Emergence of 5G Technology

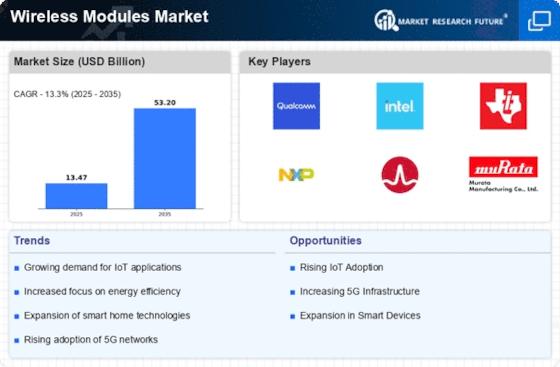

The Wireless Modules Market is on the brink of transformation with the emergence of 5G technology. This next-generation wireless communication standard promises to deliver faster data speeds and lower latency, which are crucial for various applications, including IoT and smart cities. The rollout of 5G networks is expected to create new opportunities for wireless module manufacturers, as devices will require advanced modules to leverage the benefits of this technology. Analysts predict that the 5G market could reach a valuation of over 700 billion by 2026, indicating a substantial opportunity for growth within the Wireless Modules Market. As industries and consumers alike begin to adopt 5G-enabled devices, the demand for innovative wireless modules is likely to increase, driving competition and technological advancements in the sector.

Growth in Wearable Technology

The Wireless Modules Market is poised for growth due to the rising popularity of wearable technology. As health and fitness tracking devices gain traction, the demand for efficient wireless communication solutions becomes paramount. The wearable technology market is projected to exceed 60 billion by 2025, with wireless modules serving as the backbone for connectivity. These modules enable seamless data transmission between wearables and smartphones, enhancing user engagement and functionality. The integration of advanced wireless technologies, such as Bluetooth and Wi-Fi, is likely to drive innovation within the Wireless Modules Market, as manufacturers seek to create more compact and energy-efficient solutions. This trend not only reflects consumer interest in health and wellness but also indicates a broader movement towards personalized technology, which could further stimulate market growth.

Expansion of Industrial Automation

The Wireless Modules Market is significantly influenced by the expansion of industrial automation. Industries are increasingly adopting wireless communication technologies to enhance operational efficiency and reduce costs. The market for industrial automation is expected to grow substantially, with estimates suggesting a compound annual growth rate of around 10% over the next few years. Wireless modules are integral to this transformation, enabling real-time data exchange and remote monitoring of equipment. This shift towards automation not only streamlines processes but also enhances productivity, thereby driving demand for advanced wireless solutions. As industries continue to embrace automation, the Wireless Modules Market is likely to witness increased investments in research and development, leading to innovative products that cater to the evolving needs of various sectors.

Rising Demand for Smart Home Solutions

The Wireless Modules Market is experiencing a notable surge in demand for smart home solutions. As consumers increasingly seek convenience and automation, the integration of wireless modules in home appliances and security systems becomes essential. According to recent data, the smart home market is projected to reach a valuation of over 150 billion by 2025, with wireless modules playing a pivotal role in this growth. These modules facilitate seamless communication between devices, enhancing user experience and operational efficiency. The trend towards smart homes is likely to drive innovation within the Wireless Modules Market, as manufacturers strive to develop more sophisticated and user-friendly solutions. This demand not only reflects changing consumer preferences but also indicates a broader shift towards interconnected living environments, which could further propel the market forward.

Increased Focus on Smart Transportation Solutions

The Wireless Modules Market is witnessing a heightened focus on smart transportation solutions. As urbanization accelerates, the need for efficient and sustainable transportation systems becomes increasingly critical. Wireless modules play a vital role in enabling communication between vehicles, infrastructure, and users, facilitating the development of intelligent transportation systems. The market for smart transportation is projected to grow significantly, with estimates suggesting a compound annual growth rate of around 15% over the next few years. This growth is likely to drive demand for advanced wireless modules that support vehicle-to-everything (V2X) communication, enhancing safety and efficiency on the roads. As cities invest in smart infrastructure, the Wireless Modules Market is expected to benefit from increased adoption of these technologies, leading to innovative solutions that address contemporary transportation challenges.