Expansion of Research Collaborations

The protein engineering market is witnessing an expansion of research collaborations among academic institutions, industry players, and government agencies. These partnerships are fostering innovation and accelerating the development of new protein-based solutions. In the US, collaborative research initiatives are increasingly common, with funding for joint projects reaching approximately $5 billion in 2025. Such collaborations enable the sharing of resources, expertise, and technology, which can significantly enhance the efficiency of research and development efforts. As organizations work together to tackle complex challenges in healthcare and biotechnology, the protein engineering market is likely to benefit from the accelerated pace of innovation. This collaborative approach not only drives advancements in protein engineering but also creates a more dynamic and interconnected market landscape.

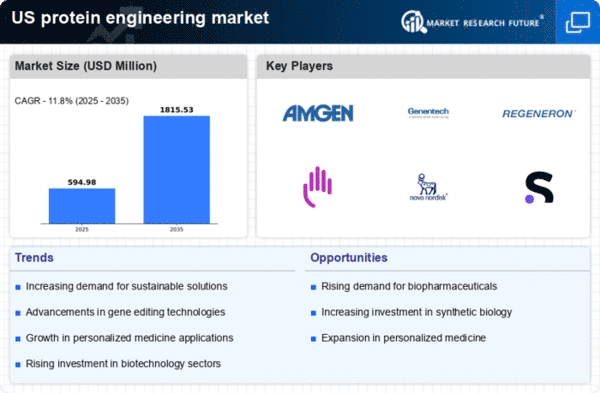

Rising Demand for Biopharmaceuticals

The protein engineering market is experiencing a notable surge in demand for biopharmaceuticals, driven by the increasing prevalence of chronic diseases and the need for innovative therapies. In the US, the biopharmaceutical sector is projected to reach approximately $500 billion by 2025, indicating a robust growth trajectory. This demand is largely fueled by advancements in protein engineering techniques that enable the development of more effective and targeted treatments. As a result, pharmaceutical companies are investing heavily in research and development, which is likely to further propel the protein engineering market. The focus on personalized medicine, which tailors treatments to individual patients, also underscores the importance of protein engineering in creating bespoke therapeutic solutions. Consequently, the growth of the biopharmaceutical industry is a significant driver for the protein engineering market, fostering innovation and expanding market opportunities.

Increased Investment in Biotechnology

The protein engineering market is benefiting from a significant increase in investment in biotechnology, particularly in the US. Venture capital funding for biotech firms has surged, with investments reaching approximately $20 billion in 2025. This influx of capital is enabling companies to explore innovative protein engineering solutions and accelerate the development of new products. The growing interest from investors is largely attributed to the potential of protein engineering to address pressing health and environmental challenges. As biotechnology continues to evolve, the protein engineering market is likely to see enhanced research capabilities and the emergence of novel applications, further driving market growth. Additionally, government initiatives aimed at supporting biotech innovation are expected to bolster investment in the sector, creating a favorable environment for the protein engineering market to thrive.

Growing Focus on Sustainable Practices

Sustainability is becoming a central theme in the protein engineering market, as companies increasingly prioritize environmentally friendly practices. The demand for sustainable protein sources is rising, driven by consumer awareness and regulatory pressures. In the US, the market for sustainable proteins is projected to grow by over 20% annually, reflecting a shift towards eco-friendly alternatives. Protein engineering plays a crucial role in this transition, as it enables the development of plant-based and lab-grown proteins that minimize environmental impact. Companies are leveraging protein engineering techniques to create sustainable food products that meet consumer expectations while reducing carbon footprints. This growing focus on sustainability is likely to propel the protein engineering market, as businesses seek to align with environmental goals and capitalize on the expanding market for sustainable proteins.

Technological Innovations in Protein Design

Technological advancements in protein design are transforming the protein engineering market, enabling researchers to create novel proteins with enhanced functionalities. Innovations such as CRISPR gene editing and machine learning algorithms are streamlining the protein design process, making it more efficient and cost-effective. In the US, the market for protein design tools is expected to grow at a CAGR of over 15% through 2025, reflecting the increasing reliance on these technologies. These innovations not only facilitate the development of new therapeutics but also enhance the production of enzymes and other proteins used in various industries, including food and agriculture. As companies adopt these cutting-edge technologies, the protein engineering market is likely to witness accelerated growth, driven by the demand for high-performance proteins and the need for sustainable production methods.