Rising Geriatric Population

The somatostatin analogs market is poised for growth due to the rising geriatric population in the US. As individuals age, the likelihood of developing hormonal disorders increases, leading to a higher demand for effective treatment options. The US Census Bureau projects that by 2030, all baby boomers will be over 65 years old, significantly impacting healthcare needs. This demographic shift suggests a potential increase in the prevalence of conditions treated by somatostatin analogs, thereby driving market growth. The somatostatin analogs market is likely to expand as healthcare providers focus on addressing the unique needs of the aging population.

Advancements in Diagnostic Techniques

Advancements in diagnostic techniques are significantly impacting the somatostatin analogs market. Enhanced imaging technologies and biomarker identification have improved the detection of neuroendocrine tumors and other hormonal disorders. This has led to earlier diagnosis and treatment initiation, which is crucial for effective management. As a result, the demand for somatostatin analogs is expected to rise, as these therapies are often prescribed following diagnosis. The integration of advanced diagnostics into clinical practice not only facilitates timely intervention but also supports the growth of the somatostatin analogs market by increasing patient access to these essential treatments.

Growing Prevalence of Hormonal Disorders

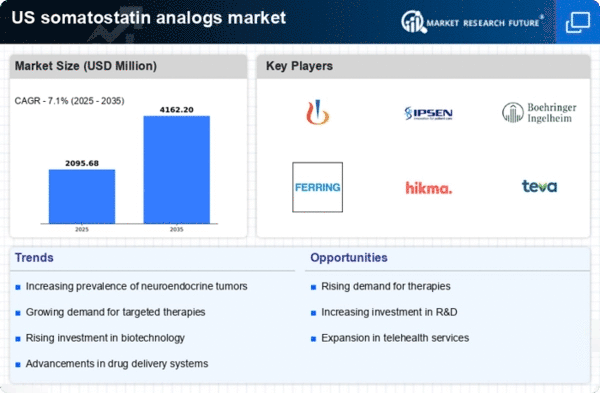

The somatostatin analogs market is experiencing growth due to the increasing prevalence of hormonal disorders such as acromegaly and neuroendocrine tumors. According to recent data, the incidence of acromegaly in the US is estimated to be around 3 to 4 cases per million people annually. This rising incidence necessitates effective treatment options, thereby driving demand for somatostatin analogs. Furthermore, the growing awareness among healthcare professionals regarding the benefits of these therapies contributes to market expansion. As more patients are diagnosed with hormonal disorders, is expected to see a corresponding increase

Regulatory Support for Innovative Therapies

Regulatory support for innovative therapies is a key driver of the somatostatin analogs market. The US Food and Drug Administration (FDA) has been actively promoting the development of new treatments through expedited review processes and incentives for orphan drugs. This regulatory environment encourages pharmaceutical companies to invest in research and development of somatostatin analogs, leading to a broader range of treatment options for patients. As new formulations and delivery methods are introduced, the somatostatin analogs market is expected to benefit from increased competition and improved patient access to these vital therapies.

Increased Investment in Healthcare Infrastructure

The somatostatin analogs market is benefiting from increased investment in healthcare infrastructure across the US. Government initiatives aimed at enhancing healthcare access and quality are likely to improve patient outcomes and treatment availability. For instance, funding for specialized treatment centers and research institutions is on the rise, which may lead to better patient education and awareness regarding hormonal disorders. This, in turn, could drive the demand for somatostatin analogs as more patients seek effective therapies. The ongoing investment in healthcare infrastructure is expected to create a favorable environment for the somatostatin analogs market to thrive.