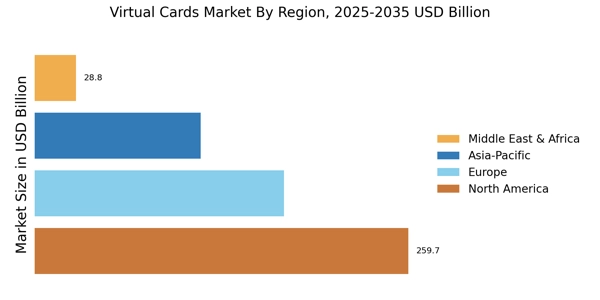

North America : Digital Payment Leader

North America leads the virtual cards market, accounting for approximately 45% of global share. Growth is driven by strong e-commerce penetration, enterprise adoption of b2b virtual cards, and innovation by major credit card network market share leaders. The U.S. remains a hub for b4b payments us virtual cards, supported by fintech expansion and favorable regulations. The demand for enhanced security features and fraud prevention measures further propels market expansion, with the U.S. leading the charge, followed by Canada with a 15% market share. The competitive landscape is characterized by major players such as Visa, Mastercard, and American Express, which dominate the market with innovative offerings. The presence of fintech companies like PayPal and Stripe also enhances competition, driving technological advancements. Regulatory frameworks in the U.S. and Canada support the growth of virtual cards, ensuring consumer protection and fostering innovation in digital payments.

Europe : Emerging Digital Finance Hub

Europe accounts for around 30% of global share, driven by regulatory initiatives and fintech innovation. Adoption by enterprises and consumers strengthens regional presence in the virtual cards market, supported by leading players and strong digital banking infrastructure. The rise in online shopping, coupled with increasing consumer preference for secure payment methods, drives this trend. Regulatory initiatives, such as the EU's PSD2 directive, promote transparency and competition in the financial sector, further catalyzing market growth. The UK and Germany are the largest markets, holding 10% and 8% shares respectively. Leading countries in Europe are characterized by a strong presence of fintech companies and traditional banks offering virtual card solutions. The competitive landscape includes key players like Revolut, Adyen, and N26, which are innovating to meet consumer demands. The regulatory environment encourages the adoption of digital payment solutions, ensuring a secure and efficient payment ecosystem. This dynamic landscape positions Europe as a key player in The Virtual Cards Market.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific holds nearly 20% of global share, supported by smartphone penetration, fintech adoption, and increasing demand for secure digital payments. The region presents strong growth opportunities across consumer and b2b virtual card segments. Countries like China and India are leading this trend, with China holding a substantial market share of approximately 12%, driven by its advanced digital payment infrastructure and consumer adoption of fintech solutions. The competitive landscape in Asia-Pacific is diverse, featuring both established financial institutions and innovative fintech startups. Key players such as PayPal and Stripe are expanding their services, while local companies are also gaining traction. The regulatory environment is evolving, with governments promoting digital payment solutions to enhance financial inclusion and economic growth, making the region a hotbed for virtual card adoption.

Middle East and Africa : Emerging Market Potential

MEA holds about 5% of global share, with growth driven by mobile banking, young demographics, and increasing acceptance of virtual payment solutions, including usd virtual card offerings for cross-border commerce. The growth is driven by increasing smartphone penetration, a young population, and a shift towards digital payments. Countries like South Africa and the UAE are at the forefront, with South Africa accounting for approximately 3% of the market share, supported by government initiatives to promote financial technology and digital banking solutions. The competitive landscape is characterized by a mix of local and international players, with companies like PayPal and local banks offering virtual card solutions. The region's regulatory frameworks are evolving to support digital payment innovations, fostering a conducive environment for growth. As financial literacy improves and digital infrastructure develops, the MEA region presents significant opportunities for virtual card adoption and market expansion.