Expansion of E-commerce and Retail Sectors

The Warehousing Sorting System Market is significantly influenced by the expansion of e-commerce and retail sectors. As online shopping continues to grow, the need for efficient sorting systems becomes increasingly critical. E-commerce companies require rapid order processing and accurate inventory management to meet consumer expectations. Data indicates that the e-commerce sector is expected to grow by 15% annually, necessitating the adoption of advanced sorting technologies in warehouses. This growth presents a substantial opportunity for the warehousing industry to innovate and enhance sorting capabilities.

Focus on Sustainability and Green Practices

Sustainability initiatives are becoming a central theme in the Warehousing Sorting System Market. Companies are increasingly prioritizing eco-friendly practices, which include the adoption of energy-efficient sorting systems. These systems not only reduce carbon footprints but also lower operational costs. Recent findings suggest that warehouses implementing sustainable sorting technologies can achieve up to a 20% reduction in energy consumption. This focus on sustainability is likely to drive investment in innovative sorting solutions that align with environmental goals, thereby shaping the future of the warehousing sector.

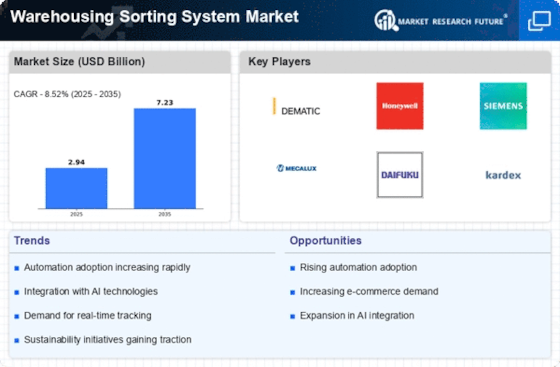

Technological Advancements in Sorting Systems

The Warehousing Sorting System Market is experiencing a surge in technological advancements, particularly in automation and artificial intelligence. These innovations enhance sorting accuracy and speed, thereby improving overall operational efficiency. For instance, the integration of machine learning algorithms allows for real-time data analysis, optimizing sorting processes. According to recent data, the adoption of advanced sorting technologies is projected to increase by 25% over the next five years. This trend indicates a shift towards more sophisticated systems that can handle complex sorting tasks, ultimately driving growth in the warehousing sector.

Increasing Labor Costs and Workforce Challenges

The Warehousing Sorting System Market is also affected by rising labor costs and challenges in workforce management. As labor expenses continue to escalate, companies are compelled to seek automation solutions to maintain profitability. Automated sorting systems can alleviate the reliance on manual labor, thereby addressing workforce shortages and reducing operational risks. Current trends indicate that businesses investing in automation are likely to see a return on investment within two years, making it a compelling option for warehouses aiming to optimize their sorting processes.

Rising Demand for Efficient Supply Chain Management

In the Warehousing Sorting System Market, the increasing demand for efficient supply chain management is a pivotal driver. Companies are seeking to streamline operations to reduce costs and improve delivery times. The implementation of advanced sorting systems can significantly enhance inventory management and order fulfillment processes. Recent statistics suggest that businesses utilizing automated sorting solutions have reported a 30% reduction in operational costs. This trend underscores the necessity for warehouses to adopt innovative sorting technologies to remain competitive in a rapidly evolving market.