- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

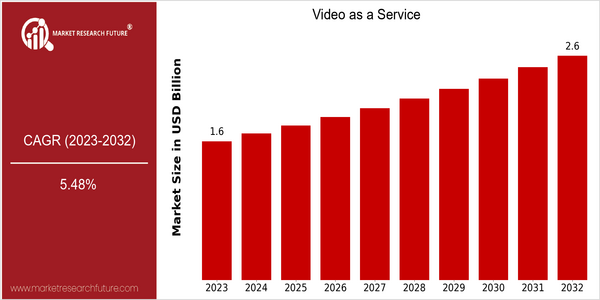

| Year | Value |

|---|---|

| 2023 | USD 1.59 Billion |

| 2032 | USD 2.59 Billion |

| CAGR (2024-2032) | 5.48 % |

Note – Market size depicts the revenue generated over the financial year

In the next chapter, we will learn about the VaaS market. VaaS is a market for delivering streaming media content to subscribers. VaaS is expected to grow at a CAGR of 5.48% from 2024 to 2032. The growing demand for video solutions in various industries is mainly due to the increasing use of cloud-based services and the increasing need for scalable communication tools. The VaaS market is expected to grow significantly, mainly due to the development of streaming technology, the improvement of video quality, and the wide availability of mobile devices that facilitate the use of video content and collaboration. The increase in remote work and virtual collaboration is driving the need for reliable communication platforms. The integration of artificial intelligence and machine learning in VaaS will enhance the experience of users and improve the performance of the service. The major VaaS vendors, such as Zoom, Cisco, and Microsoft, are investing heavily in the development of new products and establishing strategic cooperation. Recent collaborations to integrate VaaS with existing enterprise software will help VaaS penetrate the market and penetrate customers, and VaaS will become an essential part of the modern business infrastructure.

Regional Market Size

Regional Deep Dive

Despite the fact that the market for VaaS is experiencing significant growth in several regions, the demand for cloud-based services is still very low. North America, where the technological and digital environment is well developed, is seeing a growth in the demand for digital services, while Europe is seeing a growth in the regulatory frameworks that ensure data security and privacy in digital services. The Asia-Pacific region is rapidly growing due to the spread of mobile devices and the increase in Internet penetration, while the Middle East and Africa are experiencing growth driven by investments in digital transformation. Latin America is also becoming an important player, particularly in the field of communications and video streaming, especially after the pandemic.

Europe

- The European Union's General Data Protection Regulation (GDPR) has set a high standard for data privacy, compelling VaaS providers to implement stringent compliance measures, which can enhance consumer trust.

- Innovations in 5G technology are enabling higher quality video streaming and real-time communication, with companies like Vodafone and Deutsche Telekom investing heavily in infrastructure to support VaaS growth.

Asia Pacific

- The rapid increase in smartphone penetration and affordable internet access in countries like India and China is driving the adoption of video services, with local players like Tencent and Alibaba leading the charge.

- Government initiatives, such as the Digital India program, are promoting digital literacy and infrastructure development, which is expected to further boost the VaaS market in the region.

Latin America

- The COVID-19 pandemic has accelerated the adoption of video streaming services in Latin America, with companies like Globo and Televisa expanding their digital platforms to meet consumer demand.

- Economic factors, such as the increasing availability of affordable internet plans, are enabling more consumers to access video services, which is expected to drive market growth in the coming years.

North America

- The rise of remote work has led to increased demand for video conferencing solutions, with companies like Zoom and Microsoft Teams enhancing their VaaS offerings to cater to this trend.

- Regulatory changes, such as the California Consumer Privacy Act (CCPA), are influencing how video service providers manage user data, prompting companies to adopt more robust data protection measures.

Middle East And Africa

- The UAE's Vision 2021 initiative is fostering a digital economy, encouraging investments in video technology and services, with companies like Etisalat and du expanding their VaaS offerings.

- Cultural factors, such as the growing popularity of online content consumption among younger demographics, are driving demand for video services, leading to increased competition among local and international providers.

Did You Know?

“As of 2023, video content is projected to account for over 82% of all consumer internet traffic, highlighting the growing importance of video services in the digital landscape.” — Cisco Annual Internet Report

Segmental Market Size

The market for telecommunications is experiencing rapid growth, largely due to the increasing demand for telecommunications and collaboration tools. A number of factors are driving this demand, including the growth of hybrid work environments, where organisations seek efficient solutions for meetings and training, and the need for scalable content delivery in the education and entertainment sectors. Also, government initiatives promoting digital transformation further increase the appeal of the sector. In terms of value, VaaS is currently in a stage of large-scale deployment, with Zoom and Microsoft Teams at the forefront of adoption across industries. These platforms are used primarily for virtual events, education and training, and meetings. Also, macro-economic trends, such as the november influenza pandemic, have accelerated the shift towards digital solutions, while green initiatives have increased the appeal of more eco-friendly video solutions. Cloud-based video platforms and AI-based analytics are the main tools shaping the sector. These tools enhance the user experience and improve efficiency.

Future Outlook

The VaaS market is expected to increase from $1.59 billion in 2023 to $2.59 billion in 2032, a CAGR of 5.48 percent. The growth is mainly driven by the increasing demand for scalable and flexible video solutions in various industries, such as education, training, and entertainment. Also, with the remote and hybrid working methods in organizations, the need for effective communication tools will continue to increase, with the penetration rate of the enterprise VaaS market in 2032 reaching more than 60 percent. Also, the integration of machine learning and artificial intelligence in video analytics will improve the user experience and the efficiency of the system. The spread of 5G technology will further improve the quality of streaming and reduce the latency, further increasing the use of VaaS. Also, the trend of interactive content and the personalization of the viewer will also be an important factor in the future. VaaS is expected to continue to grow steadily in the next decade.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 1.5 Billion |

| Market Size Value In 2023 | USD 1.59 Billion |

| Growth Rate | 6.30% (2023-2032) |

Video as a Service Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.