Integration of Telemedicine

The integration of telemedicine into healthcare practices is reshaping the pupillometer market. As remote consultations become more prevalent, the need for portable and user-friendly diagnostic tools is increasing. Pupillometers that can be easily utilized in telehealth settings allow practitioners to assess patients' eye health without requiring in-person visits. This shift not only enhances patient access to care but also encourages the adoption of pupillometers in various healthcare settings. The telemedicine market in the US is anticipated to reach $175 billion by 2026, suggesting a significant opportunity for pupillometer manufacturers to align their products with telehealth solutions.

Growing Geriatric Population

The aging population in the US is a critical driver for the pupillometer market. As individuals age, they become more susceptible to various eye conditions, necessitating regular eye examinations. Pupillometers play a vital role in these assessments, providing essential data for diagnosing age-related ocular diseases. The US Census Bureau projects that by 2030, approximately 20% of the population will be aged 65 and older, which could lead to an increased demand for eye care services and diagnostic tools. This demographic shift presents a substantial opportunity for the pupillometer market to expand its reach and cater to the needs of an aging population.

Advancements in Optical Technology

Recent advancements in optical technology are significantly influencing the pupillometer market. Innovations such as improved imaging techniques and enhanced sensor capabilities are leading to the development of more accurate and efficient pupillometers. These technological improvements not only enhance the precision of pupil measurements but also facilitate the integration of pupillometers with other diagnostic equipment. As healthcare providers increasingly prioritize accuracy in diagnostics, the demand for technologically advanced pupillometers is likely to rise. The optical technology market is projected to grow at a CAGR of 7% through 2027, indicating a favorable environment for the pupillometer market to thrive.

Rising Demand for Diagnostic Tools

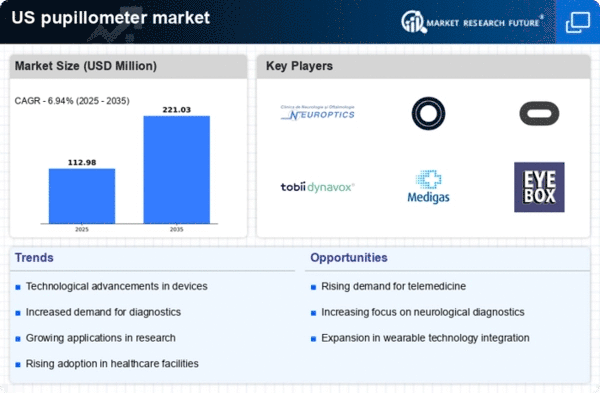

The increasing prevalence of eye-related disorders in the US is driving the demand for advanced diagnostic tools, including pupillometers. As conditions such as glaucoma and diabetic retinopathy become more common, healthcare providers are seeking efficient methods for early detection and monitoring. The pupillometer market is expected to benefit from this trend, as these devices provide precise measurements of pupil response, aiding in the diagnosis of various ocular conditions. According to recent estimates, the market for diagnostic ophthalmic devices is projected to grow at a CAGR of approximately 6.5% over the next five years, indicating a robust demand for pupillometers as part of comprehensive eye care solutions.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in the US, which is positively impacting the pupillometer market. Healthcare professionals are increasingly advocating for regular eye examinations as a means of preventing vision loss and other ocular diseases. This shift towards preventive care is driving the adoption of pupillometers, as they provide valuable insights into patients' eye health. The preventive healthcare market is expected to reach $4 trillion by 2026, highlighting the potential for pupillometer manufacturers to capitalize on this trend by promoting their devices as essential tools for early detection and intervention in eye health.