcare services and increase diagnosis accuracy. The need for AI solutions is further fueled by governments throughout the world investing in AI technology to modernize healthcare systems and enhance public health outcomes. Recent years have seen a rise in trends like the use of AI in medication research and discovery.

AI is being used more and more by pharmaceutical companies to speed up the drug development process, which lowers the time and expense involved in introducing new medications to the market. Additionally, there is a growing emphasis on AI-powered solutions to mental health problems, which offer creative therapeutic approaches and enhance patient involvement.All things considered, the global healthcare AI market is changing rapidly, driven by both technical breakthroughs and government backing in different geographical areas.

Figure 1: Healthcare Artificial Intelligence (AI) Market Size, 2025-2035 (USD Billion)

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Healthcare Artificial Intelligence (AI) Market Drivers

Increasing Demand for Personalized Medicine

The Global Healthcare Artificial Intelligence (AI) Market Industry is witnessing a significant shift towards personalized medicine, which utilizes genetic, environmental, and lifestyle factors to tailor medical treatment to individual patients. According to the National Institutes of Health (NIH), personalized medicine has the potential to increase treatment effectiveness in up to 70% of patients by predicting how they will respond to a specific treatment.This underscores a demand for advanced AI systems capable of processing large datasets to identify individual patient profiles and tailor treatments accordingly.

Organizations like IBM Watson Health are at the forefront, leveraging AI to analyze patient data, thus significantly contributing to improved patient outcomes and driving market growth further.

Rising Healthcare Costs and the Need for Cost-Efficiency

One prominent driver of the Global Healthcare Artificial Intelligence (AI) Market Industry is the rising healthcare costs that have prompted healthcare providers to seek cost-effective solutions. The World Health Organization (WHO) highlighted that global healthcare spending is projected to reach 10 trillion USD by 2022. AI technologies, such as predictive analytics and robotic process automation, can reduce operational inefficiencies and manageable costs, driving substantial savings for healthcare organizations.

For instance, companies like Philips and Siemens Healthineers are investing significantly in AI to streamline processes, emphasizing the critical role of AI in managing rising expenses in healthcare.

Increasing Incidence of Chronic Diseases

Chronic diseases are on the rise globally, necessitating innovative approaches to healthcare delivery. The Global Healthcare Artificial Intelligence (AI) Market Industry is significantly influenced by the World Health Organization (WHO) reporting a rise in chronic diseases, predicting that by 2030, approximately 23 million people will die from diabetes annually. This rising prevalence of chronic conditions fuels demand for AI-driven solutions that can provide monitoring, data analysis, and predictive capabilities to improve patient management and outcomes.

Companies like Google Health and Medtronic are harnessing AI technologies to develop innovative solutions for chronic disease management, thus shaping the future of healthcare.

Healthcare Artificial Intelligence (AI) Market Segment Insights

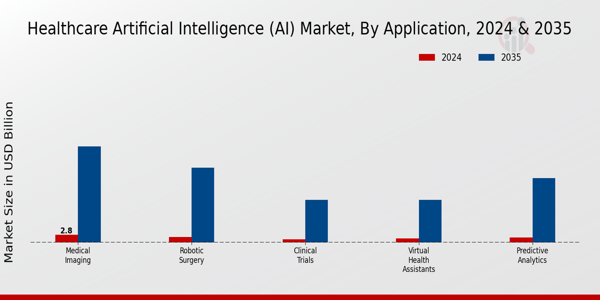

Healthcare Artificial Intelligence (AI) Market Application Insights

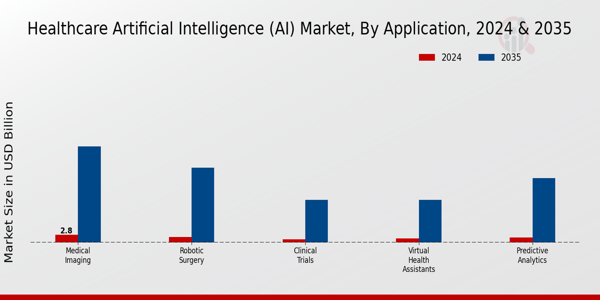

The Global Healthcare Artificial Intelligence (AI) Market is experiencing substantial growth, particularly within the Application segment. In 2024, the overall market value is poised to reach 9.28 USD Billion and is projected to expand significantly to 120.0 USD Billion by 2035. Within this landscape, individual segments demonstrate varying degrees of growth and importance, with Medical Imaging, Predictive Analytics, Robotic Surgery, Clinical Trials, and Virtual Health Assistants leading the differentiation.

In 2024, Medical Imaging is valued at 2.8 USD Billion, a figure that is set to surge to 36.0 USD Billion by 2035, showcasing its critical role in enhancing diagnostic accuracy and treatment plans through AI-powered imaging technologies.Predictive Analytics, valued at 1.8 USD Billion in 2024 and expected to grow to 24.0 USD Billion by 2035, holds substantial potential in anticipating patient outcomes and optimizing healthcare operations, which enhances patient care while minimizing costs.

Robotic Surgery is also significant within this market segment; its value is projected to climb from 2.0 USD Billion in 2024 to 28.0 USD Billion by 2035, highlighting the increasing reliance on AI-driven robotics for minimally invasive procedures, leading to shorter recovery times for patients.Furthermore, Clinical Trials, currently valued at 1.2 USD Billion and anticipated to reach 16.0 USD Billion in 2035, are greatly benefiting from AI in patient recruitment, data analysis, and real-time monitoring, making the research process more efficient and reliable.

Virtual Health Assistants, valued at 1.48 USD Billion in 2024 with prospects of hitting 16.0 USD Billion in 2035, are revolutionizing patient engagement and support by providing quick responses and personalized health information.

The majority holding of Medical Imaging and Robotic Surgery within this segment underlines their importance in advancing patient care through technological innovation.As the Global Healthcare Artificial Intelligence (AI) Market continues to expand, these Application areas not only reflect significant market growth but also represent invaluable tools that aim to streamline healthcare delivery and enhance patient outcomes globally.

This robust growth trajectory is spurred by an increasing reliance on data-driven decision-making, enhanced efficiencies in healthcare processes, and the continual demand for improved patient outcomes through innovative technologies, further solidifying the significance of these segments in the Global Healthcare Artificial Intelligence (AI) Market landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Healthcare Artificial Intelligence (AI) Market Technology Insights

The Global Healthcare Artificial Intelligence (AI) Market, focusing on the Technology segment, is poised for substantial growth as it transitions into a valuation of 9.28 billion USD 2024 and further climbing to 120.0 billion USD by 2035. This market growth is driven by advancements in technologies such as Machine Learning, Natural Language Processing, Computer Vision, and Deep Learning. Machine Learning plays a pivotal role in predicting patient outcomes and optimizing diagnostic processes, while Natural Language Processing enhances data analysis by transforming unstructured data into actionable insights.

Computer Vision significantly aids in medical imaging, allowing for quicker and more accurate diagnostics, thus streamlining workflow in healthcare settings. Meanwhile, Deep Learning is at the forefront of understanding complex medical data and improving treatment personalization. The Global Healthcare Artificial Intelligence (AI) Market statistics indicate that these technologies are not only essential for enhancing operational efficiencies but are also revolutionizing patient care across the globe. With an increasing focus on data-driven decision-making and automation in healthcare, the demand for these technologies continues to rise as they address challenges such as high operational costs and the need for improved patient outcomes.

Healthcare Artificial Intelligence (AI) Market End Use Insights

The Global Healthcare Artificial Intelligence (AI) Market is rapidly evolving, with a strong focus on the End Use segment, which includes Hospitals, Pharmaceutical Companies, Research Institutions, and Diagnostic Centers. In 2024, the market was valued at 9.28 billion USD, reflecting a growing demand for AI applications in healthcare. Hospitals play a critical role due to their need for advanced data analysis, patient care optimization, and operational efficiency. Pharmaceutical Companies leverage AI for drug discovery and development processes, significantly reducing the time and costs associated with bringing new drugs to market.

Research Institutions utilize AI to enhance their capabilities in data analysis and experimentation, leading to more significant findings in medical research. Diagnostic Centers benefit from AI by improving accuracy and speed in analyzing medical images and laboratory results. The significant growth opportunities within this market are driven by technological advancements, increased investment in healthcare technologies, and the ongoing need for improved patient outcomes.

However, challenges such as data privacy concerns and the integration of AI systems into existing infrastructures persist.Overall, the Global Healthcare Artificial Intelligence (AI) Market segmentation across these End Use categories reflects a strong potential for market growth in the coming years.

Healthcare Artificial Intelligence (AI) Market Component Insights

The Global Healthcare Artificial Intelligence (AI) Market is poised for significant growth, with the overall market was valued at 9.28 USD Billion in 2024 and projected to reach 120.0 USD Billion by 2035. This surge is driven by various factors, including technological advancement and the increased demand for efficient healthcare solutions. Within the market, the component segment comprises critical elements such as software, hardware, and services, each contributing uniquely to the overall performance of the industry. Software solutions, essential for data analysis and predictive modeling, play a significant role in enhancing clinical decision-making and operational efficiency.

Hardware infrastructure supports these software applications, facilitating extensive data processing essential for sophisticated AI algorithms. Additionally, services encompassing implementation, support, and consulting are vital for integrating AI solutions within healthcare settings, enabling organizations to maximize their investments in technology. According to Global Healthcare Artificial Intelligence (AI) Market statistics, the rapid adoption of these components is indicative of their importance in transforming healthcare delivery and improving patient outcomes globally.

Furthermore, challenges such as data privacy concerns and the integration of AI with existing systems provide opportunities for innovation and growth in the market as stakeholders seek to address these issues.

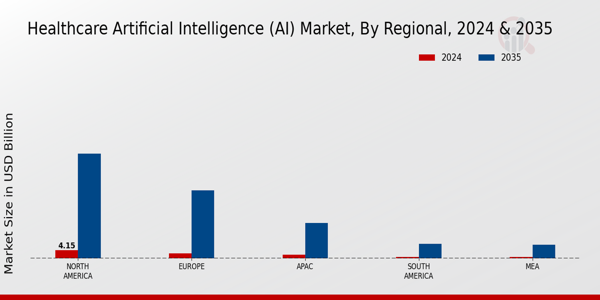

Healthcare Artificial Intelligence (AI) Market Regional Insights

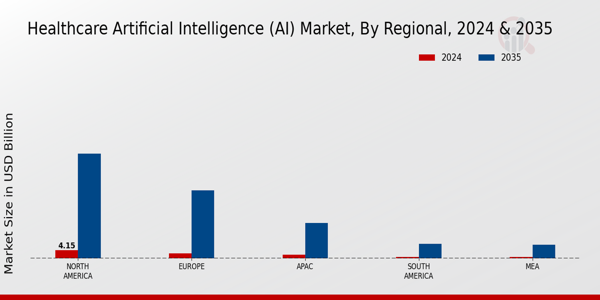

The Regional segmentation of the Global Healthcare Artificial Intelligence (AI) Market showcases substantial differences in market valuation and potential. In 2024, North America leads with a valuation of 4.15 USD Billion and is projected to dominate the market significantly by reaching 53.0 USD Billion in 2035, largely owing to its advanced healthcare infrastructure and consistent investments in technology. Europe follows with a valuation of 2.7 USD Billion in 2024, expected to grow to 34.5 USD Billion by 2035, driven by the high adoption rates of AI technologies within healthcare systems.

The APAC region, with 1.85 USD Billion in 2024, is predicted to expand to 18.0 USD Billion by 2035, benefiting from rapid digital transformation and increasing healthcare demand. South America, though smaller, is projected to grow from 0.85 USD Billion in 2024 to 7.5 USD Billion in 2035, presenting emerging opportunities in AI applications amid expanding healthcare access. Meanwhile, the Middle East and Africa (MEA) stands at 0.73 USD Billion in 2024, with growth to 7.0 USD Billion by 2035, signifying gradual adoption fueled by regional advancements in healthcare technology.

These figures highlight the significant growth trajectory and diverse opportunities within the Global Healthcare Artificial Intelligence (AI) Market across various regions.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Healthcare Artificial Intelligence (AI) Market Key Players and Competitive Insights

The Global Healthcare Artificial Intelligence (AI) Market has been experiencing substantial growth, driven by advancements in technology, increased demand for efficient healthcare solutions, and a surge in data generation within the sector. Competitive insights reveal that numerous players are investing heavily in AI to enhance patient outcomes, streamline operations, and reduce costs. The market is characterized by a mix of established healthcare technology firms alongside new entrants focused on innovative solutions.

As the landscape evolves, collaboration between tech companies, healthcare providers, and research institutions becomes increasingly prevalent, fostering an environment of rapid innovation. Companies are increasingly focusing on incorporating AI-driven analytics, machine learning algorithms, and natural language processing to transform healthcare practices ranging from diagnostics to personalized medicine and patient management.

Amazon's presence in the Global Healthcare Artificial Intelligence (AI) Market reflects its strength in leveraging cloud computing and advanced analytics. The company has been developing comprehensive platforms that integrate AI capabilities into healthcare solutions. Its vast cloud infrastructure enables healthcare organizations to adopt AI technologies quickly and efficiently, optimizing operations and enhancing patient care.

Additionally, Amazon’s capabilities in data storage and processing play a pivotal role in handling large datasets common in healthcare, providing a significant advantage over competitors. The company's commitment to innovation is also evident in its numerous partnerships aimed at enriching the healthcare ecosystem.

Through these collaborative efforts, Amazon continues to solidify its position and influence in the healthcare AI space, driving advancements that improve healthcare delivery and outcomes.IBM has positioned itself strongly in the Global Healthcare Artificial Intelligence (AI) Market, primarily through its Watson Health initiative, which focuses on using AI for various healthcare applications, including diagnostics, treatment recommendations, and patient management.

IBM's strengths lie in its extensive research background and capabilities in natural language processing and machine learning.The company's strategic mergers and acquisitions have allowed it to enhance its AI capabilities while expanding its portfolio to include advanced solutions catering to complex healthcare challenges. IBM's collaboration with healthcare institutions enables it to refine its offerings, making them more responsive to industry needs. Moreover, IBM’s established relationships within the healthcare ecosystem empower it to deliver impactful solutions that drive clinical and operational improvements.

The ongoing development of AI-driven tools illustrates IBM's commitment to fostering innovation within the healthcare sector on a global scale.

Key Companies in the Healthcare Artificial Intelligence (AI) Market Include:

Healthcare Artificial Intelligence (AI) Market Industry Developments

Recent developments in the Global Healthcare Artificial Intelligence (AI) Market have showcased significant advancements and investments. In September 2023, Amazon unveiled its AI-driven healthcare platform aimed at improving patient diagnostics and operational efficiency. IBM has also strengthened its AI capabilities by announcing a partnership with Siemens Healthineers to enhance imaging solutions. In August 2023, NVIDIA expanded its AI healthcare portfolio, focusing on genomics and drug discovery, with substantial investments in Research and Development.

Meanwhile, Cerner and Microsoft solidified their alliance to integrate AI into electronic health record systems, enhancing data analysis and patient management. Growth in market valuation is evident, as Google and Philips reported increased adoption rates of AI technologies, projected to boost efficiency and reduce costs.

Furthermore, in recent months, Medtronic announced its acquisition of a predictive analytics firm, signaling a strategic move toward advanced AI-driven medical devices. Major happenings over the past 2-3 years reflect a surge in AI applications in diagnostics, treatment personalization, and operational efficiencies across the industry, indicating a robust and rapidly evolving landscape for Healthcare AI on a global scale.

Industry News

Qure.ai : Johnson & Johnson Medtech Partners with Qure.ai to Boost Early Detection of Lung Cancer May 2025

- This partnership aims to leverage AI for improved early detection of lung conditions.

Sanofi : Digital Transformation and Artificial Intelligence June 2025

- Sanofi highlights its commitment to building and deploying AI-based solutions across its value chain, from research and development to manufacturing and patient engagement. They categorize their AI use into "Expert AI," "Snackable AI," and "Generative AI" to accelerate discovery, development, and delivery.

Johnson & Johnson : 6 ways Johnson & Johnson is using AI to help advance healthcare Oct 2024

- J&J details how they are using AI to analyze operating room data for efficiency and learning, improve surgical procedures (e.g., cardiac ablation with CARTO™ 3 System's deep learning), and explore AI for presurgical planning and post-op patient tracking.

care.ai :2024 KLAS Emerging Solutions Top 20 Nov 2024

- care.ai was recognized in the KLAS Emerging Solutions Top 20 report

Healthcare Artificial Intelligence (AI) Market Segmentation Insights

Healthcare Artificial Intelligence (AI) Market Application Outlook

- Virtual Health Assistants

Healthcare Artificial Intelligence (AI) Market Technology Outlook

- Natural Language Processing

Healthcare Artificial Intelligence (AI) Market End Use Outlook

Healthcare Artificial Intelligence (AI) Market Component Outlook

Healthcare Artificial Intelligence (AI) Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

7.36(USD Billion) |

| Market Size 2024 |

9.28(USD Billion) |

| Market Size 2035 |

120.0(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

26.2% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Amazon, IBM, Cerner, NVIDIA, Salesforce, Philips, GE Healthcare, Google, Epic Systems, Cognizant, Microsoft, Medtronic, Optum, Siemens Healthineers |

| Segments Covered |

Application, Technology, End Use, Component, Regional |

| Key Market Opportunities |

Predictive analytics for patient outcomes, AI-driven drug discovery processes, Personalized treatment plans and recommendations, Remote patient monitoring solutions, Enhancing diagnostic accuracy with AI |

| Key Market Dynamics |

Rising demand for personalized medicine, Increasing adoption of telehealth services, Growing investment in healthcare startups, Advancements in AI technologies, Regulatory challenges in data privacy |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Healthcare Artificial Intelligence Market Highlights:

Frequently Asked Questions (FAQ):

The Global Healthcare Artificial Intelligence (AI) Market is expected to be valued at 9.28 USD Billion by 2024.

By 2035, the projected market size for the Global Healthcare Artificial Intelligence (AI) Market is expected to reach 120.0 USD Billion.

The expected CAGR for the Global Healthcare Artificial Intelligence (AI) Market from 2025 to 2035 is 26.2%.

North America is expected to dominate the Global Healthcare Artificial Intelligence (AI) Market with a value of 53.0 USD Billion by 2035.

The market value for the Medical Imaging application is projected to reach 36.0 USD Billion by 2035.

Key players in the Global Healthcare Artificial Intelligence (AI) Market include Amazon, IBM, Cerner, NVIDIA, and Microsoft.

The anticipated market value for the Predictive Analytics application in 2024 is 1.8 USD Billion.

The South American segment is expected to grow to 7.5 USD Billion by 2035, showing significant growth potential.

The market size for the Clinical Trials application is expected to be valued at 16.0 USD Billion in 2035.

The APAC region is expected to contribute 18.0 USD Billion to the Global Healthcare Artificial Intelligence (AI) Market by 2035.