Research Methodology on Vehicle Security Market

Introduction:

The present-day market trend in the automotive sector is the increasing demand for vehicle security. With the rise in automobile thefts, the demand for vehicle security solutions has increased substantially across the globe. This is driving the automotive security solutions market for the vehicle segment. From immobilizers to tracking solutions, the market for vehicle security is on a growth trajectory as consumers become more aware of the security of their cars. Market Research Future (MRFR) has released a report concerning the vehicle security market that provides a comprehensive analysis of the market. The report includes historical developments, current and projected market standings, future trends and technological advancements.

Research Methodology:

The research methodology employed in the market study of the vehicle security market encompasses both primary and secondary research. The primary purpose is to collect data from industry experts, key market players, industry stakeholders, regulatory bodies and other sources to gain an insight into the market and its underlying factors, their views and how the market is expected to behave. Secondary research also involves extensively studying databases such as the American Association of Motor Vehicle Administrators (AAMVA), American Automobile Association (AAA), Automobile Association of South Africa (AASA) and Automobile Association of India (AAI), among others. These databases enable to obtain detailed information via reliable and verifiable sources.

To collect the required data and information, MRFR conducted interviews with the industry participants and key opinion leaders to gauge unfiltered opinions and offer insights into the current market scenarios. The research study will help stakeholders, including investors, interlopers and product/service providers to get a deeper understanding of the market and make more informed decisions. The research also focuses on the trends and technological advancements which are revolutionizing the industry, the latest market news and deals, company outlook, and mergers and acquisitions.

Market Segments:

The vehicle security market has been segmented based on component, solution, vehicle type and end user.

By component, the vehicle security market has been segmented into hardware, software and service. The hardware segment accounts for the largest market share and it is expected that it will continue to dominate the market during the forecast period. The hardware component of the vehicle security system includes GPS and tracking devices, immobilizers, alarms and other devices.

By solution, the vehicle security market has been segmented into integrated security systems, tracking devices, and anti-theft systems. The integrated security system constitutes a majority of the market share due to its cost-effectiveness and enhanced protection.

By vehicle type, the vehicle security market has been segmented into light vehicles, heavy vehicles and two-wheelers. The light vehicles segment holds the majority of the market share due to an increase in the production of cars.

By end user, the vehicle security market has been segmented into OEM and aftermarket. The aftermarket segment is expected to hold a larger market share due to its wide application in retrofitting vehicles with vehicle security systems.

Regional Analysis:

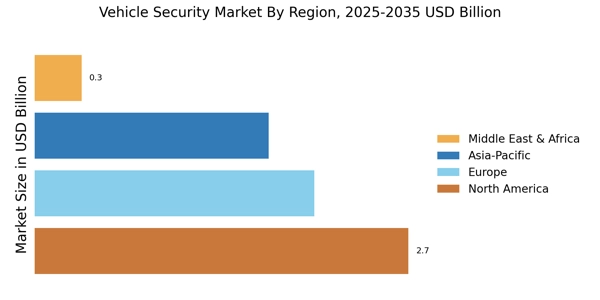

The report segments the global vehicle security market into North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW).

North America is expected to lead the vehicle security market, followed by Europe. The presence of strong automobile industries and industries providing vehicle security solutions such as IoT, intelligent transportation systems, etc. is driving the market.

The APAC region is expected to be the fastest-growing market due to the rising demand for connected cars in countries like India and China. The presence of a large number of automotive manufacturers and the implementation of advanced vehicle security systems in luxury vehicles are driving the market in the region.

The RoW region is expected to account for the lowest market share due to the lack of awareness regarding vehicle security systems.

Competitive Dashboard:

Some of the key market players in the vehicle security market include Continental AG (Germany), Robert Bosch GmbH (Germany), Delphi Automotive LLP (UK), Averbis Automotive Security Solutions (Germany), Silicon Vale Vehicle Security Solutions (US), Preh Automotive (Germany), Renault S.A.S. (France), Lear Corporation (US), Vector Informatik GmbH (Germany), ON Semiconductor Corporation (US), Core Microwave Technology Solutions (US), Autoliv Inc. (US), and Honda Motor Co., Ltd. (Japan). The companies adopt mergers & acquisitions, product developments, collaborations, partnerships and expansions as their key strategies to gain significant market share.

Conclusion:

From the report, it can be concluded that the vehicle security market is expected to grow at a rapid rate owing to the increasing demand for vehicle safety and security. The presence of a large number of automobile manufacturers and the use of advanced vehicle security systems in luxury cars are driving the market. The report provides an in-depth analysis of the industry including company outlook, technological advancements, trends and forecasts (for the period of 2023-2030).