Growing Energy Sector Investments

The energy sector is witnessing substantial investments, particularly in oil and gas exploration and production. This trend is significantly impacting the welded pipes market, as these pipes are essential for transporting fluids and gases in various applications. Recent reports suggest that the global energy investments are expected to reach trillions of dollars in the coming years, driven by the need for energy security and sustainability. Consequently, the demand for welded pipes is likely to rise, as they are favored for their strength and reliability in high-pressure environments. The welded pipes market is thus positioned to capitalize on the increasing energy sector investments, which may lead to enhanced growth opportunities for manufacturers.

Increased Focus on Sustainability

The welded pipes market is experiencing a shift towards sustainability, driven by growing environmental concerns and regulatory pressures. Manufacturers are increasingly adopting eco-friendly practices, such as using recycled materials and reducing waste during production. This focus on sustainability not only meets consumer demand for greener products but also aligns with global efforts to combat climate change. Recent studies indicate that the market for sustainable construction materials, including welded pipes, is expected to grow significantly. As companies strive to enhance their sustainability profiles, the welded pipes market is likely to benefit from this trend, potentially leading to increased market share for those who prioritize environmentally friendly practices.

Rising Demand in Construction Sector

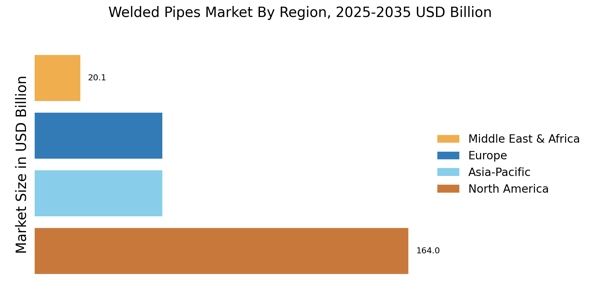

The construction sector is experiencing a notable surge in demand for welded pipes, driven by ongoing infrastructure projects and urbanization. As cities expand and new buildings emerge, the need for reliable piping solutions becomes paramount. The welded pipes market is poised to benefit from this trend, as these pipes offer durability and cost-effectiveness. Recent data indicates that the construction industry is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years, further fueling the demand for welded pipes. This growth is likely to be particularly pronounced in developing regions, where infrastructure development is a priority. Consequently, the welded pipes market stands to gain significantly from the increasing investments in construction and infrastructure.

Advancements in Manufacturing Technologies

Technological advancements in manufacturing processes are reshaping the welded pipes market. Innovations such as automated welding techniques and improved quality control measures enhance the efficiency and reliability of welded pipes. These advancements not only reduce production costs but also improve the overall quality of the pipes, making them more appealing to consumers. For instance, the introduction of advanced welding equipment has led to a reduction in defects and an increase in production speed. As a result, manufacturers are better positioned to meet the growing demand for high-quality welded pipes. The welded pipes market is likely to see a shift towards more sophisticated manufacturing processes, which could lead to increased market share for companies that adopt these technologies.

Regulatory Support for Infrastructure Projects

Regulatory frameworks supporting infrastructure development are playing a crucial role in the welded pipes market. Governments are increasingly recognizing the importance of modernizing infrastructure to boost economic growth and improve public services. This recognition has led to the implementation of policies that facilitate investment in infrastructure projects, including transportation, water supply, and energy distribution. As a result, the demand for welded pipes is expected to rise, as they are integral to these projects. Recent government initiatives indicate a commitment to investing in infrastructure, which could lead to a significant increase in the welded pipes market. The alignment of regulatory support with market needs suggests a favorable environment for growth in the coming years.