Aging Population

The demographic shift towards an aging population in the United States significantly influences the US Uti Drugs Market. Older adults are more susceptible to UTIs due to various factors, including hormonal changes and comorbidities that affect urinary function. The US Census Bureau projects that by 2030, nearly 20% of the population will be aged 65 and older, which could lead to an increased incidence of UTIs. This demographic trend suggests a rising demand for UTI medications tailored to the needs of older patients. Furthermore, healthcare providers are likely to focus on developing age-appropriate formulations and treatment regimens, thereby driving innovation and growth within the UTI drug market.

Increased Healthcare Expenditure

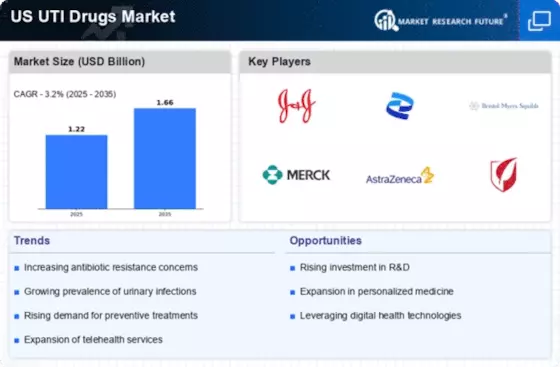

The upward trend in healthcare expenditure in the United States serves as a critical driver for the US Uti Drugs Market. With the national healthcare spending projected to reach approximately $6 trillion by 2027, there is a growing investment in pharmaceuticals, including UTI treatments. This financial commitment enables research and development of new drugs, enhancing the availability of effective treatment options. Additionally, increased insurance coverage for prescription medications allows more patients to access necessary UTI drugs without financial burden. As healthcare spending continues to rise, it is likely that the UTI drug market will experience substantial growth, reflecting the prioritization of effective healthcare solutions.

Rising Awareness of UTI Prevention

The increasing awareness regarding urinary tract infections (UTIs) and their prevention is a notable driver in the US Uti Drugs Market. Educational campaigns by healthcare organizations and government bodies have led to a heightened understanding of UTI symptoms and risk factors. This awareness encourages individuals to seek medical advice promptly, thereby increasing the demand for UTI medications. According to recent data, approximately 50-60% of women experience at least one UTI in their lifetime, which underscores the necessity for effective treatment options. As more people become informed about the implications of untreated UTIs, the market for UTI drugs is likely to expand, reflecting a growing need for both prescription and over-the-counter solutions.

Emergence of Antimicrobial Resistance

The rising concern over antimicrobial resistance (AMR) is reshaping the landscape of the US Uti Drugs Market. As bacteria become increasingly resistant to conventional antibiotics, there is a pressing need for new and effective UTI treatments. The Centers for Disease Control and Prevention (CDC) has identified AMR as a significant public health threat, prompting research into alternative therapies and novel drug formulations. This urgency may lead to increased investment in the development of UTI drugs that can effectively combat resistant strains. Consequently, the market may witness a shift towards innovative solutions, including combination therapies and new classes of antibiotics, to address the challenges posed by AMR.

Telehealth Adoption for UTI Management

The growing adoption of telehealth services in the United States is transforming the approach to UTI management, thereby impacting the US Uti Drugs Market. Telehealth offers patients convenient access to healthcare professionals, facilitating timely diagnosis and treatment of UTIs. This trend is particularly beneficial for individuals who may face barriers to in-person consultations, such as mobility issues or geographic limitations. As telehealth becomes more integrated into routine healthcare, it is likely to enhance patient engagement and adherence to treatment regimens. Consequently, the demand for UTI medications may increase as patients receive prompt prescriptions through virtual consultations, reflecting a shift in how UTI care is delivered.