Aesthetic Appeal

The aesthetic appeal of rainscreen cladding is a significant driver in the US Rainscreen Cladding Market. As urbanization continues to rise, the demand for visually striking and architecturally innovative buildings is increasing. Rainscreen cladding offers a versatile design solution that can enhance the exterior appearance of structures while providing functional benefits. The ability to use various materials, such as wood, metal, and fiber cement, allows architects to create unique facades that stand out. This trend is particularly evident in commercial and residential projects, where the visual impact is paramount. As a result, the market for rainscreen cladding is expected to grow, with aesthetic considerations likely influencing purchasing decisions and driving innovation in design.

Customization Demand

The US Rainscreen Cladding Market is experiencing a surge in demand for customization and personalization. Architects and builders are increasingly seeking unique cladding solutions that cater to specific design requirements and aesthetic preferences. This trend is evident in the growing popularity of bespoke rainscreen systems that allow for a wide range of colors, textures, and finishes. Customization not only enhances the visual appeal of buildings but also enables better integration with the surrounding environment. As a result, manufacturers are investing in flexible production capabilities to meet this demand. The customization trend is likely to contribute to market expansion, with estimates suggesting that customized rainscreen solutions could account for over 30% of the total market share by 2026.

Regulatory Compliance

Regulatory compliance is a critical driver in the US Rainscreen Cladding Market. Stricter building codes and safety regulations are compelling builders and architects to adopt rainscreen systems that meet these standards. The International Building Code (IBC) and local regulations often mandate the use of non-combustible materials in high-rise buildings, which boosts the demand for rainscreen cladding. Furthermore, compliance with energy efficiency standards, such as those set by the Department of Energy, is pushing the industry towards more efficient cladding solutions. This regulatory landscape is expected to foster market growth, as adherence to these codes not only ensures safety but also enhances the overall performance of buildings, making rainscreen cladding an attractive option.

Technological Innovations

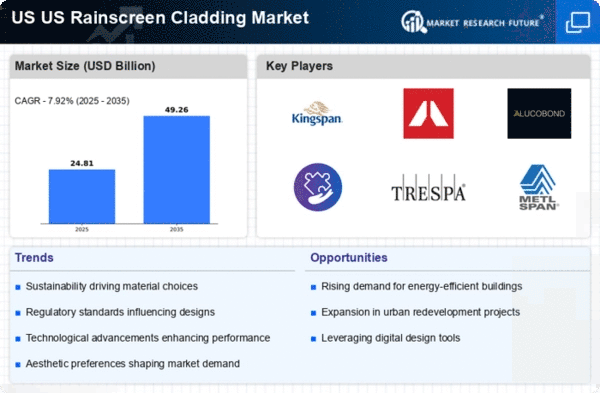

Technological advancements are reshaping the US Rainscreen Cladding Market. Innovations in materials and installation techniques are enhancing the performance and aesthetic appeal of rainscreen systems. For example, the introduction of lightweight composite materials allows for easier installation and improved durability. Additionally, advancements in manufacturing processes have led to the development of cladding options that offer superior weather resistance and longevity. The market is witnessing a shift towards smart cladding solutions that integrate sensors for monitoring building performance. This technological evolution is expected to drive market growth, with projections indicating a compound annual growth rate (CAGR) of approximately 7% over the next five years, reflecting the increasing adoption of advanced cladding technologies.

Sustainability Initiatives

The US Rainscreen Cladding Market is increasingly driven by sustainability initiatives. As environmental concerns gain prominence, building codes and regulations are evolving to prioritize energy efficiency and sustainable materials. The adoption of rainscreen cladding systems, which enhance thermal performance and reduce energy consumption, aligns with these initiatives. For instance, the U.S. Green Building Council's LEED certification encourages the use of sustainable building materials, including rainscreen cladding. This trend is reflected in the market, where the demand for eco-friendly materials is projected to grow significantly, potentially reaching a market value of over USD 1 billion by 2027. Consequently, manufacturers are focusing on developing innovative, sustainable cladding solutions that meet these regulatory requirements.